The Cold Bitcoin Summer of 2024

This super cycle has been unique so far in cryptocurrency’s history, so investors are looking hard at all the relevant market flows, multiples, and ratios to determine where the Bitcoin price is headed next.

Some things that have made this Bitcoin cycle different are:

- Massive on-ramping of Wall Street through the Bitcoin ETFs.

- Reaching a new all-time high price before the halving event.

- Lower percentage returns from the most recent bottom to the ATH.

With the market looking so different compared to past markets with 50,000% and 8,500% gains from trough to peak, crypto investors are scratching their heads and asking was that it?

Is this cycle already over for Bitcoin price alpha?

One clue to whether Bitcoin price has peaked for the cycle or has more room left to run after consolidating is in the MVRV ratio.

What Is Bitcoin MVRV Ratio?

The Bitcoin MVRV ratio is the Market Value to Realized Value ratio that helps crypto saver investors and trader investors to get a better sense of the market’s position in bitcoin relative to its most recent price movements.

The market value part of the MVRV ratio is simple enough.

Taking the entire supply of bitcoin and multiplying it by the current average market price of bitcoin on crypto exchanges gives us the market cap (value).

The realized value part of MVRV, on the other hand, multiplies each bitcoin balance by the price that existed at the time of its last transaction. This effectively strips out the bitcoins that are lost and appropriately weights the long holders' (hodlers) balances.

The ratio if these two, MV/RV shows how much the market is "pumped". The authors of the ratio, identified also two key levels of the indicator: below 1 - the asset is undervalued and above 3.7 - the asset is overvalued.

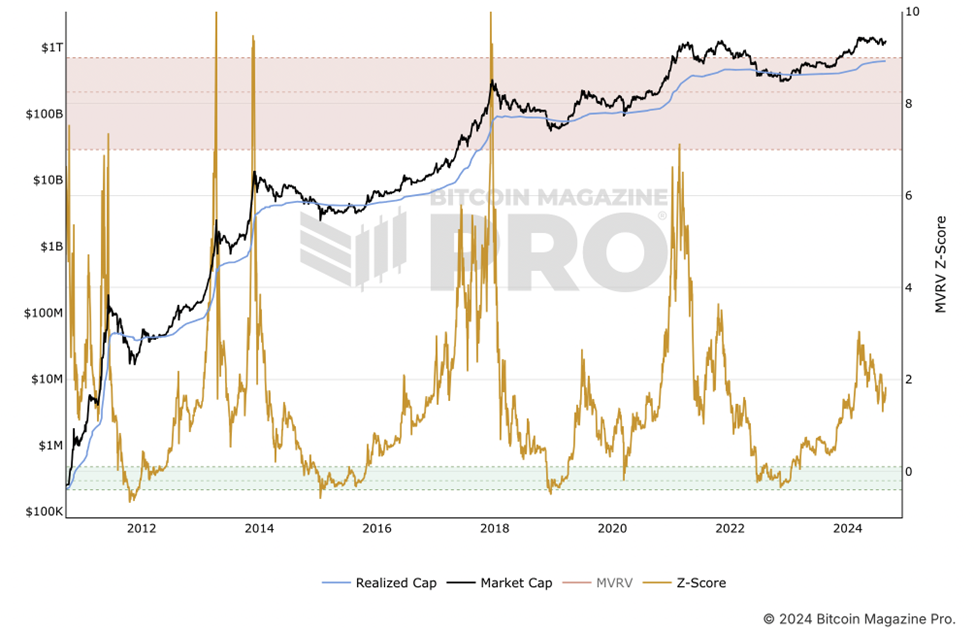

In January 2023, at the price bottom of 2022’s crypto winter, we observed a near perfect match between the market value and realized value of bitcoin . At the time, MVRV ratio was close to 1 and even going below the mark, which indicated the beginning of the accumulation phase.

It predicted the market direction well. The long-term cyclical bear market had cleared and bitcoin’s valuation figures began to go steadily up again from this point.

Not only in this episode but during the bitcoin life, MVRV showed a great correlation with the bitcoin price. This correlation of MVRV ratio with the bitcoin price helped market watchers to see how realistic current crypto exchange prices are.

Bitcoin MVRV Ratio Is Decoupling from Bitcoin Price

When RV is relatively stationary, the MVRV is basically a multiple of bitcoin price, so we would expect to see a high correlation with the price itself.

However, as older coins change hands at recent prices and are revalued, the Realized Value comes closer to Market Value, MVRV drops and the correlation between MVRV and bitcoin price breaks. Usually that happens near cycle tops.

Since mid-April we have observed some steady decoupling of the Bitcoin price from the Bitcoin MVRV ratio. The price graph flies above the MVRV graph.

At the same time, the MVRV ratio stands today at its all-time average value of 1.7. This level has historically marked a transition between macro bull and bear market trends. If nothing extraordinary pushes the bitcoin price up, this equilibrium will last until the losses are "digested" and the price graph joins the MVRV graph again.

Bitcoin halving season hype is well over. The Spot Bitcoin ETF total cap has met and even exceeded the expectations of experts, but the growth has cooled down recently and we have even observed some net outflows in the past few days.

Now, market observers are mostly watching the U.S. economic data and other external factors that can affect crypto markets.