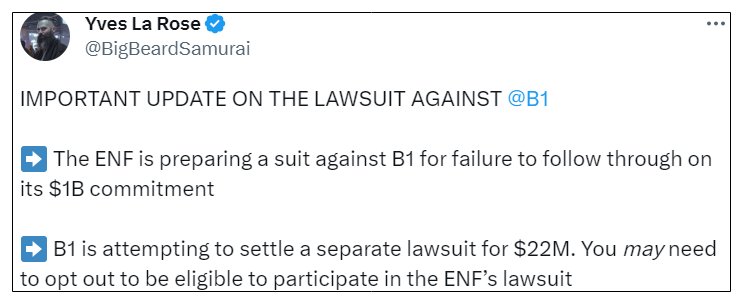

EOS Network Foundation (ENF) is preparing a class action lawsuit against the platform's original developer and token issuer, Block.one (B1), for allegedly failing to invest a promised $1 billion into the network and its community.

The move was announced on Monday by the foundation’s CEO, Yves La Rose, putting extra pressure on B1, which is currently looking to settle a separate $22 million lawsuit from the Crypto Assets Opportunity Fund. The ENF suggested that investors may need to opt out of this settlement in order to join the new lawsuit.

Block.one launched an Initial Coin Offering (ICO) for the EOS Network in July 2017 and collected a record $4.1 billion over the following 12 months, with a promise to invest $1 billion of this into the network and community. Yet the blockchain has arguably not lived up to its early promise, debunking the idea that the platform would become something like “Ethereum on Steroids”. As La Rose said at a virtual conference in May of 2022, “EOS, as it stands now, is a failure”.

The community largely blames Block.one for the platform’s poor performance. The promised $1 billion never materialized. Instead, B1 used the ICO funds to develop its own crypto exchange, Bullish, and the Voice social network, neither of which run on the EOS network.

To hold B1 accountable and revive the network, Yves La Rose created the EOS Network Foundation, which has successfully wrestled control of the network away from Block.one. La Rose first announced the foundation's intentions to pursue a lawsuit in May 2023, stating that:

“As the time has passed, it has become apparent that B1 does not have and has never had any intention of investing the $ 1 billion promised in the EOS Network. EOS token holders relied on B1 promised when they purchased the initial ERC-20 token, and later when they purchased EOS Token for use on the EOS Network.”

Already well under way, however, is a separate $22 million class action lawsuit against B1 initiated in 2018, of which most investors in EOS are already plaintiffs. La Rose believes the value the developer owes to the EOS community is much greater than this, and felt a new lawsuit may achieve better results.

“The measly $22 million that Block.one offered is pathetic. The damage caused on a $4-billion raise is far beyond what is offered in reparations.”

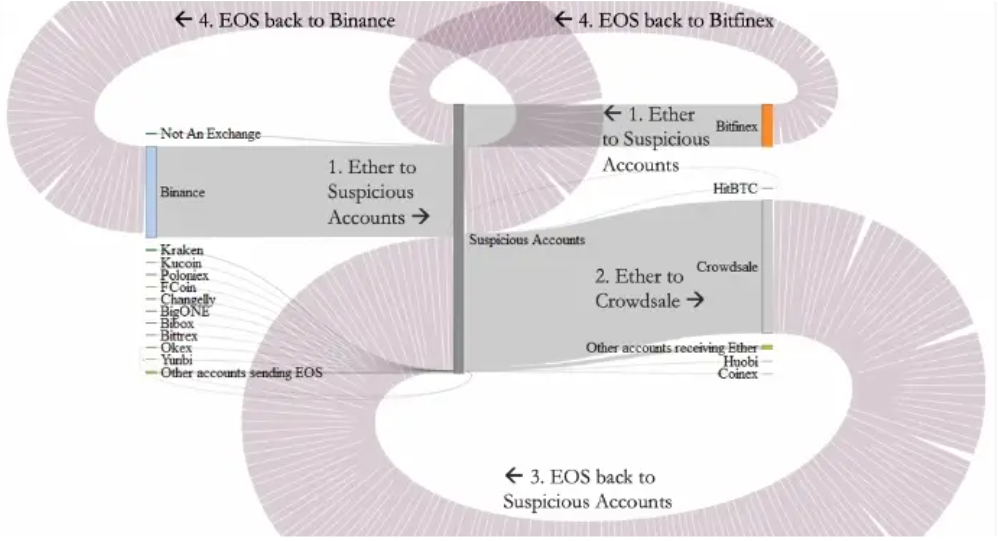

There have been suggestions that the record-breaking $4 billion ICO may have been somewhat artificially inflated. A 2021 report by John Griffin revealed that there had been possible wash trading of the EOS ERC-tokens during the financing phase.

According to Griffin’s analysis, suspicious Ethereum accounts funded largely via Binance and Bitfinex repeatedly invested in the crowd sale. However, instead of keeping the tokens, these were quickly sold back on to the two exchanges, with the resulting ether from the sale used to reinvest in the ICO.

Inflated or not, EOS followers thus far appear rather indifferent to La Rose's tweet. It has only seven replies at time of writing, one of which snarkily points out that his initial promise to hold B1 accountable came 2 years ago.

Investors have until August 29 to decide whether to stick with the $22 million settlement seemingly within reach, or put their faith in La Rose and aim their sights significantly higher. We will wait and Observe which way they jump.