The estate of collapsed cryptocurrency exchange FTX has filed approximately 25 lawsuits against former stakeholders and associates to recover billions in assets, including a $1.8 billion claim against rival exchange Binance and its former CEO Changpeng "CZ" Zhao.

Binance Share Repurchase Under Scrutiny

The lawsuit against Binance and CZ centers on a 2021 share repurchase deal where FTX bought back Binance's equity stakes in both companies. Court documents reveal Binance and other defendants received $1.76 billion for their 20% stake in FTX's international unit and 18.4% stake in its U.S.-based entity, West Realm Shires. The payment consisted of FTX's exchange token, FTT, Binance's BNB token, and its BUSD stablecoin.

FTX's estate alleges the transaction constitutes a "constructive fraudulent transfer" since its trading affiliate Alameda Research, which funded the deal, "was insolvent at the time of the share repurchase and could not afford to fund the transaction." Court filings state FTX and Alameda "may have been insolvent from inception and certainly were balance-sheet insolvent by early 2021."

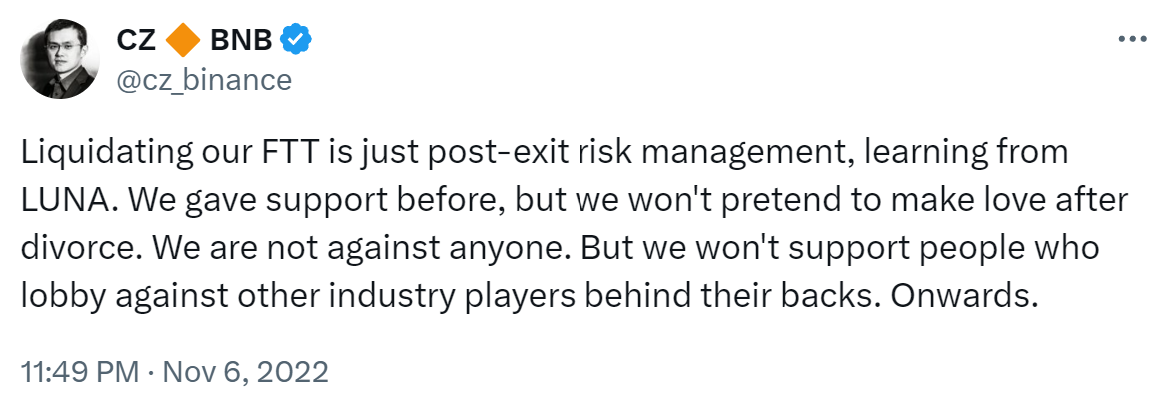

The estate also accuses CZ of deliberately triggering FTX's collapse through a series of public statements. Court documents cite a tweet from November 2022, in which CZ announced Binance would liquidate approximately $529 million in FTT tokens. The lawsuit characterizes these statements as "maliciously calculated to destroy his rival." More tweets from the same date have also been listed in the complaint.

"The claims are meritless, and we will vigorously defend ourselves," a Binance spokesperson told CNBC.

