A hearing for the European Union's Markets in Crypto Assets Regulation (MiCA) is scheduled for April 18, according to the European Parliament's official website. On the very same day, legislators are also slated to discuss another law with ramifications for the crypto industry – the regulation on the information required to travel with crypto transfers.

Nonetheless, witnessing the progress of these major initiatives, we'd like to direct our readers' attention the various parts of the crypto industry that fall beyond MiCA's and AML/CFT's regulatory scope.

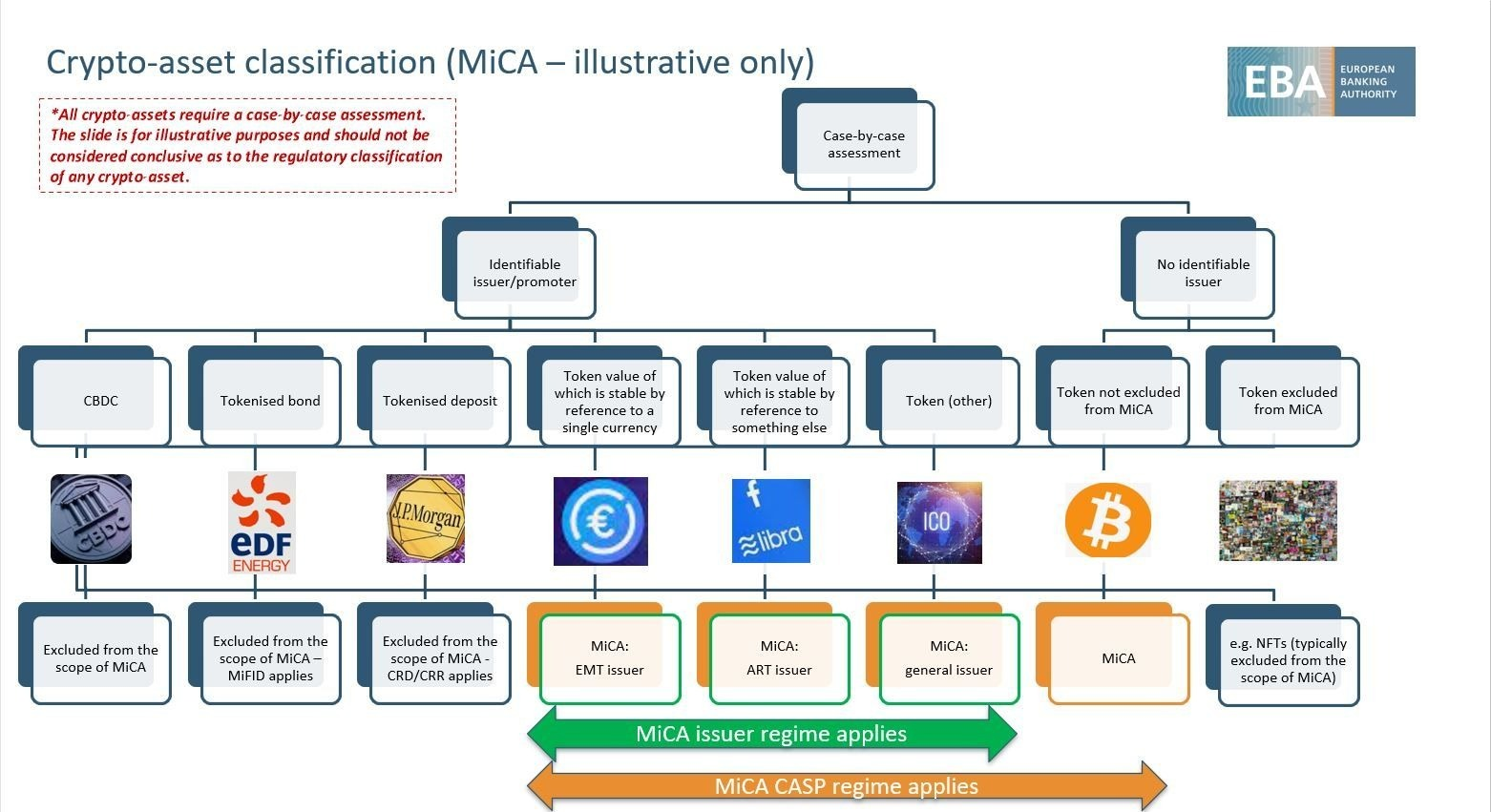

MiCA has primarily focused on stablecoins, with other aspects of the sector such as NFTs and DeFi products generally excluded — for the time being.

Crypto-assets that have already been defined as financial instruments or electronic money under the Markets in Financial Instruments Directive (MiFID) and the Electronic Money Directive (EMD), such as tokenized bonds, are exempt from MiCA. The same goes for tokenized deposits that are governed by EU law through the various versions of the Capital Requirements framework (the Directive CRD and the Regulation CRR).

Central Bank Digital Currencies (CBDCs) likewise aren’t affected by MiCA.

Additionally, MiCA predominantly applies to the identifiable issuers and promoters of crypto assets. Assets with no issuer, such as Bitcoin, will mandate Crypto-asset service providers (CASPs) to uphold and maintain various measures to ensure investor protection. CASPs, such as crypto exchanges, will be required, under MiCA, to publish and supply a white paper outlining potential risks and will be held liable for publishing misleading content. CASPs will also be held legally responsible in the event of hacks or other avoidable system failures. Lastly, to operate within the EU, crypto-asset service providers will require authorization.

Non-fungible tokens are not expressly covered by MiCA, with the European Council stating unambiguously in a June 2022 press release that "Non-fungible tokens (NFTs), i. e. digital assets representing real objects like art, music, and videos, will be excluded from the scope except if they fall under existing crypto-asset categories."

The press release did add, however, that by the end of 2023, a separate legislative proposal addressing the NFT market could be produced if the European Commission finds it necessary.

It is worth noting that fractional NFTs may be considered fungible under MiCA and thus fall within the scope of the regulation. As a result, MiCA leaves room for interpretation when it comes to how some NFTs may be regulated.

Aside from potential future EU legislation addressing the NFT market, Christine Lagarde, president of the European Central Bank, has mentioned the need for increased regulatory oversight of the crypto market beyond MiCA. Lagarde stated that the ESRB had begun investigating how legislators could potentially broaden the scope of MiCA, outlining potential future areas of focus for the so-called MiCA II.

These include addressing the potential dangers of the crypto industry's interconnectedness with traditional financial institutions, providing regulatory oversight of decentralized finance, cryptocurrency staking and lending, as well as Bitcoin.

Meanwhile, various facets of decentralized finance, such as the immutability of smart contracts, were affected by the EU's Data Act.

In summary, MiCA primarily focuses on stablecoins and requires crypto-asset service providers to uphold measures for investor protection. The regulation will not apply to crypto-assets already defined as financial instruments or electronic money under EU law, such as tokenized bonds and deposits, as well as CBDCs. Beyond MiCA, the European Central Bank has called for increased regulatory oversight of the crypto market, potentially further addressing DeFi, NFTs, cryptocurrency staking and lending, and Bitcoin, among others.

For now, we'll just have to wait to see what changes to the regulatory landscape unfold in 2023. And as always, we'll keep you informed of all the latest developments.