It's often difficult to figure out the driving force behind Bitcoin's sudden declines.

But with the world's biggest cryptocurrency plunging by 9% over the past week, and coming perilously close to sliding below $54,000 in the process, the issue driving fear among investors is painfully clear.

It all relates to a criminal operation in Germany. Back in January, prosecutors successfully seized a staggering 50,000 BTC from the operator of movie2k.to, a site that offered illegal downloads of TV shows and movies.

Worth over $2.8 billion at the time of writing, this is the largest crypto confiscation in the country's history. But a bigger problem emerged: what the government should do it with it all.

Six months on, we've now got our answer. Records from Arkham Intelligence show Germany's liquidating this BTC en masse—and transferring the ill-gotten gains to the likes of Coinbase, Bitstamp and Kraken.

That 50,000 BTC balance has dwindled substantially over the past week—it currently stands at just 22,800 BTC—fueling fears that these bulky transactions will exert selling pressure and jeopardize a fragile-looking bull run.

Once sold, the proceeds will boost the coffers of the state of Saxony—with Germany's Attorney General's Office telling the Bild newspaper that no decision has been made on how the funds will be used.

Interestingly though, the German government's now facing pressure of its own—primarily from local politicians who want the selling spree to stop.

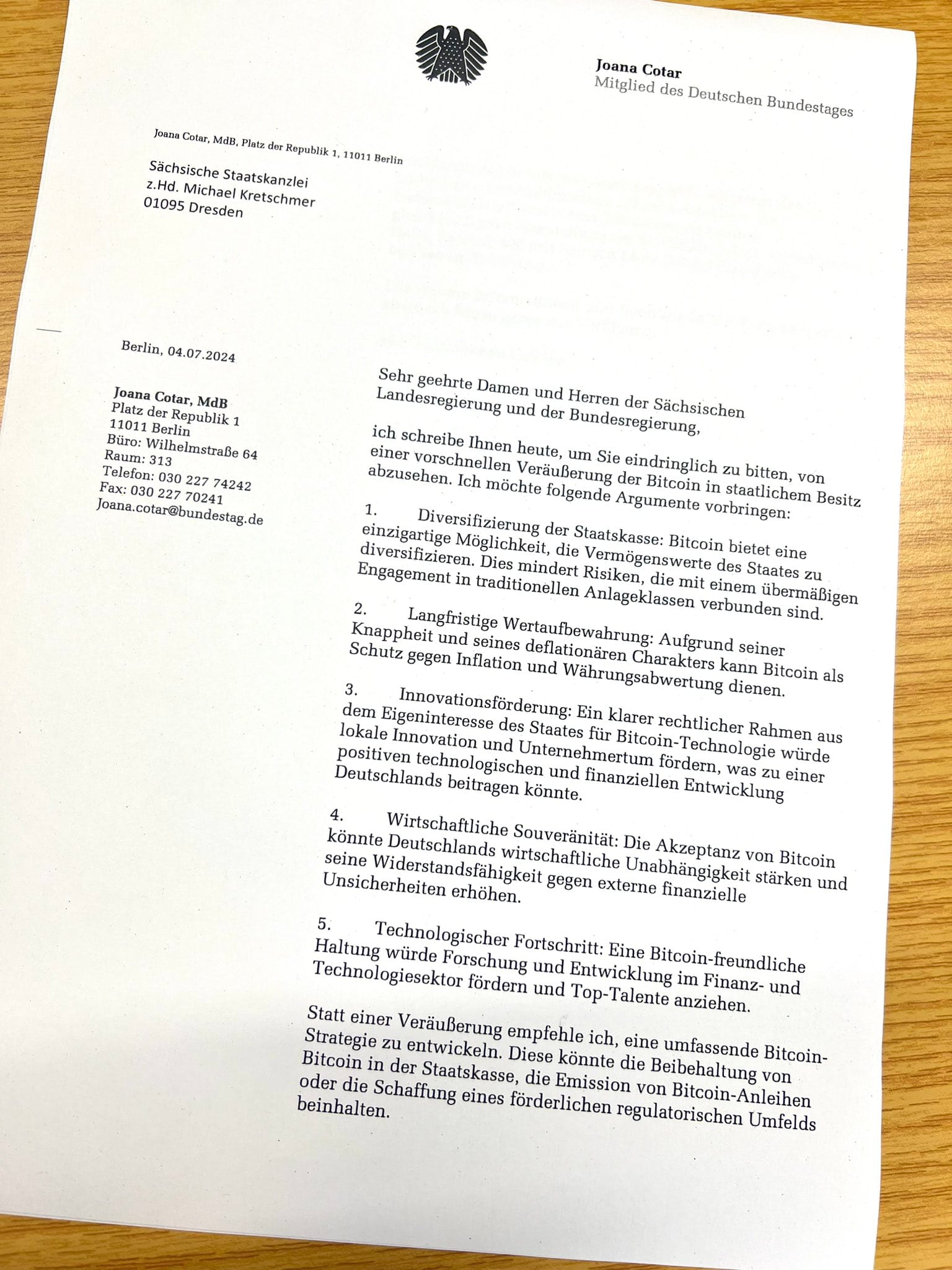

Joana Cotar, a member of the Bundestag who until recently was part of the far-right Alternative for Germany party, has urged Chancellor Olaf Scholz to "refrain from a hasty disposal," and consider the benefits of holding BTC in reserve.

Repeating oft-made arguments from ardent Bitcoin supporters, she wrote that Bitcoin could help diversify the state treasury, serve as a hedge against inflation, and encourage innovation and entrepreneurship.

Cotar also suggested that accepting Bitcoin "could strengthen Germany's economic independence and increase its resilience to external financial uncertainties"—slightly bizarre considering this cryptocurrency has long been designed to challenge the traditional financial ecosystem, and even one day step up as a successor to fiat currencies.

Her letter was initially sent on July 4—and based on the frenzied activity seen in the German government's crypto wallet over recent days, it seems like her pleas have pretty much fallen on deaf ears.

It's fair to say that the timing of these sell-offs is pretty unfortunate for Bitcoin, which tends to suffer from lower liquidity during the summer months.

What's more, it also coincides with efforts to compensate those who lost substantial amounts of BTC when Mt. Gox went bust in 2014.

With Germany still holding on to about half of this ill-gotten crypto haul, and no signs of transfers to exchanges slowing down, things might get worse for Bitcoin before they get better.

JAN3 founder Samson Mow, who has long lobbied for nation-state Bitcoin adoption, has attempted to put a brave face on the situation—posting on X:

"The fact is that Bitcoin supply is constrained, constantly decreasing, and demand is increasing."

Mow went on to argue that the market has been "absorbing all Bitcoin sales nicely" so far, adding:

#Bitcoin whales accumulating German @BTC. pic.twitter.com/5vdviOJK5O

— Samson Mow (@Excellion) July 9, 2024