Etherscan has unveiled a new feature: credit scores for Ethereum wallets which changes how users assess trustworthiness and financial behavior. It is available under the Cards tab, along with Safety Score, Risk Score, DAO activity and other cards integrated in the explorer.

The feature, announced via Etherscan’s X account, promises enhanced transparency and helps users make informed decisions while avoiding potentially risky transactions.

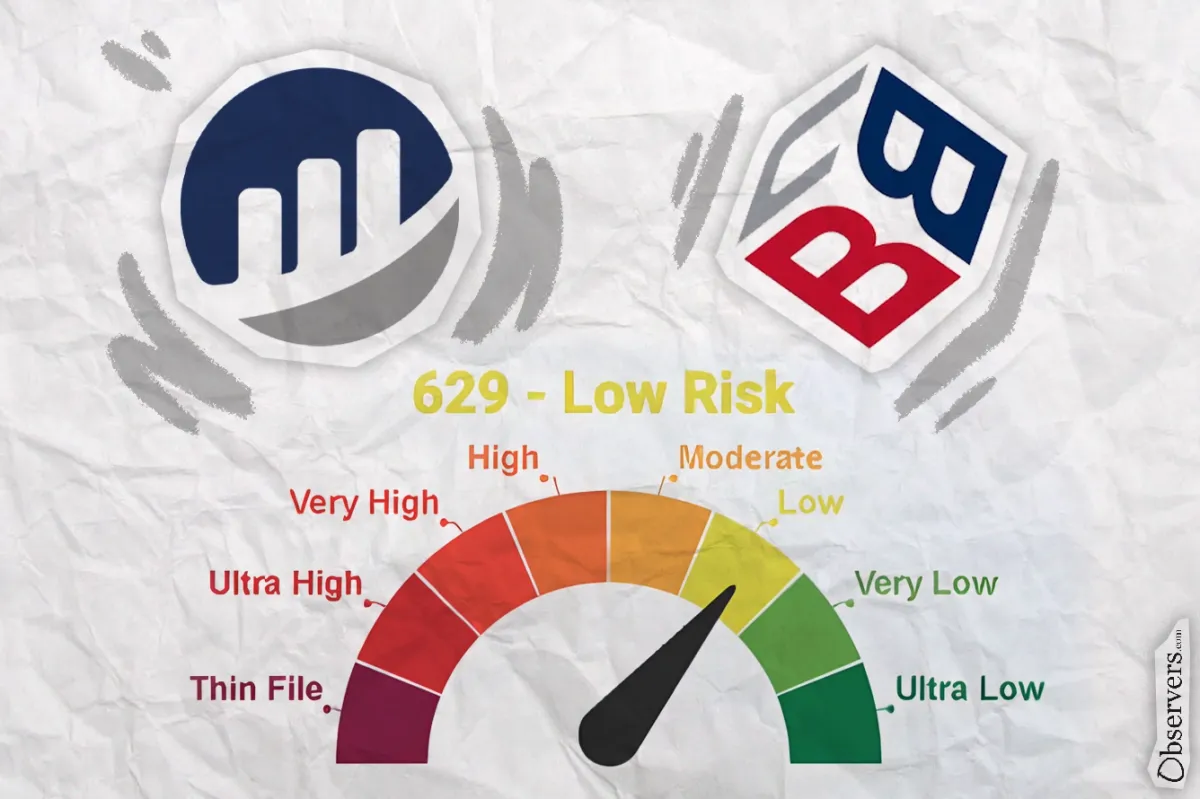

The score is powered by Blockchain Bureau and based on on-chain activity, offering what they claim is a clear credit risk evaluation. It ranges from 'Thin File' (insufficient data) to 'Ultra Low Risk' (consistent, reliable behavior), providing a snapshot of wallet credibility.

Every wallet on etherscan now has a creditscore.

— Andre Cronje (@AndreCronjeTech) February 8, 2025

Go to etherscan > wallet you want to check > Cards tab

Score powered by @TheBlockBureau

Anyone that wants it onchain for their dapp, hit me up.

Making undercollateralized one step simpler. @functi0nZer0 nudge nudge pic.twitter.com/6ndtEQdtDi

Credit Scores In Decentralized Finance (DeFi)

In DeFi, credit scoring diverges significantly from traditional financial systems. Traditional credit scores rely on centralized agencies assessing factors like payment history, outstanding debt, and length of credit history. In contrast, DeFi credit scoring utilizes on-chain data, analyzing users' transaction histories, smart contract interactions, and asset holdings to determine creditworthiness.

This decentralized approach offers greater transparency and inclusivity, especially for individuals lacking traditional credit histories. However, due to the pseudonymous nature of blockchain addresses, an effective credit rating service would need to associate multiple addresses with a single user's credit profile. This in turn, requires extensive blockchain intelligence capabilities with insights into the historical transactions, accounts and their associations.

The demand for DeFi credit scores is growing, driven by the expansion of decentralized lending platforms. Notably, TransUnion, a major U.S. credit reporting agency, announced plans to provide credit scoring services to public blockchain networks, aiming to bridge the gap between traditional credit assessment and decentralized finance.

Incorporating credit scores into dApps allows automatic adjustments of loan terms, interest rates, or collateral requirements. This can minimize default risks and improve the lending dApps' financial performance. However, the reliance on centralized credit score providers undermines the decentralized, permissionless nature of these services.

Startups like Cred Protocol and Spectral Finance are pioneering decentralized approaches to assess creditworthiness using on-chain data.

Credit Score from Blockchain Bureau

Blockchain Bureau is a company founded in South Africa in 2023. Self-reportedly, the company scans data on 20 blockchains and maintains information about more than 15 million on-chain loan transactions.

The company's main product is Providence, a solution designed to provide access to indexed on-chain data and facilitate the decision-making process through user-readable dashboards and APIs.

Integration with Etherscan enhances Blockchain Bureau’s credit scoring and risk assessment capabilities by providing real-time access to extensive on-chain data, including transactions and wallet behaviors. This can help strengthen the product's risk models and improve credit scoring accuracy.