Wall Street's crypto-related exchange-traded funds hold about $52.8 billion in Bitcoin and $5.5 billion in ether. The tendency is for these values to grow, but each at their own pace.

The different degrees of interest that mainstream and institutional investors have for BTC or ETH ETFs and the amount of influence TradFi can inflict on the assets is a reflection of the differences that exist between the two cryptocurrencies, their ecosystems, and their use cases.

Let's look at some key differences.

How Does Demand For ETFs Influence The Price Of Bitcoin and Ether?

Bitcoin had its most bullish September in a decade. The month is usually a tough one for the world's largest cryptocurrency, but as Wall Street's legacy firms take hold of the digital asset, new price patterns are emerging, and Bitcoin price's responsiveness to macro changes in the United States is increasing.

Following the reach of an all-time high of $73,666 in March 14, Bitcoin's price has been in a downtrend—every time it makes a new high, a new bottom is formed.

This situation has led to a sharp decline in retail investors' participation in BTC trading but interestingly, not of institutional investors.

Their risk appetite for Bitcoin is manifested in spot ETF inflows, which have been on the rise since the start of the year. Research from crypto exchange Bitfinex notes that the differences in these behaviors have "contributed to a greater correlation between BTC and the SPX [S&P500]."

This has two consequences.

- First, with Bitcoin's performance more in line with that of traditional assets, it becomes more susceptible to what is happening in those markets than to what is happening in the crypto ecosystem.

Although Bitcoin's price has always been responsive to external events, there is now a difference. The illusion that it might perform differently and offer a "safe haven" is dead.

- The second consequence is that "sustained ETF inflows could buoy the BTC price" and maintain its dominance (the ratio of its market cap to the cumulative market cap of all cryptos) over the market.

In the first two months after the launch of BTC spot ETFs, the price of Bitcoin went from $46,354 to an all-time high two months later.

With Ether, however, we did not see the same price response.

On July 23, the day of the spot Ether exchange-traded funds launch, ETH was trading at $3,482, and it hasn’t reached that high since. Today, according to data from Trading View, it is trading at $2.349.

Contrary to purely speculative Bitcoin, ether's price is affected by more factors, such as the profits generated by the project (gas fees), staking opportunities, expectations of upgrades, etc. In this dimension, it acts more like a company share than money.

Ether is also a medium of exchange in the largest Web3 ecosystem and the most traded currency in its several layer twos. It doesn't have an upper supply limit, and without that "scarcity" factor on the supply side, its pricing mechanisms are similar to fiat currency.

So, while demand for ETFs leads to an increase in demand for Ether, other (very strong) factors influence its price.

How Have EFTs Impacted Market Dominance?

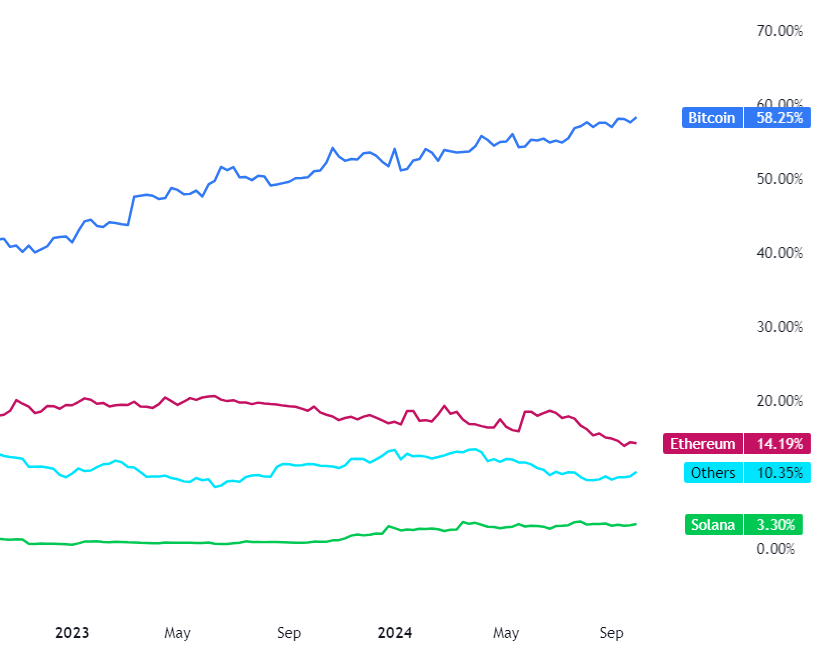

Since 2023, when ETF expectations began to grow, Bitcoin's dominance—the ratio between its market cap and the total market cap of the entire crypto market—has grown from around 40% to slightly above 58%.

As Bitcoin becomes more detached from the crypto markets, its dominance also becomes less threatened by altcoins as there is an independent (and booming) demand for it.

Ethereum, on the other hand, is firmly inside the crypto market - a deep part of the ecosystem where things happen and which sets the tone for the innovation and growth of Web3.

Like its price, its dominance is not significantly determined by the demand for exchange-traded funds or other investment vehicles.

How Popular Are Crypto Spot ETFs?

The willingness of mainstream investors to gain exposure to Bitcoin through these investment vehicles has made them some of the most successful ETFs in the financial world: their flows have outpaced those of the first net gold ETF (inflation-adjusted) launched in 2005.

BlackRock's iShares Bitcoin Trust (IBIT) is currently one of the best-performing ETFs on a year-to-date basis, with all its close competitors—$VOO, $IVV,$VTI, and $QQQ—being major traditional funds.

Regarding the huge popularity of these funds in the U.S., Ki Young Ju, founder of crypto data analytics firm CryptoQuant, noted that the demand of U.S. citizens for these instruments is leading to an increase in the ratio of Bitcoin holdings in the United States compared to other countries.

Ether spot ETFs haven't reached the same heights of popularity, and given how they work, probably never will. Does this go to show that, while Bitcoin is becoming a mainstream asset, Ether isn't? We will continue to observe.