El Salvador is close to securing a financial agreement with the International Monetary Fund (IMF) valued at over $1.3 billion. President Nayib Bukele says the money will help stabilize the nation's economy. The potential deal, however, may lead to significant changes in the nation's pioneering Bitcoin legislation, according to the Financial Times, with the IMF requiring a shift in policy to meet its standards.

The Deal: Changes to Bitcoin Law

In 2021, El Salvador became the first country to adopt Bitcoin as legal tender, a move initiated by Bukele to foster financial inclusivity and reduce dependency on traditional banking systems.

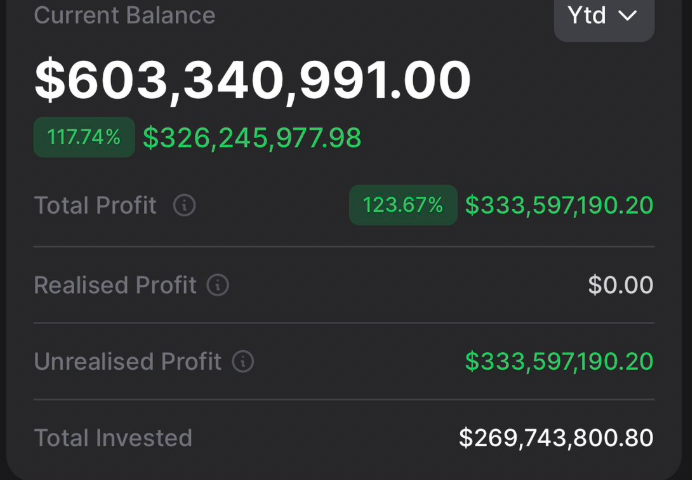

In the same year, Bukele also attracted attention by placing El Salvador's financial future in the hands of Bitcoin, buying up holdings with tax-payer money.

The adoption was met with international concern and local skepticism due to the volatile nature of cryptocurrencies and their potential impact on the country’s financial stability.

Still, the bet seems to be paying off. Just last week, after a massive post-US-election crypto rally, the country's holdings stood at over $600 million USD, a gain of 117%, or $326,245,977.98.

The IMF, however, has been critical of El Salvador's move to integrate Bitcoin into its economy, citing concerns of transparency, and consumer protection alongside financial stability. As part of this new deal, the government of El Salvador could be obliged to drop a law forcing businesses to accept Bitcoin as payment and instead make it a voluntary method among other changes.

If the deal is finalized as expected it should unlock another $1 billion of lending from the Inter-American Development Bank and another $1 billion from the World Bank over the next few years.

Predatory Loans vs Bitcoin

El Salvador sees an IMF loan as the answer to a significant budget deficit and looming debt obligations. Critics of the decision to seek help from the IMF wonder why El Salvador can't dip into its Bitcoin reserve to manage the short-term crisis, avoiding all the associated conditions of this kind of loan.

Public and Expert Reactions

The potential policy shift has sparked a mix of reactions among citizens and economic experts. Supporters of the Bitcoin Law fear that diluting the bill could undermine El Salvador’s stance as a leader in cryptocurrency integration within governmental operations. Opponents of the original law, however, see the negotiations with the IMF as a chance to correct what they believe was an economic misstep, potentially leading to greater financial discipline and stability.

And What About All the Gold?

Seven years ago, El Salvador made waves globally by becoming the first country to ban metal mining completely. This move won broad approval from environmentalists, local communities, and even the Catholic Church.

But now, President Nayib Bukele is on a mission to overturn this ban, sparked by a big discovery: El Salvador's land holds an estimated $3 trillion in unmined gold. This potential gold rush has reignited discussions, with some suggesting the IMF money could be used to fund the restart of gold mining.

Can El Salvador Remain a Global Crypto Leader?

The outcome of the looming IMF deal will affect the country's economic recovery and digital finance landscape and may also set a precedent for how national governments embrace cryptocurrencies.

The decision to amend the Bitcoin Law to pursue an IMF loan highlights the complex balance between innovation and traditional economic practice. We have seen this dance between trad-finance and cryptocurrency playing out worldwide.

One thing is for sure: as a global leader in crypto, whatever El Salvador does next will be watched closely.