GameStop, a major player in the retail gaming industry and a publicly traded company, has made headlines with its decision to shut down its NFT marketplace. The move, announced recently, is attributed to the ongoing regulatory uncertainty surrounding the cryptocurrency space.

As of February 2, 2024, GameStop’s users will no longer have the ability to purchase, sell, or create NFTs on its platform. However, it is important to note that these NFTs, being blockchain-based, will continue to be accessible and can be traded on other platforms. Earlier last year, GameStop made a similar decision to wind down its NFT wallet, citing an identical reason.

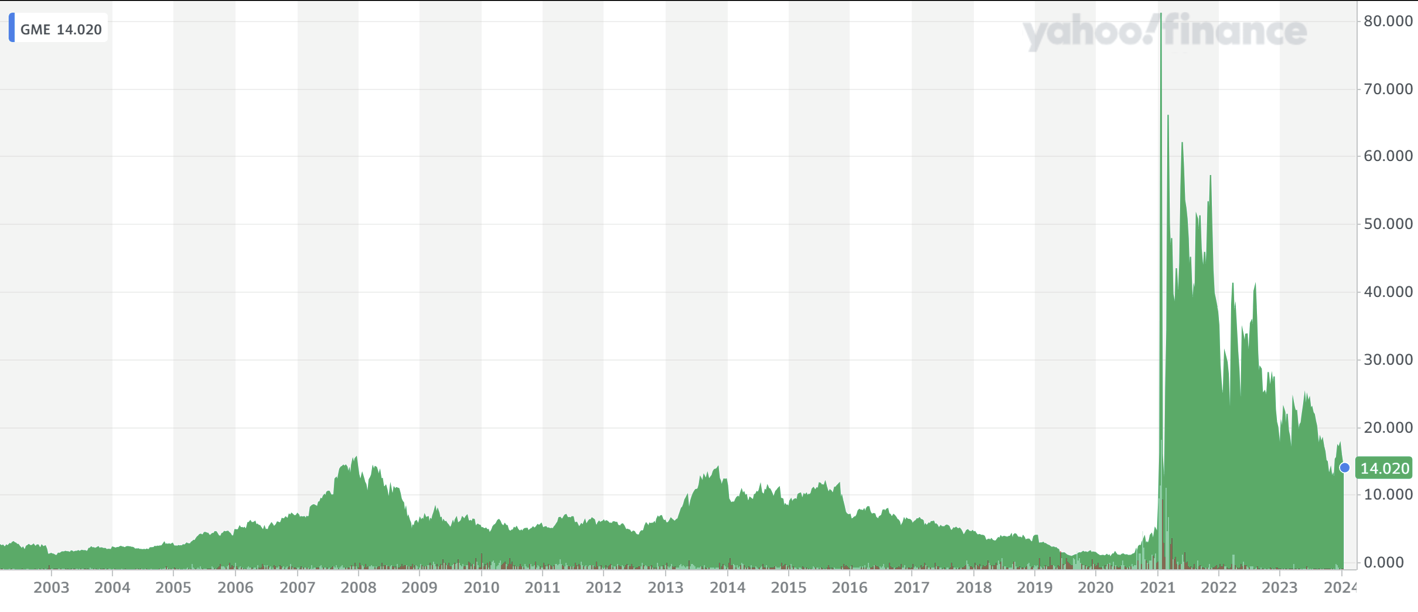

Gamestop entered the NFT space around two years ago, amidst much excitement and anticipation. In partnership with Immutable X, the company launched a $100 million grant program paid in IMX tokens, aimed at supporting NFT content creators and tech developers. To bolster this venture, GameStop expanded its team by hiring 20 new staff members who were dedicated to its new digital endeavor.

However, the company’s journey in the crypto world was not smooth. Its partnerships within the crypto industry were mired in controversy. As part of the partnership agreement, GameStop received a significant allotment of IMX tokens. However, just a day after announcing the partnership, GameStop dumped $47 million worth of IMX onto the market. This sell-off occurred just as IMX’s value spiked following partnership news, only to plummet by 23% in the subsequent 24 hours, causing significant discontent within the IMX community.

The underlying reason given for discontinuing both the NFT marketplace and wallet remains a topic of speculation. While regulatory challenges are cited as the official reason, some speculate other factors at play, including a lack of market traction. Recent data suggests that GameStop’s NFT marketplace volume was relatively insignificant, especially when compared to larger platforms like Blur and Opensea.

Last June, GameStop's crypto journey faced another hurdle with the firing of CEO Matt Furlong, who had led the company’s push into NFTs. This might suggest that there has since been a shift in strategy, steering away from cryptocurrency projects.

In a broader context, GameStop’s retreat from the cryptocurrency space is not an isolated incident. Last year, several companies pulled back from crypto-related initiatives, often citing regulatory uncertainties as the primary concern. For example, Revolut, a notable player in the financial technology sector, cited an “evolving regulatory environment” as the reason behind its decision to discontinue crypto services to U.S. customers.