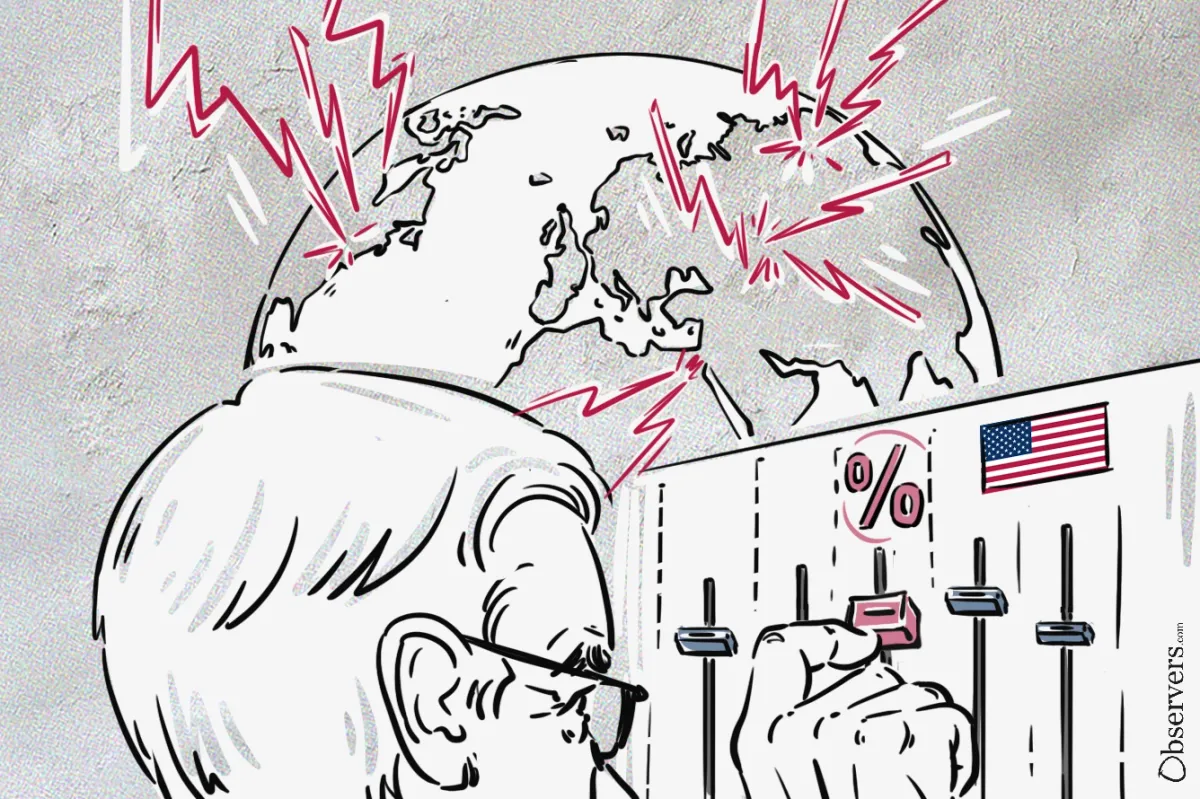

The United States Federal Reserve Bank is softening its tight monetary policy by lowering the federal fund rate by an aggressive 50 basis points.

Fed Chairman Jerome Powell announced the economic stimulus today after a two-day policy meeting in which it was decided that the Fed's rate is moving to the 4.75-5% bracket from the 5.25-5.5% level.

The Fed's interest rate, which acts as a benchmark for all the other interest rates in the country, has been set in the 5.25-5.5% bracket since July 23.

Investors have been expecting a rate cut since Powell remarked that "the time has come for policy to adjust" at the annual Jackson Hole Symposium on August 23.

Investors and analysts initially predicted a 25-basis-point cut, but after fresh data on the country's inflation was released on September 11, expectations of a more radical interest cut rose.

According to the latest report, the annual rate of the consumer price index in August was at the lowest point since February 2021. At 2.5%, inflation was down from 2.9% in July and much lower than the 9.1% generational peak in June 2022.

Referring to the lowering inflation and rising concerns that the unemployment level will spike in the near future, Bill Dudley, former President of the Federal Reserve Bank of New York, said that an aggressive 50 basis points was the right approach, as it "fits the logic of the moment."

How Does The Fed's Interest Rate Affect Crypto?

Despite crypto falling outside the scrutiny and control of governments and traditional finance markets, when the Fed lowers interest rates, borrowing becomes cheaper, leading to a rise in investors' appetite for higher-risk assets, including cryptocurrencies.

And while most significant price shifts in crypto have been a consequence of factors from inside the market, such as the Terra/Luna crash or the FTX collapse, crypto prices generally tend to trend the same as traditional financial assets.

The approval of BTC and then ETH short Exchange Trade Funds in the U.S. in 2024 led to retail investors expanding their investment portfolios to include cryptos, which has contributed to investors treating both traditional and decentralized assets in a similar way.

"The truth is that crypto prices have proven to be impacted by the same directional sentiment that impacts retail stock investors," Dan Raju, CEO of brokerage platform Tradier

While the news seems to be good, there is equally good reason to be cautious.

Jamie Dimon, CEO of JPMorgan, has warned that the U.S. dollar isn't "out of the woods" yet. Central Banks tend to lower interest rates at signs that the economy is slowing down. For the executive of the Wall Street giant bank, stagflation and recession are still very possible scenarios for the coming years.

Boris Kovacevic, global macro strategist at Convera in Vienna, said, " If they go 50, there is a chance that the Fed has some information that investors don't have and that recession risks are more likely than currently anticipated and priced in."

A slower economy means investors are less willing to invest in risk-free and high-risk assets, which has a negative impact on the crypto market.