On June 6, Ethereum researcher and developer Michal Neuder and his colleagues published a proposal to increase the maximum allowed stake per Ethereum validator. Although labeled as ‘a modest proposal’ by the authors, over the last three weeks it has stimulated much in-depth discussion, with many interesting points raised, both for and against.

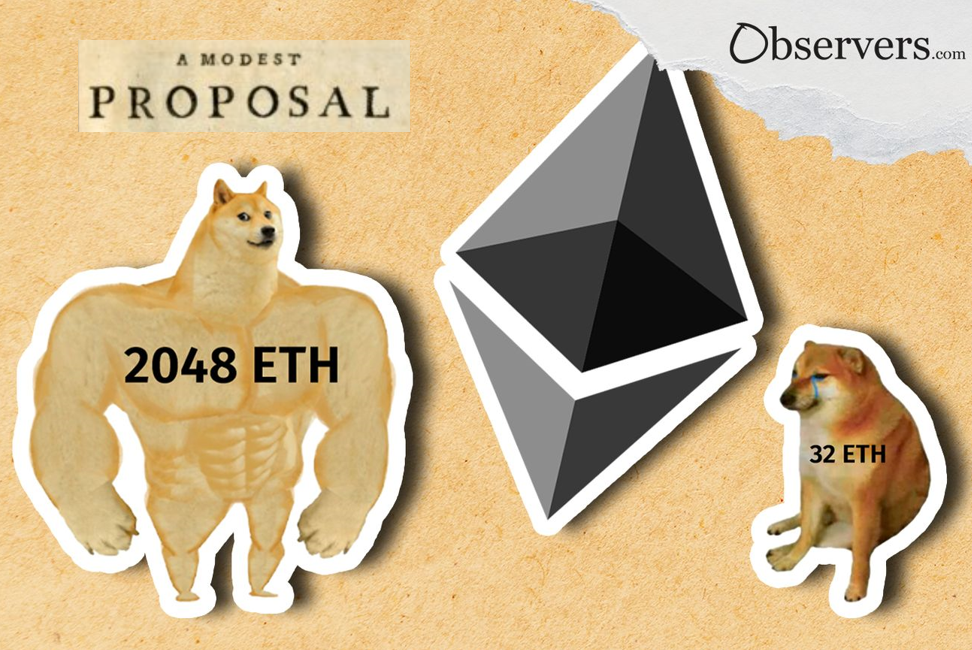

MAX_EFFECTIVE_BALANCE (MaxEB) is a constant that limits the stake of Ethereum validators to 32 ETH. Because of this, if a validator stakes more than 32 ETH, any additional amount will not earn them extra yield, thus discouraging such action. The logic of this limitation feeds into the blockchain design trilemma - it is possible to have any two of the following three: security, decentralization or scalability. With the security component of the network set high, the Ethereum MaxEB parameter was set low to encourage decentralization via many validators, which significantly worsened the scalability component.

However, though designed to prevent centralization of stake, MaxEB became a formality that was readily overridden by large validator entities. Recent research showed that out of 500,000 Ethereum validators at the end of 2022 only around 5% (25,000) were solo validators. The others are controlled by a few core entities such as Lido Finance, Coinbase and Kraken that had simply set up multiple 32 ETH “validator spots” to overcome the rule. Furthermore, the rule created congestion for the 93,000 validators waiting for their activation on the network.

The authors justified their proposal from the perspective of Ethereum network development and operational factors.

For the former, they claim that single-slot finality with the planned one million validator set is not achievable in the near future, given the current hardware possibilities.

Single-slot finality is a network performance target included in the Ethereum PoS roadmap. It assumes reducing slot finalization from the current 15 minutes to 12 seconds (a single validation slot). Quicker finalization can be achieved by either decreasing the number of nodes required to authorize the transaction or through quicker propagation (currently not technically feasible).

The other operational factors mentioned by the authors include the so-called compounding problem. Because of MaxEB, the received stake rewards do not earn stakes themselves (e.g. are not compounded). On the other hand, the subsequent withdrawals of stake rewards after each payment for restacking create extra transaction overhead on the network.

While these arguments are valid, the 32ETH limit on MaxEB was the chosen compromise for the blockchain trilemma. The current proposal is a shift towards scalability at the expense of decentralization. While it is true that the decentralization objective is not currently being achieved, the authors propose to drop it entirely instead of improving it.

The MaxEB increase proposal is at the forum discussion stage now. It can take months before it evolves into a design improvement proposal. So, we continue to Observe.