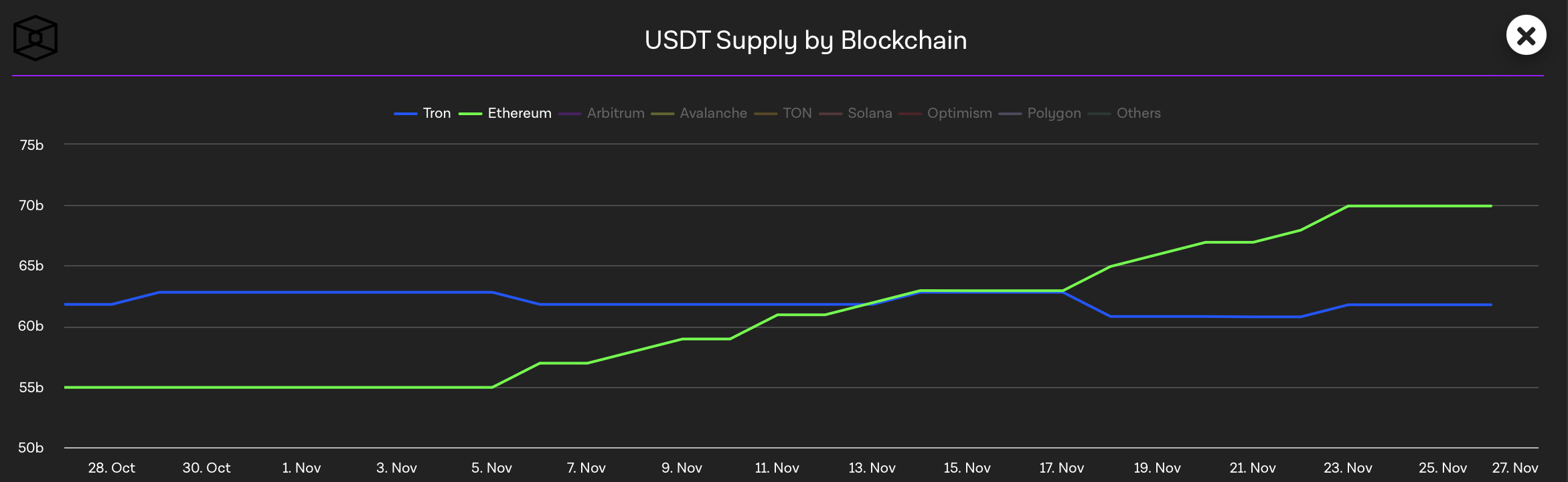

Ethereum has overtaken Tron as the blockchain hosting the most USDT (Tether), marking the first time since 2022 that Ethereum leads in the largest stablecoin supply. According to The Block Data, Ethereum moved into first place on November 13.

The gap only widened in the following days, as Tether minted $2 billion USDT on Ethereum and $1 billion on Tron on November 23, adding to the $10 billion minted earlier this month. Now, Tether’s data show that the net circulation on Ethereum is $8.5 billion more than that on Tron.

Ethereum also leads in USDC hosting, although its dominance is slowly decreasing as Solana, Base, and Arbitrium are gaining momentum.

