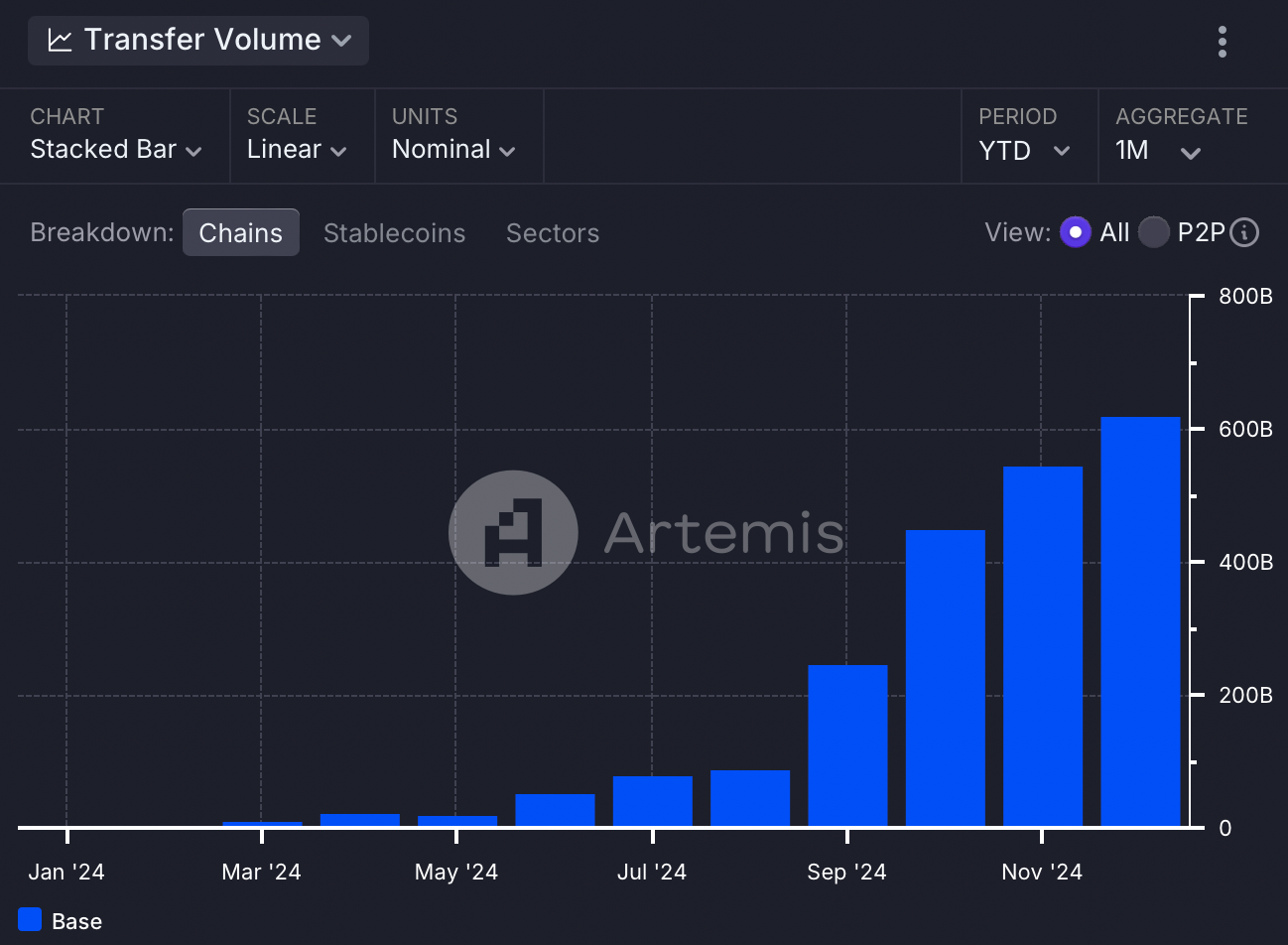

The Base blockchain has seen a dramatic surge in stablecoin activity and an overall growth of around 10x since June. Its daily transfer volumes reached a new ATH of $39.6 billion on December 17, while its monthly volume has already surpassed $622 billion.

Last month, Base outranked all other chains in stablecoin transfer volume for the first time. Since then, it has overtaken major players like Solana, Tron, and occasionally Ethereum too.

The volume is mainly generated on Aerodrome's decentralized exchange (DEX). ]The exchange has overtaken Uniswap and all other protocols on Base in terms of total value locked, fee generation, and volume and now accounts for almost half of Base’s TVL. Almost all transfers are executed in Coinbase-related USDC.

Back and Forth on Aerodrome

According to Artemis' research, the heart of this growth lies in strange market maker activity on Aerodrome. Several addresses with similar patterns generate over $7.5 billion in transfer volume per day, which amounts to around 20-45% of daily stablecoin transfer volumes over the last month. $2-3 billion per day of this volume belongs to a single address.

These addresses provide liquidity to trading pools, specifically USDC/WETH, and then withdraw and reinvest it every few minutes. The process is further streamlined by pre-planning transactions for continuous operation.

Earned trading fees and $AERO rewards are mainly reinvested. Other advanced strategies include leveraging other platforms like AAVE to borrow more assets for liquidity provision.

