AI and machine learning can identify money laundering patterns that would be missed by traditional blockchain analytics, according to new research by Elliptic.

The company has been dabbling with this experimental technology for the best part of five years — and has now publicly released a dataset containing over 200 million transactions so the wider community can develop other techniques for detecting illicit activity.

Elliptic's study was jointly carried out with the MIT-IBM Watson AI Lab, and the British firm says the outputs are already being used to enhance its products, adding:

"Blockchains provide fertile ground for machine learning techniques, thanks to the availability of both transaction data and information on the types of entities that are transacting, collected by us and others. This is in contrast to traditional finance where transaction data is typically siloed."

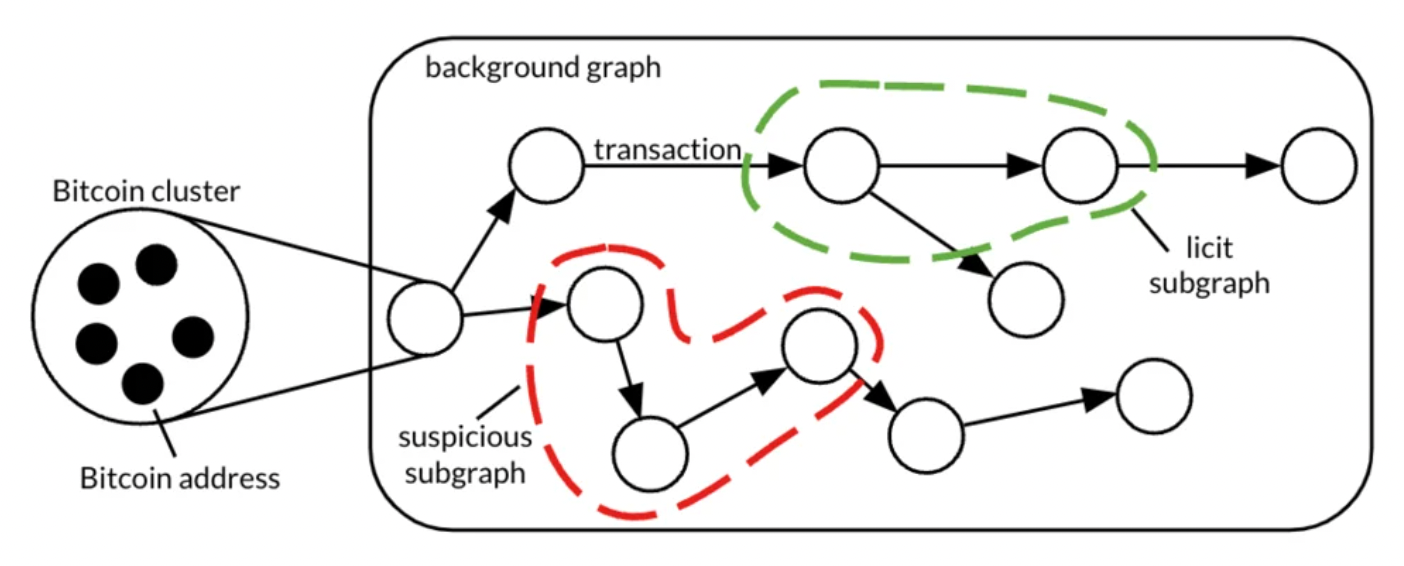

A machine learning model was trained to spot "subgraphs," which Elliptic describes as "chains of transactions that represent Bitcoin being laundered."

A crypto exchange was enlisted to see whether this new approach would accurately uncover money laundering attempts within its business. A total of 52 suspicious subgraphs were identified by the tool — without access to any account information. It later emerged that the trading platform had flagged 14 wallets because of suspected illicit activity. Potential wrongdoing is normally detected in just one in 10,000 accounts — "suggesting that the model performs very well."

What's especially significant is that the machine learning model was able to reveal previously unknown illicit wallets — meaning further research can be carried out to identify those responsible. Elliptic said:

"This approach has already enabled us to identify a number of previously unknown wallets used by illicit actors including Ponzi schemes and darknet markets."

Elliptic argues that AI-based analytics — when combined with the transparency of blockchains — mean cryptocurrencies are "far from being a haven for criminals," not least because "siloed" data in traditional finance means such techniques cannot be deployed as successfully.

When hacks and scams occur, exchanges are often in a race against time to freeze funds before they are moved off platform and out of reach. Tools like this could dramatically cut the time it takes to spot illicit digital assets, meaning victims have a higher likelihood of being made whole.

It's another small step in making crypto an impractical target for criminals — and helping the industry shrug off its reputation of being a "Wild West" for scammers, fraudsters and hackers.