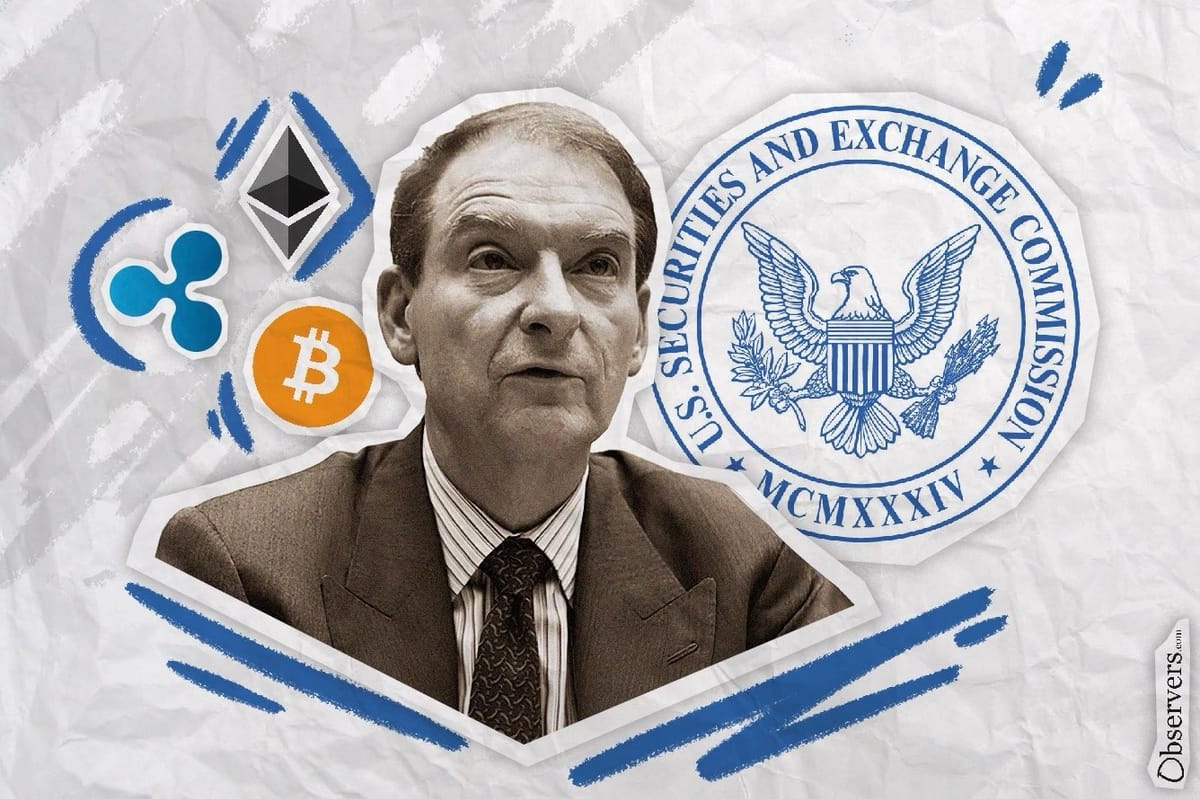

Paul Atkins, Trump's nominee to lead the U.S. Securities and Exchange Commission (SEC), is poised to transform U.S. crypto regulation through public rulemaking and industry collaboration and away from Gary Gensler's enforcement-driven approach.

"I think we will have an SEC that just functions better and more effectively than what we've had under Chair Gensler," said Jake Chervinsky, Chief Legal Officer at Variant, on the Unchained podcast. "All of the folks I've talked to who know Chair Gensler personally will say that he's a politician first and a regulator or operator second, and that's not at all what I hear about Paul Atkins."

The transition could begin before Senate confirmation. Commissioner Hester Peirce or Commissioner Mark Uyeda will likely serve as acting chair—both former Atkins staffers whose existing relationship suggests potential early preparation of new regulatory frameworks. Under interim leadership, the SEC might begin developing proposals to address core questions about its role in crypto oversight and market structure.

However, the SEC requires a bipartisan composition, with no more than three commissioners from any one party. As Atkins prepares to take the chair position, two non-Republican commissioner seats need to be filled.

Senate Democrats sought to reconfirm SEC Commissioner Caroline Crenshaw, who opposed court-mandated Bitcoin ETF approvals, but the Tuesday confirmation vote was reportedly canceled. Senator Tim Scott has requested that nominations be delayed until the new Senate convenes, while Senator Elizabeth Warren's role in selecting Democratic commissioners could provide a counterweight to the Trump administration's crypto agenda. Chervinsky has suggested this could lead to continued pushback within the SEC, though he argues Democrats might better serve their interests by selecting more moderate commissioners following their recent electoral defeat.

Major SEC enforcement cases are also expected to see changes under Atkins' leadership. In the Coinbase case, Mike Selig of Willkie Farr & Gallagher predicts a potential settlement without admitting securities violations:

"There could be a settlement here that doesn't concede that any crypto assets are securities. Of the hundreds of assets listed on an exchange platform, one of them maybe is a security."

Chervinsky further said:

"I don't understand Paul Atkins to be a person who believes in regulation by enforcement. What we will see is the SEC no longer taking novel positions on legal issues in the courts as opposed to engaging in a public process through rulemaking."

In the Ripple case, he notes that both sides could continue litigation despite potential settlement opportunities. Ripple might pursue appeals to establish what they've called "the Ripple test as the successor to the Howey test."

According to Selig, Atkins will "work to create a pathway for issuance of crypto assets" and reconsider whether they should be treated as securities. As a past critic of prescriptive frameworks, Atkins previously dissented on Regulation NMS rulemaking, viewing it as a hindrance to innovation in capital markets.

A fundamental question about agency jurisdiction remains. "The SEC has been the most active and aggressive regulator in the U.S. thus far with respect to crypto, but there really is this core question whether the SEC has any business at all regulating this industry or whether that's really the proper purview of the Commodity Futures Trading Commission (CFTC)," Chervinsky explains. At the CFTC, Summer Mersinger leads contenders for chair, followed by Commissioner Caroline Pham and Brian Quintenz, former CFTC Commissioner now at a16z crypto.

As White House Director of AI and Cryptocurrency Policy, David Sacks will coordinate agency approaches through a new crypto council. Selig claims this will "include both the new DeFi world as well as some of the old TradFi world kind of working together."

Treasury Secretary nominee Scott Bessent will reassess money services business regulations and sanctions policies like the Tornado Cash ban. Selig explains that Bessent views the Biden regulatory framework as "a return to central planning" and wants to reduce regulatory taxes on technology businesses.

The "Operation Chokepoint 2.0" campaign targeting crypto banking relationships will likely end "immediately," according to Chervinsky, though banks' willingness to service crypto clients may still vary. "The question will be to what extent do the banks actually want to bank those companies," he adds.

Looking ahead, Chervinsky emphasizes that the industry needs more than just friendly regulators:

"We cannot be leaving this stuff up to whatever leadership at the SEC happens to think at any given time. We need Congress to step in and decide how are these markets regulated and importantly, by whom."