The Impact on the Base’s Ecosystem and Its Participant

While this strategy might be regarded as artificial inflation of volumes in the first place, the Artemis team outlines that this wash trading has a broader impact on the Base ecosystem.

By injecting liquidity into Aerodrome’s pools, market makers improve trading efficiency, reduce slippage, and offer better execution prices, which is good for traders.

Passive liquidity providers are in a less favorable situation. While they still earn a yield, their share of the rewards decreases when active participants dominate pool liquidity.

Is Base Really Growing?

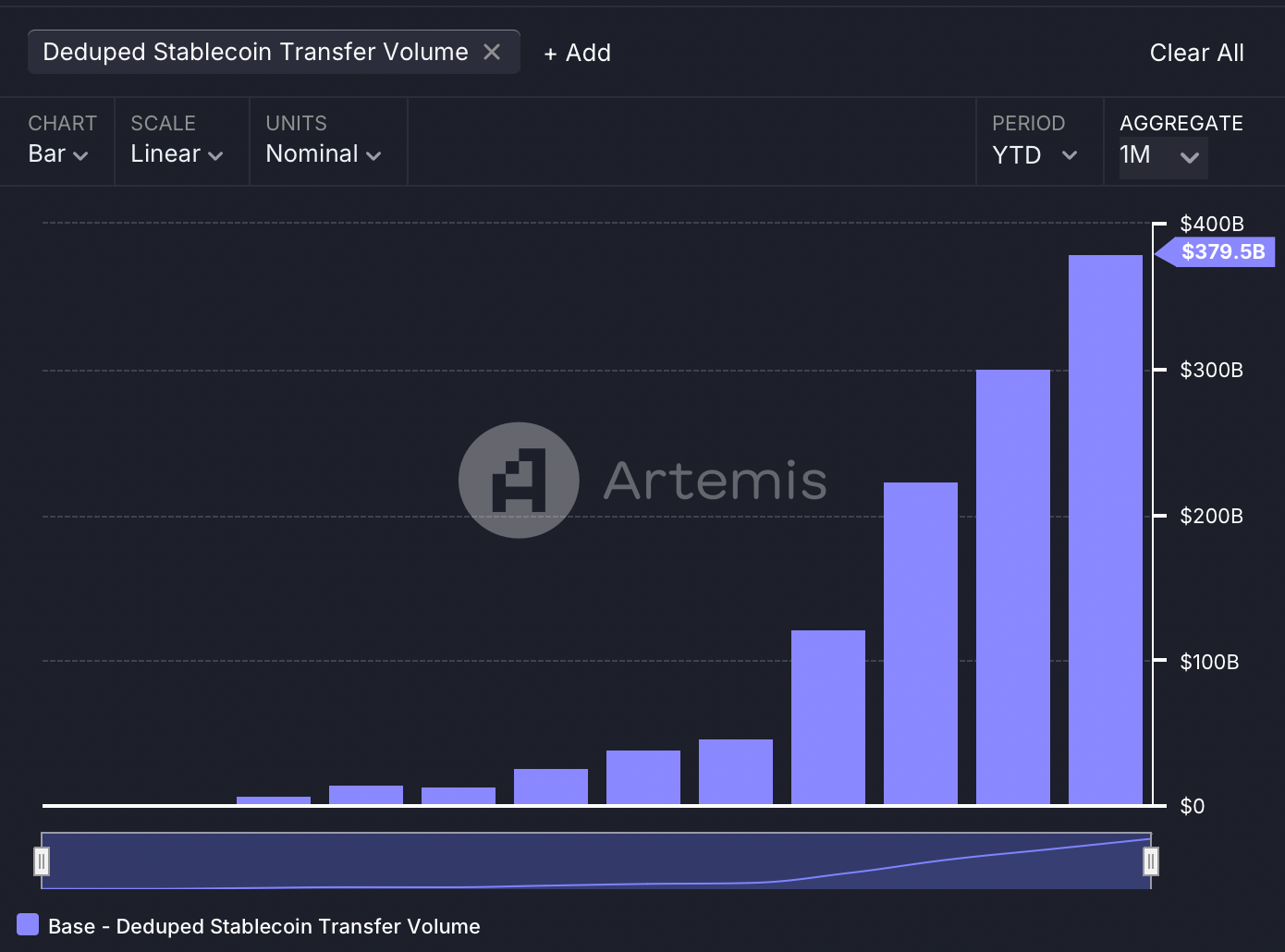

Still, the Base’s growth is more than just market-making activity, according to Artemis' new stablecoin metrics, which filter out duplicates, internal transfers, MEV, and bot activity.

Even though the adjusted volume is 40% less, it reveals explosive growth in stablecoin transfers on Base, with daily active addresses remaining at a high level and stablecoin active addresses growing by 16% over December.

Some critics earlier suggested that Aerodrome’s volumes might be artificially inflated by "a programmatic bot, who exclusively trades in the ETH/USDC pool." Even if this is partially true, these data show that Aerodrome has successfully attracted real participants as well.

The growing stablecoin activity on Base aligns with the general trend. This month, the total market capitalization of stablecoins rose above $200 billion and surpassed the previous ATH recorded in 2022. The trading volume of stablecoins is rapidly growing across all chains.