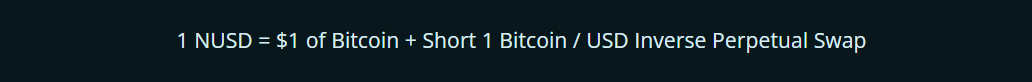

Stablecoins, Decentralized stablecoins, NakaDollar (NUSD), Satoshi Nakamoto Dollar, BitMEX, Banks, Perpetual Futures (Perpetuals, Perps), Arthur Hayes, MakerDAO, DAI, Bitcoin

Hayes Explains Problems With Stablecoins, Proposes a New Type

Arthur Hayes, the co-founder and former CEO of crypto exchange BitMEX, criticized both custodian and decentralized stablecoins and proposed a new stablecoin called the Satoshi Nakamoto Dollar, or NakaDollar (NUSD). Unlike existing stablecoins, NUSD would be supported only by Bitcoin.