Ex-White House Scaramucci Targeted

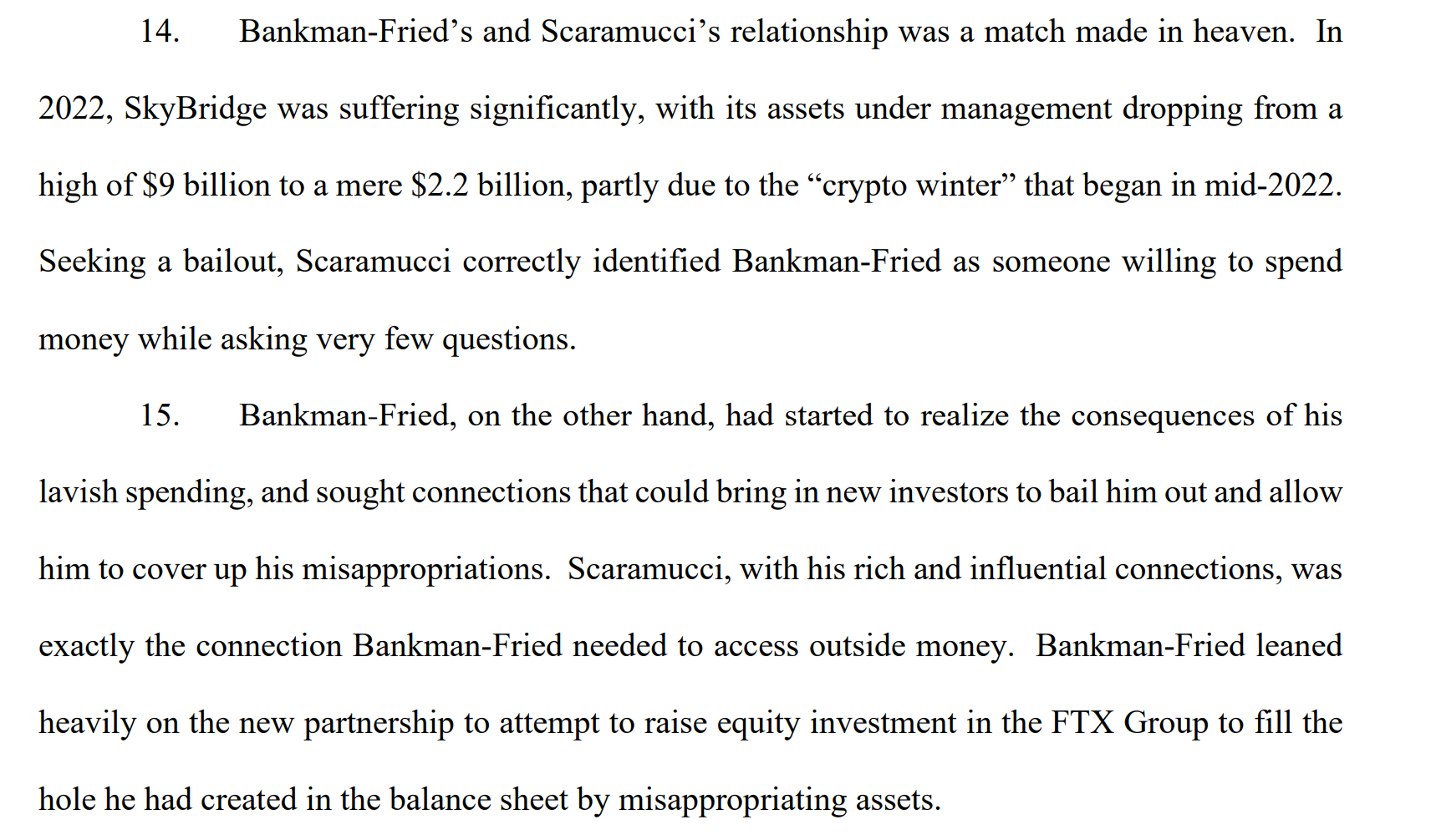

The FTX estate also demands over $100 million from Anthony Scaramucci, former White House Communications Director, and SkyBridge Capital, alleging former FTX CEO Sam Bankman-Fried "poured significant time and money" into cultivating Scaramucci's "established financial, political, and social network" during the crypto market downturn of 2022.

FTX alleges that the SkyBridge investments exemplify Bankman-Fried's wasteful spending and lack of accountability. The estate is particularly focused on recovering funds tied to FTX's venture arm's 2022 acquisition of a 30% stake in SkyBridge.

Court documents claim Scaramucci sought a "bailout" as SkyBridge's assets under management had plummeted from $9 billion in 2015 to $2.2 billion.

The lawsuit targets $12 million from a SALT conference sponsorship, $55 million from investments in Scaramucci entities, and damages from alleged unauthorized sales of bitcoin and Solana tokens worth in excess of $120 million at current prices. FTX also moved to block SkyBridge's $45 million bankruptcy claim, which it says "asserts a claim for the same $45 million it has already received."

Scaramucci has not publicly commented on the legal proceedings.

FTX Sues Compound Exploiter and Others

Among the most significant cases, FTX's lawsuit against trader Nawaaz Mohammad Meerun alleges he profited over one billion dollars through platform manipulations targeting illiquid tokens.

The complaint shows how Meerun repeatedly exploited FTX, using multiple accounts with various food-themed pseudonyms to manipulate the prices of tokens, including BTMX, MOB, BAO, TOMO, SXP, and KNC.

The lawsuit claims Meerun "has been linked to money laundering operations and Ponzi schemes dating back more than a decade" and continued cryptocurrency exploits after FTX's collapse, reportedly executing a governance attack on Compound in June this year under the alias "Humpy the Whale."

Despite allegedly siphoning off hundreds of millions, court documents reveal Meerun filed bankruptcy claims totaling $13 million for funds left on FTX, submitting "his own name, address, and KYC information."

Observing moneytech and Web3Alexander Mardar

Observing moneytech and Web3Alexander Mardar

On Sunday, Alameda Research sued Waves founder Aleksandr Ivanov and affiliated entities to claw back $90 million from funds deposited with Vires.Finance, a Waves liquidity platform. The filing claims Ivanov "secretly orchestrated a series of transactions that inflated artificially the value of WAVES, while at the same time siphoning funds from Vires."

According to the suit, Alameda deposited approximately $80 million in USDT and USDC with Vires in March 2022, which was later converted to roughly $90 million worth of USDN. Despite repeated attempts by FTX debtors to recover the frozen assets, Ivanov has ignored all outreach attempts since January 2023.

Meanwhile, FTX has accused the developers of Storybook Brawl of misusing funds received from FTX for a game that never advanced beyond beta testing. Jean Chalopin, chairman of Deltec Bank, also faces claims related to an $11.5 million investment deemed economically questionable.

The lawsuits follow the approval of FTX's reorganization plan and argue the company was insolvent from at least early 2019, making these transfers fraudulent. This legal campaign represents one of cryptocurrency's largest recovery efforts, as creditors seek compensation following FTX's fall from its $32 billion valuation.

The wave of litigation comes as SBF begins serving his 25-year sentence for fraud, while CZ awaits sentencing after pleading guilty to violating U.S. banking laws and sanctions.