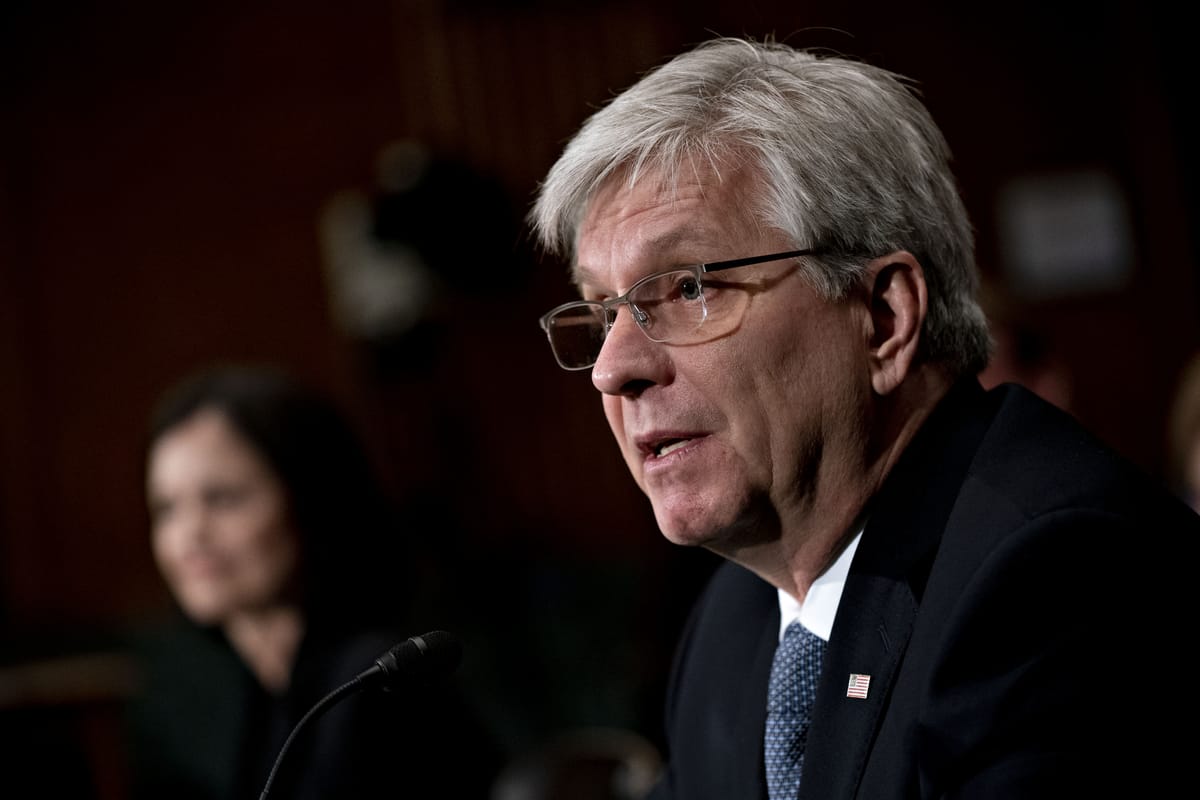

Unlike his peers, Federal Reserve Governor Christopher Waller often publically shares his optimistic views on the role of DeFi in the U.S. economy. In his latest speech, he specifically focused on how DeFi can complement, rather than replace, traditional finance.

Waller states that while DLT, smart contracts, and stablecoins could lead to efficiency gains, DeFi will not fully eliminate the need for centralized systems due to the importance of financial intermediaries for an average person. The exchanges that act as intermediaries in DeFi need to be regulated to avoid broader risks for society.

Interestingly, Waller has shown more support for stablecoins than for retail CBDCs. He has been skeptical of the need for a CBDC, arguing that there is no major failure in the USD payment system that could be solved with the help of a central bank digital currency. Waller expressed a more positive view on wholesale CBDCs that can be used exclusively by central banks, commercial banks, or other financial institutions to settle transactions involving tokenized assets.

“It makes me think that a CBDC is something you could do, but there’s nothing that makes you need it,” - Waller.

At the same time, he believes that USD-linked stablecoins could help consolidate the dollar's dominance in global transactions as crypto-assets are de facto traded in USD. In general, he finds that stablecoins can have a better effect on expanding the U.S. economic influence than CBDC, “a solution in search of a problem.”

Waller is one of the seven members of the Federal Reserve Board of Governors, a position he was nominated for by President Donald Trump. His term is set to end in 2030, and he currently serves on three of the eight committees of the Fed Board. Prior to joining the Fed, Waller was the executive vice president and director of research at the Federal Reserve Bank of St. Louis. His academic background includes years as a professor and researcher, focusing primarily on macroeconomics and monetary policy. In the past, he used to say that crypto is nothing more than "a speculative asset, like a baseball card," but he acknowledged the potential future uses and positive features of the crypto ecosystem.

It might well be that Waller's Republican ties and academic foundation shaped his perspective on crypto and financial innovation in general, or, it might just be a smart strategy. Jerome Powell’s term as Chair of the Federal Reserve ends in less than two years. After the new president is elected, Gary Gensler, the leading crypto enemy in the U.S. policy, is expected to quit. With these potential leadership changes, the U.S. government might adopt a more crypto-friendly stance in the near future. Waller may be positioning himself as a forward-thinking candidate for leadership, and his open approach to stablecoins and DeFi could bolster his case.

Waller's fellow Board members tend to keep silent on controversial crypto questions, but when they do cautiously comment, they express similar ideas. Fed Chair Jerome Powell believes that the central bank should have a “robust federal role” in overseeing stablecoins, indicating a focus on regulatory frameworks. He also confirmed this year that the U.S. is a “long way” from launching CBDC. Similarly, Michael Barr has raised concerns about the potential risks of stablecoins, including their ability to disrupt financial stability if not appropriately regulated. Governor Michelle Bowman also questioned the need for retail CBDCs, outlining that there could be some promise for wholesale CBDCs. He also warned that a poorly designed CBDC could disrupt the banking system. Interestingly, Bowman stated that CBDC had been discussed as a potential regulated "alternative to stablecoins," almost equating the two concepts.

Waller's and his fellows' stance raises an interesting question: Could stablecoins like USDT serve as a de facto U.S. CBDC? While nobody has explicitly stated this, and there are no signs that Tether or Circle are seeking state involvement, the idea suggests itself. Stablecoins, especially if regulated, offer many of the advantages that proponents of a U.S. digital dollar seek, including the potential to lower transaction costs and increase the speed of payments. What is more important is that, unlike notional U.S. CBDC, USD-linked stablecoins are already in use.