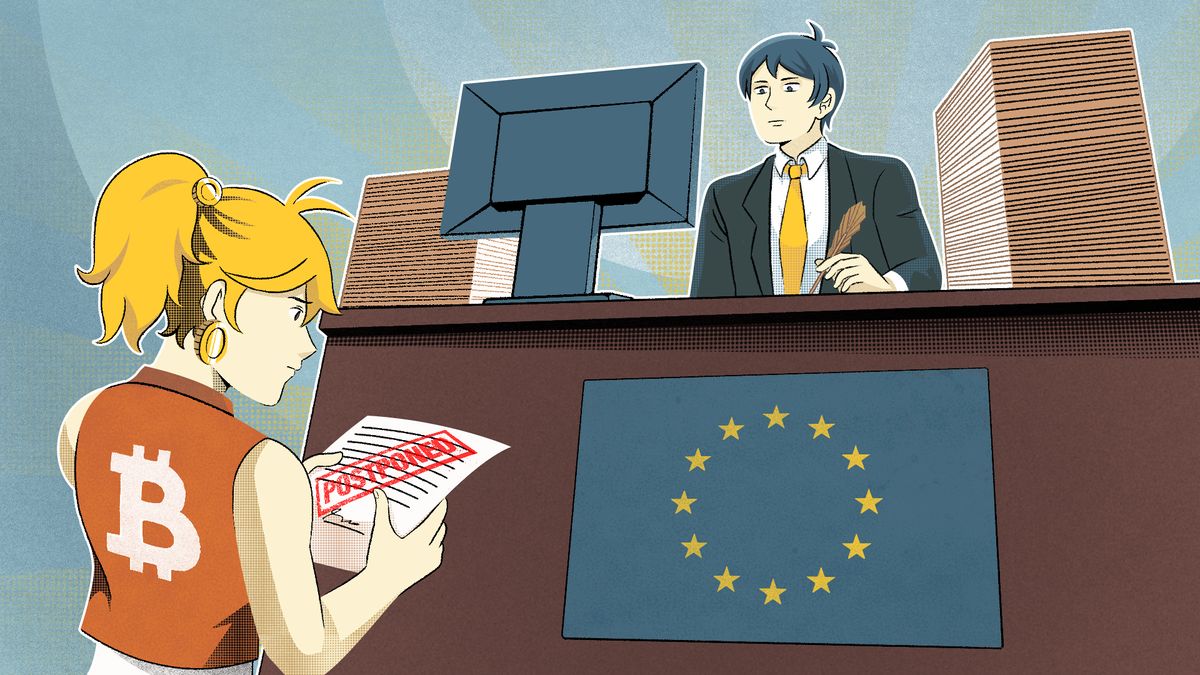

First, the initial release date of the law was pushed from November 2022 to February 2023, with an EU spokesperson explaining that the delay was due to the complexity of translating the 400-page long text into 24 official languages. Taking into account these slow bureaucratic processes and rapid developments in the crypto industry, MiCA might be outdated before it comes into force in 2025.

MiCA, is one of the first attempts to create a comprehensive regulatory framework for the cryptocurrency market, it first started its journey in 2018, and has since been making its way through the European Union’s arduous legislative process:

- 24 September 2020: The European Commission tables a proposal for the “Digital finance package”, the EU’s attempt to foster technological advancement while providing market stability and consumer protection, of which MiCA is a part.

- 8 October 2020: The European Parliament endorses the Digital finance package, inclusive of MiCA.

- 1 February 2021: The national parliament submission deadline for reasoned opinions on the grounds of subsidiarity is reached, with no submissions made by any member state.

- 30 June 2022: The provisional EU Market in Crypto-assets Regulation (MiCA) is agreed on between the European Commission, the European Parliament, and the Council of the European Union.

- 5 October 2022: The Council of the European Union confirms its intention to approve the draft legislative package, inclusive of MiCA.

- In April 2023: European lawmakers are due to vote on the final MiCA draft, thus bringing it into law.

- If the European lawmakers voting process in April of 2023 goes ahead, and agreement is reached on MiCA, crypto companies which fall under the regulatory scope can expect to begin adhering to the new regulation from between 12 to 18 months after final publication.

MiCA’s enforcement is due to take place at the member state level, so there is a long road ahead for further local interpretation and implementation. A ‘Competent authority’ shall be designated by respective members, to carry out EU legislative enforcement, with the competent authority being either an existing enforcement body, or a newly created authority for specific enforcement of EU legislation. Oversight of member states and their ‘designated authorities’ is due to be handled jointly by both the European Securities and Markets Authority and the European Banking Authority.

In addition to technical delays, the pertinent collapse of FTX, at a time when the EU’s new regulatory framework is closing in on the finishing line, has been referenced by EU lawmakers, in addition to mixed opinions on MiCA’s preventative capabilities, had it been in place during FTX’s collapse.

Addressing EU law makers in November, deputy director general at the European commission’s financial-services arm, Alexandra Jour-Schroeder, was quoted saying “Under the MiCA regime, no company providing crypto assets in the EU would have been allowed to be organized, or perhaps I should say disorganized, in the way FTX reportedly was,”.

There is however speculation on just how effective MiCA would have been in preventing the collapse of FTX, with skepticism mainly focused on the reverse solicitation exemptions present within the legislation, which would have allowed EU citizens to engage in services provided by FTX, without regulatory supervision or enforcement stretching to the Companies home domicile of the Bahamas.

At the recent World Economic Forum in Davos, Ms. McGuinness, the head of EU FISMA, shared her views on the further development of MiCA:

Even once MiCA takes effect around the start of 2025, it won’t be the end of the story. Crypto evolves quickly and “we will have to tweak what’s in place

💡 The Financial Stability, financial services, and capital Markets union (FISMA), one of 27 departments (directorates) of European Commission, was charged with the creation of MiCA, in collaboration with other EU departments such as the EU council, the European Central Bank, and the Economic and Social Committee. FISMA is also the European Commission body responsible for EU sanction policies. Mairead McGuinness has held the position of FISMA’s commissioner since October 2020, with prior positions including Vice-President of the European Parliament, and her earlier career focusing on broadcasting and journalism, including a position as agricultural editor for the Irish Independent news publication.

Previously, Christine Lagarde, president of the European Central Bank mentioned that MiCA II will be needed:

At least Europe [on the road to crypto regulation] is ahead of the pack, but as I said previously, it’s one step in the right direction. This is not it — there will have to be a MiCA II, which embraces broader what it aims to regulate and to supervise, and that is very much needed.

With the European Parliament not expected to resist the adoption of MiCA, the following years will likely be filled with quick regulatory patches and updates to meet the fast-changing industry requirements. Something we will be curious to observe.