Following a strong push from the Ethereum community, the network has finally begun implementing changes aimed at scaling its Layer 1 infrastructure. The first step was a Block Gas Limit increase.

Last week, most validators indicated that the network was prepared to increase the gas limit from 30 million to 36 million units. Validators initiated this shift without a hard fork by tweaking node configurations.

The adjustment was first proposed a year ago by Ethereum co-founder Vitalik Buterin. “Honestly, I think doing a modest gas limit increase even today is reasonable,” said Buterin during the research team's 11th AMA in January 2024.

Increasing the gas limit means Ethereum can fit more transactions into a block on Layer 1, boosting throughput.

Still, just increasing the gas limit is not a long-term scalable solution. A higher gas limit means more data on the blockchain and more storage space. Validators will need to ensure that their systems can handle this extra load without sacrificing decentralization.

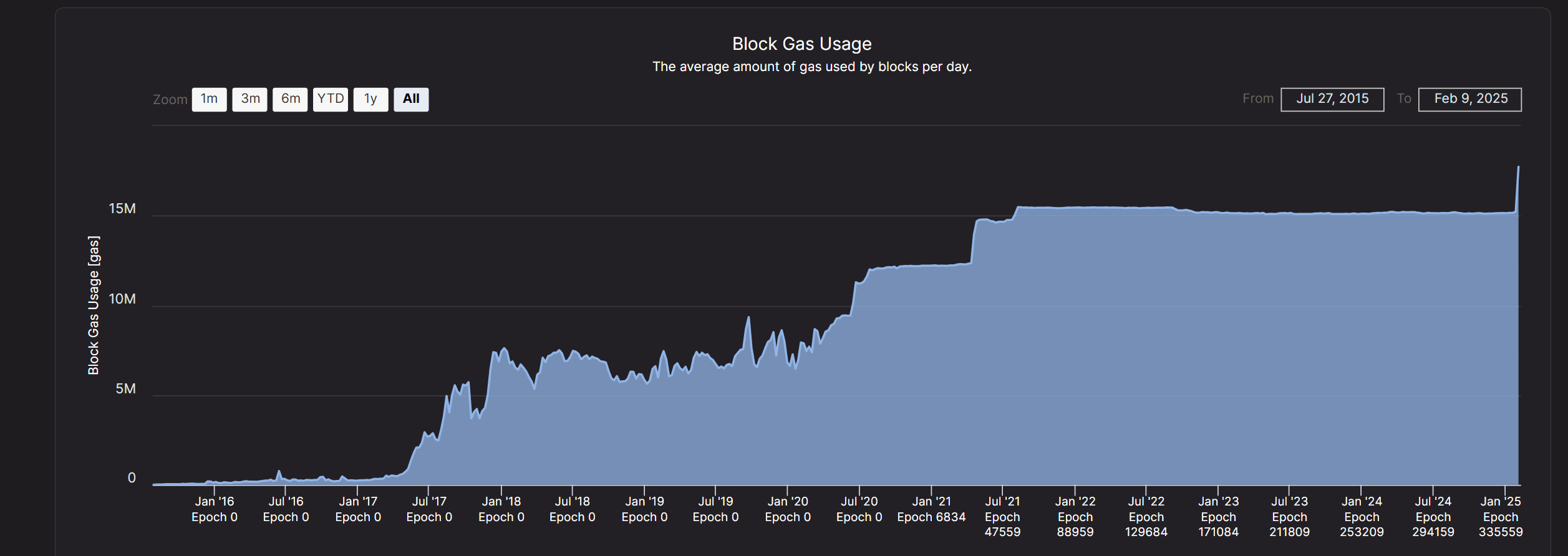

Ethereum’s cautious, gradual approach to increasing the gas limit is aligned with improvements in computing hardware. Over the years, advancements in processing and storage capabilities have gradually made such changes feasible, making the current adjustment a logical step.

Short-Term Impact of Increased Gas Limit

In the near term, Ethereum users are unlikely to notice significant changes on Layer 1. Ethereum blocks are normally 50% full due to the dynamic fee structure of the network that pushes the fee up if the target size is exceeded. While the increased gas limit is a welcome development, it won’t drastically alter the network’s performance when on-chain transaction volumes remain low.

Right now, on average, blocks consume around 15 million gas—a figure that has remained relatively stable since 2021 as most activity shifted to Layer 2 solutions. Although the higher gas limit can help process more transactions during periods of congestion (like during the NFT boom in 2021), such congestion is rare nowadays.

Meme Coins Do Not Need Super Blockchain

In previous cycles, major innovations—such as the ICO boom, the DeFi summer, and the rise of NFTs—brought retail traders to Ethereum. However, this cycle, Ethereum’s competition caused it to miss the memecoin trend. While memecoins initially began on Ethereum, Solana managed to seize the initiative, drawing retail traders and liquidity to its ecosystem.

Some in the Ethereum community may underestimate the impact of memecoins, but doing so could be a mistake. Memecoins have introduced new users to Solana, many of whom have never engaged with Ethereum and have little interest in doing so. This is a concerning trend, as platforms with active user bases and abundant liquidity are more attractive to developers looking to launch new projects. No project wants to release tokens on a network with low liquidity and limited trader activity.

Last week BNB Chain team dropped a test memecoin named TST to demonstrate the ease of creating tokens on its platform. Following a tweet by Binance founder Changpeng Zhao highlighting a tutorial for launching memecoins, TST's market cap surged reigniting the hype around BNB Chain and driving its BNB token price up. "Serious" blockchains like Sui and Cardano have also directed a share of their promotional resources to memecoin communities.

Even large memecoin projects with billions of circulated tokens do not demand much from blockchain networks. Congestion and ultra-high fees? Fine, more hype. Centralization in a validator group? That sounds like teamwork.

What Can Truly Make a Difference?

Ethereum was designed in the period when blockchains were believed to replace bankers and become the technical backbone of a new financial system. With the current user base of blockchain systems, the ideals of decentralization, scalability and security, which Ethereum was so proud to balance, don't sell.

Ethereum will need to innovate to regain momentum and attract users that require its features. What that breakthrough will be is anyone’s guess, but Ethereum’s historical progress makes it capable of launching transformative trends.

The hope is that the Ethereum community will go on to plot a course that will activate the network and return users and interest to its ecosystem. Otherwise, the number two blockchain may continue to struggle to reach its new gas limits in the observable time.