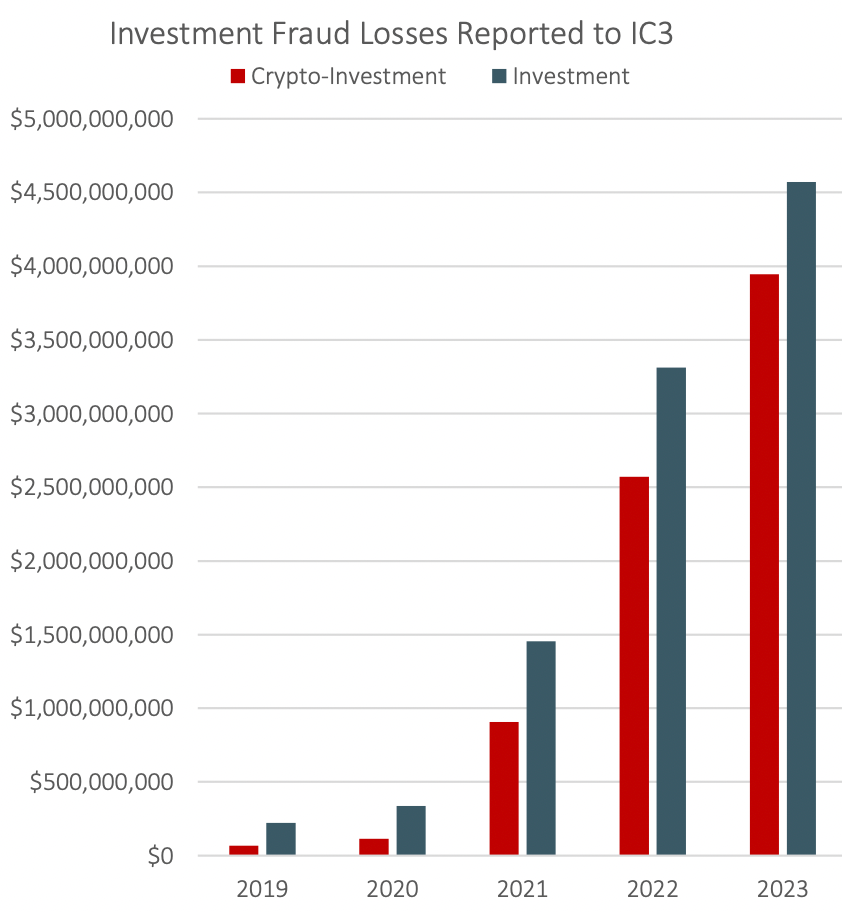

The United States Federal Bureau of Investigation (FBI) published its Internet Crime Report 2023, which showed that crypto-related scams were significantly up last year, accounting for over 86% of overall losses to investment scams (the costliest type of crime), which rose from $3.31 billion in 2022 to $4.57 billion in 2023. Fraud with reference to cryptocurrency rose from $2.57 billion in 2022 to $3.94 billion in 2023, showing an increase of 53%. The overall value of losses suffered by the U.S. in 2023 exceeds $12.5 billion and represents a 22% increase.

Over the last five years, crypto-related fraud has grown rapidly, accounting for over half of the total investment scam losses since 2021. Last year, the FBI even warned of a spike in cryptocurrency investment schemes, but apparently in vain. The report also shows that crypto is one of the most popular mediums or tools for facilitating crimes.

“The IC3 [Internet Crime Complaint Center] data suggests fraudsters are increasingly using custodial accounts held at financial institutions for cryptocurrency exchanges or third-party payment processors, or having targeted individuals send funds directly to these platforms where funds are quickly dispersed.”

We have previously observed that Chainalysis came to a contradicting conclusion. Advance excerpts from its annual Crypto Crime report suggested that illicit activity fell significantly in 2023. The recently published full version of the report challenges the FBI’s findings:

“Although the FBI has published data [Internet Crime Report 2022] showing that reports of crypto investment scams in the U.S. has been increasing year over year through 2022, our on-chain metrics suggest scamming revenues globally have been trending down since 2021.”

It is worth noting that the figures in the Chainalysis report are based on current data and are likely to grow as new illicit addresses are identified, so it could turn out that the overall downturn is significantly less (or even non-existent) by the end of this year.

Statistics from early 2024 show that many crypto phishing attacks are conducted via social media platforms such as X. Yesterday, Scam Sniffer reported that the majority of 57,000 victims who lost a combined $46.8 million last month were lured to phishing websites through posts on impersonated Twitter accounts.

🚨 [1/6] ScamSniffer's February Phishing Report

— Scam Sniffer | Web3 Anti-Scam (@realScamSniffer) March 10, 2024

In February, about 57,000 victims lost approximately $47 million to crypto phishing scams.

Compared to January, the number of victims who lost over $1 million decreased by 75%. pic.twitter.com/UgZk0K91lH

We recently observed that MicroStrategy, the largest corporate holder of Bitcoin, fell victim to a SIM swap attack. Hackers were able to gain control of the company’s X account and publish malicious phishing scam links on its feed, which lead to a minimum of around $420,000 in crypto being stolen.

Generally scamming is most successful when markets are up, exuberance is high, and people are afraid to miss out on an opportunity to get rich. As cryptocurrency prices continue to surge, the frequency of scamming and hacking incidents is likely to rise and new inexperienced customers lured by high returns will fill the ranks of victims. The best antidote is to stay informed and exercise caution - especially with unknown accounts or anonymous teams. And obviously invest only what you are ready to lose.