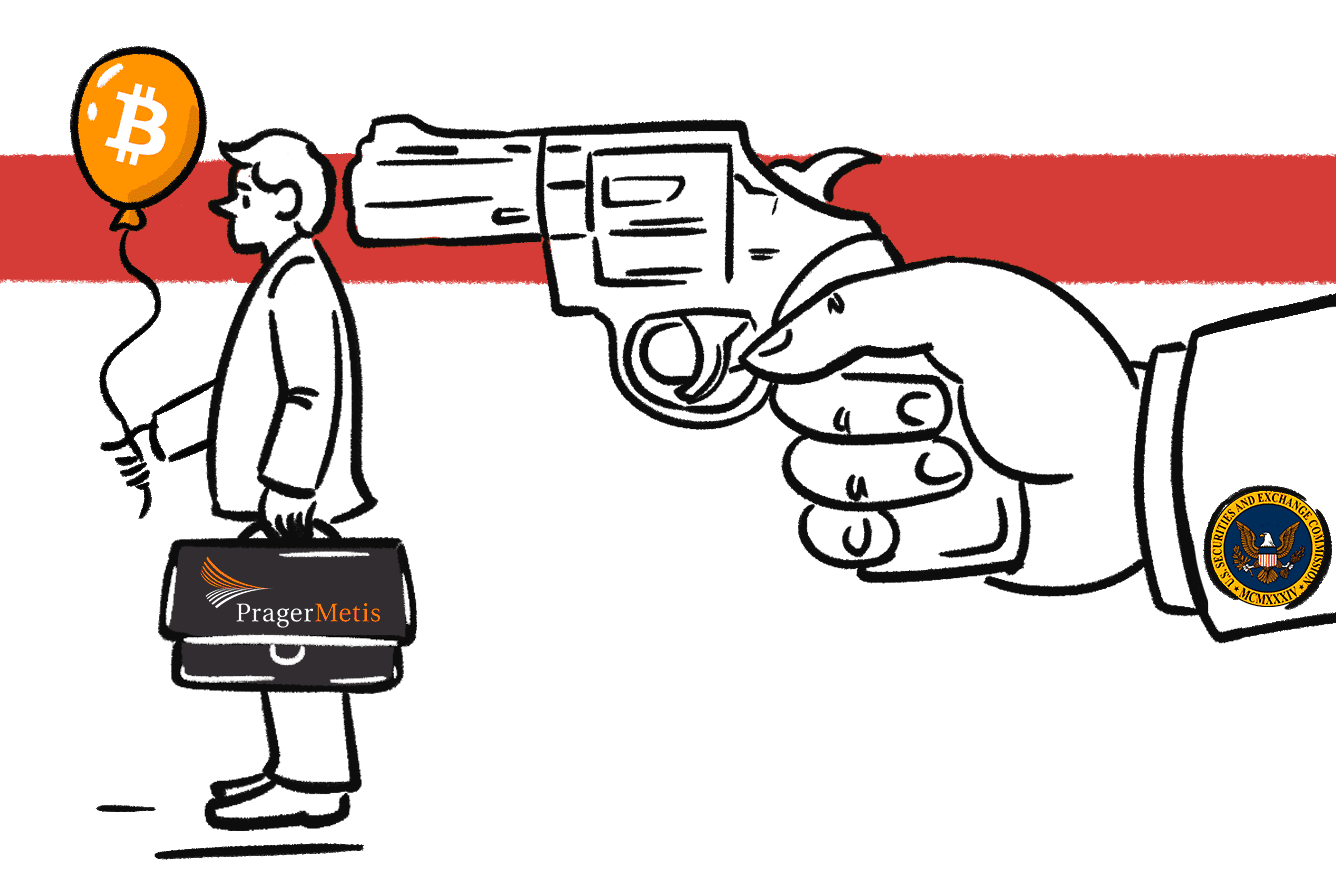

On September 29, the U.S. Securities and Exchange Commission (SEC) charged auditing firm Prager Metis with a series of violations of auditor independence rules.

The company, with over 20 offices worldwide, was one of the two firms that previously audited the international arm of FTX, reporting $1 billion in revenues in 2021, the year before the crypto-exchange filed for bankruptcy with a $7 billion shortfall in its balance sheet.

The charges that Prager Metis has now been accused of are not directly related to the Sam Bankman-Fried crypto flop but are respective of around 200 of the firm's engagements with 62 other clients.

The SEC accused the New York-registered company of failing to comply with "the Commission’s auditor independence rule" by including an indemnification clause in its engagement letters (audit contracts). According to the complaint, the matter affected 62 full audits and more than 150 other engagements, totaling $3 million in fees.

The Public Company Accounting Oversight Board (PCAOB), the body that sets audit standards for practicing firms in the U.S. explicitly permits indemnification clauses for liability and costs but only resulting from knowing misrepresentations by management (audit client). The SEC, however, has a much stricter approach, forbidding any indemnity language.

The type of indemnity clause brought up by the SEC in the complaint against Prager Metis seems to be compliant with PCAOB standards, but can diminish the incentive for the auditors to do a thorough job:

In the event that we become obligated to pay any judgment, fine, penalty, or similar award or sanction; agree to pay any amount in settlement; and/or incur any costs including legal fees, as a result of a claim, investigation, or other proceeding instituted by any third party, including any governmental or quasi-governmental body, and if such obligation is a direct or indirect result of any inaccurate or incomplete information that you provide to us during the course of this engagement, and not any failure on our part to comply with professional standards, you agree to indemnify us, and hold us harmless as against such obligations, agreement and/or costs.

Because of the importance of management’s representations to an effective audit [or examination], the Company agrees to release and indemnify [Prager] and its personnel from any liability and costs relating to our services under this agreement attributable to any knowing misrepresentations by management.

Independent auditing is the bedrock of safe and transparent financial markets as it gives investors confidence in the financial statements of the issuing entities, without which investors’ trust in both the issuers and the financial market erodes, leading capital to shy away. SEC reporting and audit standards put an extra responsibility on the accountants due to the public's exposure to the reporting entities.

However, it is difficult not to spot the connection between Prager Metis's troubles and their involvement with the crypto industry. The firm came into the spotlight following the collapse of FTX, it still has a dedicated page for digital assets services advertised on its website, and it is known as the first audit firm that opened an office in the Decentraland metaverse.

The SEC intensified its crusade against crypto following the market collapse due to the Terra/Luna crash and FTX declaring bankruptcy. For the commission, this was proof that the fairly recent and largely misunderstood crypto market lacked enough maturity to provide the desirable levels of investor safety.

As the charges against Prager Metis show, there is plenty of room for fraud and breaches of the law among the traditional checks and balances of the financial markets. While this may be a coup for the SEC, it paints its efforts in fighting crypto as even more frivolous.