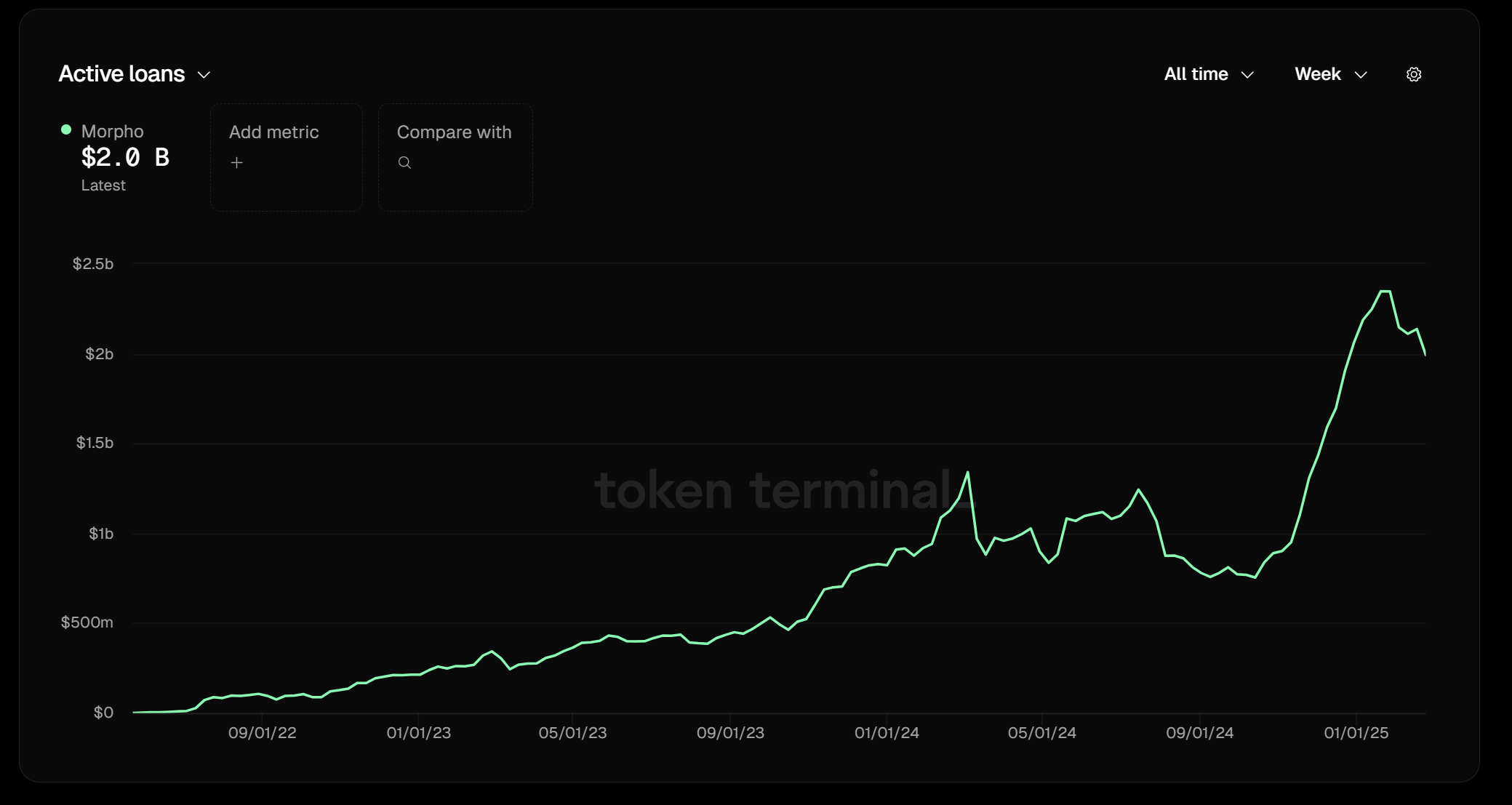

Over the past year, Morpho has grown as a DeFi lending protocol, becoming a strong competitor to established players in the space. This success is due to its efficient technical solutions and skilled business development.

Despite starting off significantly behind industry giants like Aave and Compound, Morpho has successfully expanded its active loan portfolio to $2 billion since 2022. In January alone, the project earned $20 million in fees, putting Morpho in a strong position to maintain and even accelerate its growth.

DeFi Banking Infrastructure

At first glance, Morpho might seem like other lending protocols, but it stands out with unique technical solutions that have been key to attracting clients. A key difference is that Morpho allows users to create custom lending markets.

When creating a lending market, creators can specify various parameters, including a preferred collateral asset, the asset used for lending, the pricing oracles, a preferred interest rate model, and a custom Liquidation Loan-to-Value ratio.

This innovative approach benefits both lenders and borrowers by enabling more efficient capital allocation, which leads to better interest rates for both parties. Consequently, lenders enjoy higher returns on their deposits, while borrowers benefit from lower interest rates. This method contrasts significantly with lending protocols like Aave, where the team decides on which lending markets to add.

As stated by Morpho Labs' CEO, Paul Frambot, "Aave is a bank, whereas Morpho is an infrastructure for banks."

Another feature resembling traditional lending setups is the existence of risk management mechanisms. Since the creation of lending vaults in Morpho is permissionless, the protocol has incorporated risk curators into its infrastructure to help users filter out less risky lending options. These curators are independent third-party risk experts who use their expertise to offer various Morpho Vaults.

Notably, Morpho has attracted several well-known curators, including companies like Gauntlet, a blockchain analytics firm that previously advised Aave.

Decentralized Smart Contracts Compete Too. Aave vs Morpho

Not surprisingly, Morpho’s growth hasn’t been well-received by its main competitor, Aave. In a post on X, Frambot accused Aave of trying to “prevent the growth of Morpho.” Moreover, a few months back, Aave threatened to withdraw its lending protocols from the Polygon PoS chain if Polygon collaborated with Morpho.

This potential collaboration would have utilized approximately $1.3 billion in stablecoins from the Polygon Chain bridge for curated lending pools on Morpho.

Despite these obstacles from Aave, Morpho’s unique value proposition continues to attract users. Recently, the project collaborated with Coinbase to introduce Bitcoin loans for its clients. By using Morpho, Coinbase users can now borrow up to $100,000 against their BTC. The borrowing process is facilitated by Morpho on the Base chain, with Coinbase providing an interface to access the protocol without directly managing the loans.

Thanks to its unique lending model, Morpho has been able to form strategic partnerships and grow its user base. With the project’s unique value proposition, its growth seems likely to continue, and it would be no wonder if Morpho would one day be the top DeFi lending protocol in the space.