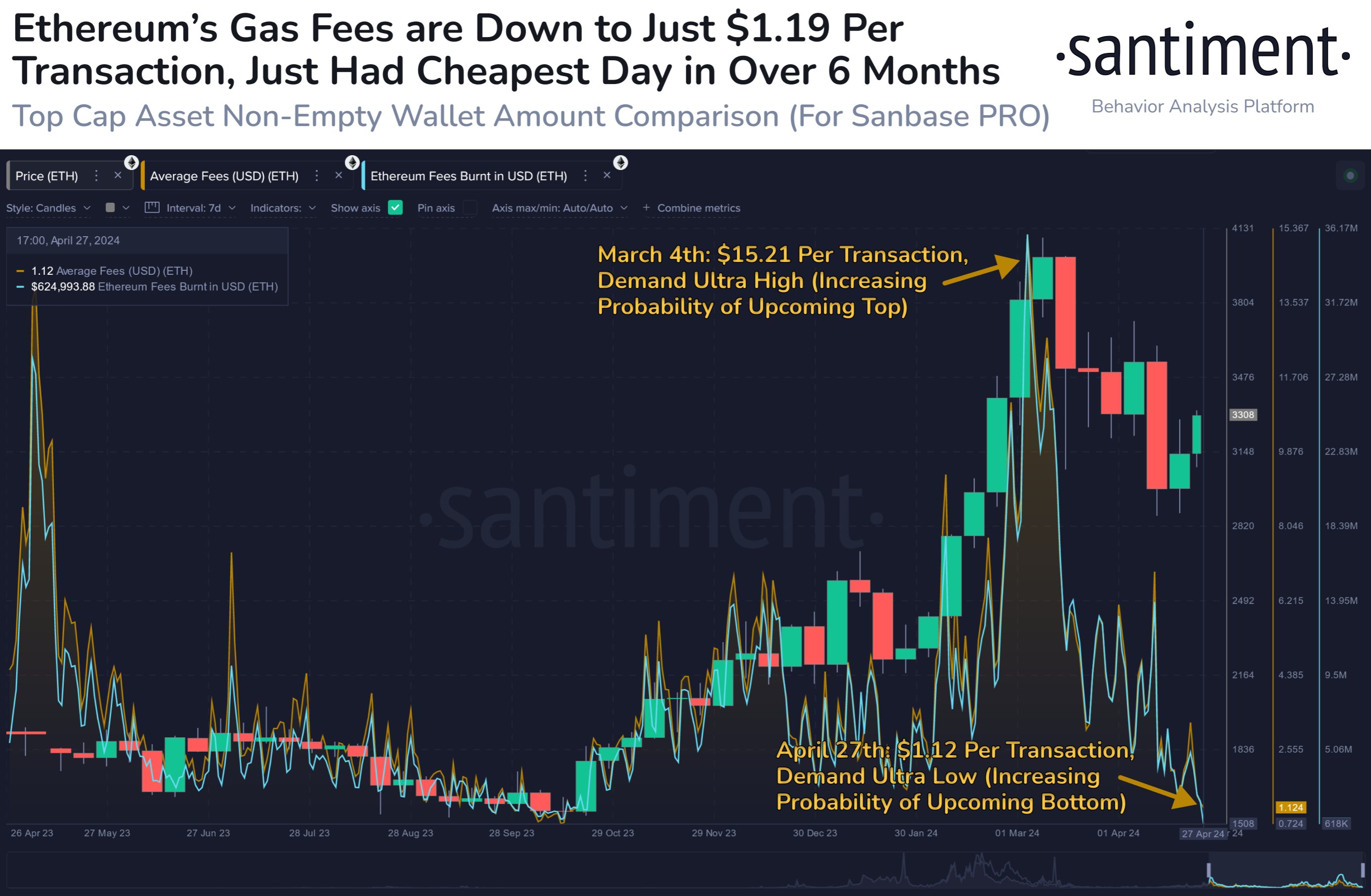

Ethereum's gas fees dropped to their lowest levels in six months this week, according to data from crypto analytics platform Santiment. Furthermore, according to data released by Dune Analytics, the median gas fee was recorded to be 6.43 gwei, which was the seventh lowest the price has ever reached in a single day over the past three years.

Santiment reported on X that gas fees on the network dropped to $1.12 per transaction on April 27, against $15.21 on March 4. Historically, cryptocurrency traders tend to swing between extreme optimism ("to the moon") and pessimism, often manifesting in fluctuating gas fees. During price peaks, fees typically spike, while they return to normal levels during downturns, Santiment said.

Ethereum gas fees spiked in February, reaching an eight-month high due to surging interest in the experimental ERC-404 tokens.

The analytics platform also said the high gas fees suggest increased activity on the network, potentially indicating an upcoming altcoin rally.

"With markets mainly retracing over the past 6 weeks, the lack of demand and strain on the network may help turn ETH and associated altcoins around sooner than many may expect."

As of April 29, the average Ethereum gas price is around 10 Gwei, compared to 41.25 Gwei a year ago, marking a massive four-times decrease.

New upgrade, lower costs

Ethereum developers hailed last month's Dencun upgrade as a major milestone for the Ethereum ecosystem. The upgrade was in part designed to drastically reduce Layer 2 (L2) network transaction costs via implementing EIP-4844, or "proto-danksharding."

One month after the upgrade, the results are clear: gas fees have plummeted across compatible L2 networks like Arbitrum, Starknet, Optimism, Base, and Zora. In most cases, fees dropped tenfold in the week following the upgrade and hovered around one cent or below, according to data from analytics platforms Dune and GrowThePie.

The update has made swapping, bridging, and interacting with smart contracts more affordable. The reduced gas fees could catalyze increased activity and growth for altcoins and decentralized applications (dApps) operating on Ethereum. Lower transaction costs make it easier for users to engage with dApps, potentially leading to higher transaction volumes and more robust interaction within the DeFi and NFT spaces.

On April 27, three Ethereum L2 networks ranked by market cap in the top five of the largest 50 cryptocurrencies. Optimism (OP) led the pack with a significant 11.7% gain, followed by Arbitrum (ARB) with a 3.6% increase and Polygon (MATIC) with 2.9%.

This hasn't happened in a while:$ETH ecosystem looks the strongest vs almost every other crypto sector (Ai, Gaming, L1s, Dino)$OP $ARB $MATIC getting the initial bid pic.twitter.com/7dCSwnfHnS

— Luke Martin (@VentureCoinist) April 27, 2024

Ethereum's decreasing gas fees could eventually pose a significant challenge to other blockchains that have positioned themselves as cheaper alternatives, like Solana, Avalanche, and even Polygon, which ironically started as a low-cost option for Ethereum transactions. Users who previously migrated due to cost concerns might be drawn back to Ethereum, potentially impacting user activity and the dApps ecosystem on these cheaper blockchains.