Ethereum’s ongoing network adoption and the recent green light for a spot Ethereum ETF could potentially bring significant uplift to its network. However, many developers within the ecosystem continue to raise concerns over the increasing centralization of Ethereum’s network. Even Ethereum’s founder, Vitalik Buterin, has acknowledged the centralization issue, pointing out that the network has gotten too comfortable depending on a limited number of large-scale entities:

“I think it is actually true that 2021-era Ethereum thought became too comfortable with offloading responsibilities to a small number of large-scale actors, as long as some kind of market mechanism or zero-knowledge proof system existed to force the centralized actors to behave honestly. Such systems often work well in the average case but fail catastrophically in the worst case.”

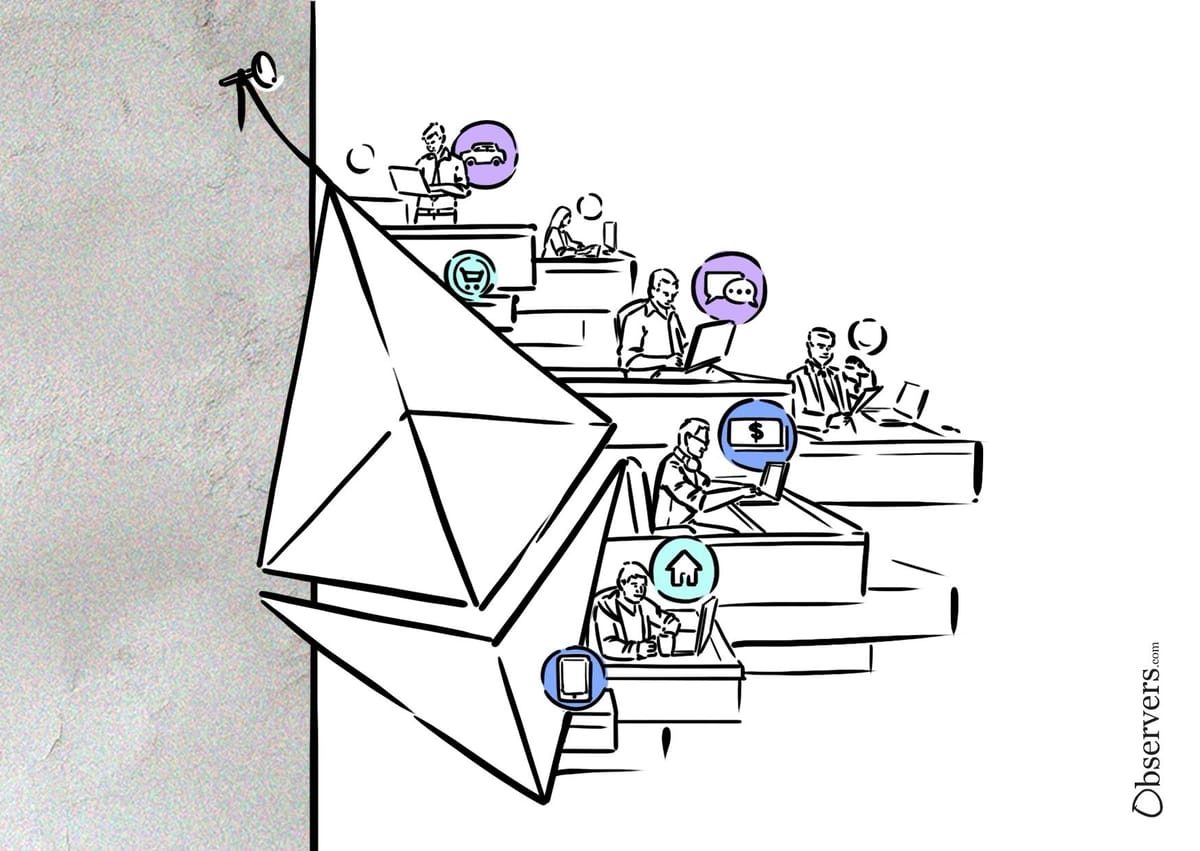

The centralization of Ethereum is evident in several areas, including staking, node clients, and node infrastructure.

A particular concern has been the concentration within Ethereum staking providers. The top three staking providers currently command over 45% of the market share, with the largest being the liquid staking protocol, Lido, which holds an astonishing 28.5% of the market share.

Despite rising concerns over the years that Lido’s dominance poses a centralization risk, effective solutions remain elusive. Furthermore, newer restaking protocols introduced on the network have added layers of complexity and potential vulnerability by allowing already staked ETH to be staked again (restaked). These restaking protocols are pulling in a lot of money, which could soon make the network’s centralization problem even worse.

The diversity, or lack thereof, among Ethereum client software is another problem. In the beginning of this year, a vast majority of Ethereum validators used Geth software, which accounted for about 78.78% of validators, including major players like Coinbase, Binance, Kraken, and Lido. Since then, there has been some progress with client diversity: now only around 55% of clients rely on Geth. Despite this improvement, the target for a relatively safe level of client diversity is below 50%, indicating further enhancements are needed.

The challenges extend to Ethereum’s node infrastructure as well. Operating nodes demand considerable disk space, intricate setup, and 32 ETH minimal stake, making it difficult for the average user to participate directly. Consequently, many opt to rely on node infrastructure providers, further centralizing the network. While efforts have been made to boost the number of solo stakers for better decentralization, more work is clearly required.

Despite these centralization challenges, Vitalik Buterin maintains an optimistic outlook, believing that the situation is “far from hopeless.” The Ethereum development team has increasingly recognized the need for a genuinely decentralized network and is actively working towards addressing these centralization issues.

However, these changes will likely take time to fully materialize and steer the network back toward its decentralized roots.