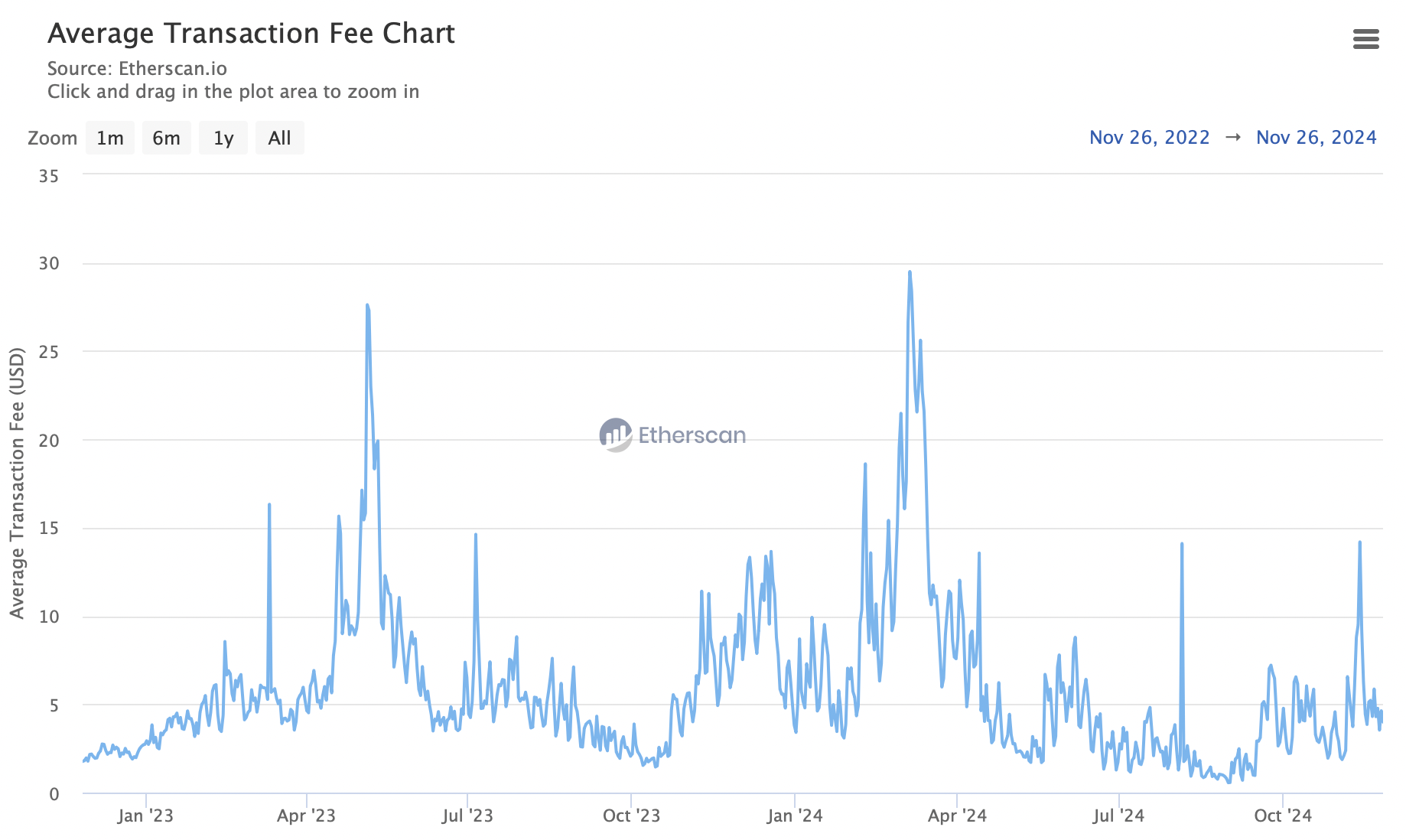

Ethereum’s decline in USDT dominance began in mid-2021 when Tron aggressively expanded into the stablecoin sector. Tron's cost-effective transaction fees had made it a popular choice for USDT issuance, especially for high-frequency, low-value transfers often seen in centralized exchanges. While its low fees remain an advantage, Tron’s ecosystem is less versatile than Ethereum’s, limiting its appeal beyond transactional efficiency.

Several factors have probably contributed to Ethereum’s regained dominance, but the main one is likely bullish market conditions. Its robust ecosystem, with advanced financial tools and deeper integration into decentralized finance, might appeal to users expressing more interest in DeFi products now as the market conditions are favourable. Thus, Ethereum can become a financial hub where traders, institutions, and projects converge.

Tether mints extra USDT tokens on Ethereum as it anticipates heightened demand due to the above-mentioned factors and the Bitcoin price rally. The minting could also be a response to expectations of higher demand driven by institutional entries that often favour Ethereum due to its security.

In 2025 Tether will need to reach hyper-productivity to accomplish our grand vision.

— Paolo Ardoino 🤖🍐 (@paoloardoino) November 24, 2024

Users are also more likely to opt for Ethereum now. The increasing use of Layer 2 networks is narrowing the cost gap between Ethereum and Tron alongside Ethereum’s progress in scalability and numerous upgrades that enhance the network's efficiency.

Besides, Ethereum fees are relatively low now compared to their average over the last years, which further takes away Tron's advantage. Still, the average fees on Tron are currently 20 times less expensive.

Another rival to Ethereum and Tron could be TON. Its partnership with USDT was a significant milestone for both companies. After a loud marketing campaign, TON became the fourth largest network for Tether, currently hosting $USDT 1.2 billion. Although it is still far from the market leaders, TON's share is steadily growing, supported by strong user loyalty.

CCData’s November report states that this month, the total market capitalization of stablecoins surged 10% to $190 billion and surpassed the previous ATH recorded in April 2022. The trading volume of stablecoins is also rapidly growing. As stablecoins de facto serve as a common unit for all trading activity across the crypto industry, this confirms that the general market sentiment is optimistic.

The TradFi major players acknowledge the situation in the crypto market is favorable now. This month, Cantor Fitzgerald purchased a 5% stake in Tether, escalating its involvement in the cryptocurrency space and highlighting institutional confidence in stablecoins. Even more interestingly, the blue-chip financial company holds most of the Tether’s reserves.