Many Ethereum supporters view the network as truly decentralized due to its large set of validators, which has grown to over one million. However, a closer look at how these validators propose transactions and build blocks reveals a less decentralized reality.

Ethereum validators have two main options for building blocks: they can either do it themselves or use the MEV-Boost middleware. Validators who build blocks independently have the freedom to choose which transactions to include. However, many lack the expertise to effectively select the most profitable transactions, putting them at a disadvantage.

To address this, MEV-Boost offers a system that helps validators maximize their earnings through block auctions. By using MEV-Boost, validators allow third-party builders to bid for the opportunity to create blocks, ensuring steady rewards without requiring deep expertise in transaction selection.

As a result, many validators opt for MEV-Boost, which provides stable and predictable earnings. However, this approach requires validators to relinquish control over which transactions are included in blocks. If a builder decides to exclude certain transactions for economic or other reasons, they have the freedom to do so.

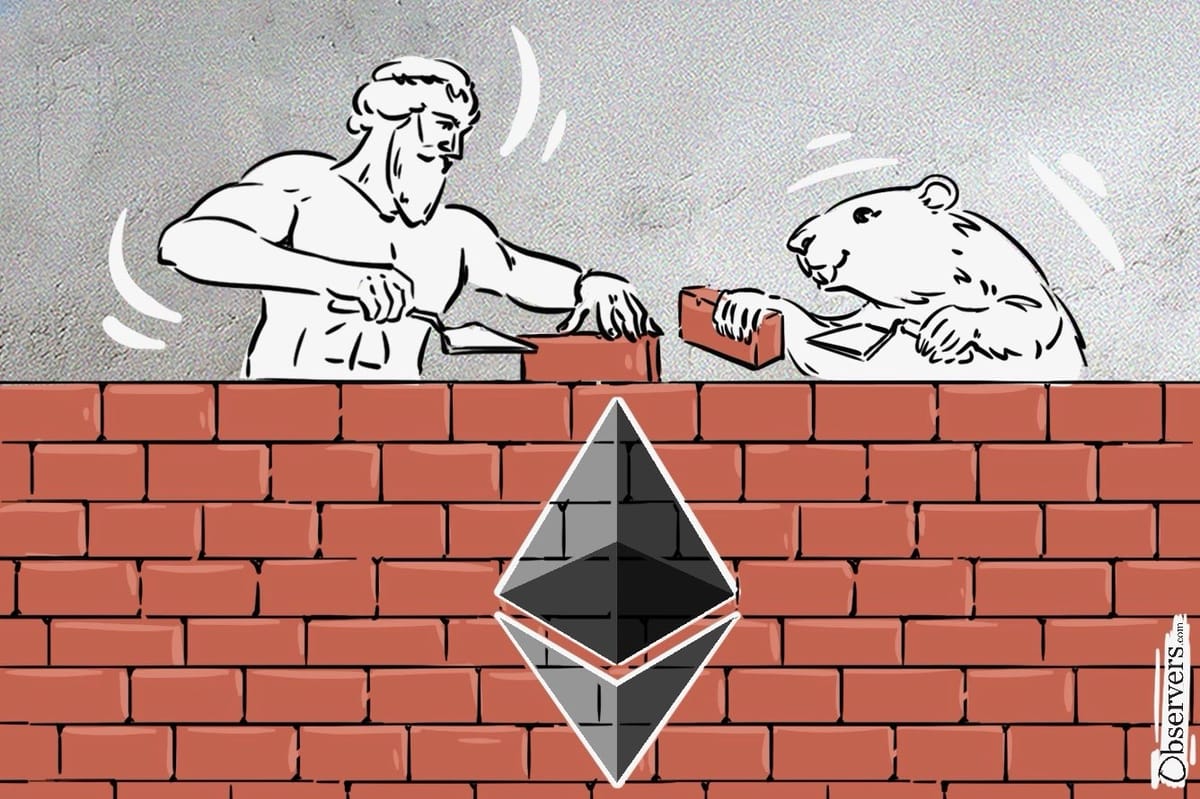

The introduction of MEV-Boost has created a competitive market for block builders, each vying to create the most profitable blocks. Initially, this market saw healthy competition, but over time, it has consolidated. Currently, only two block builders dominate the market.

The market share distribution is as follows: Beaverbuild holds 50%, Titan Builders controls 36.9%, Vanilla Builders (validators not using MEV-Boost) account for 9%, and all other block builders hold a small 4.1%.

This duopoly emerged because Titan and Beaverbuild secured deals with exclusive order flow providers. These providers offer meaningful transaction flow to only one builder, giving that builder a significant advantage.

For example, Titan Builders partnered with Banana Gun, the first Telegram trading bot, during the memecoin frenzy on Ethereum. Beaverbuild, on the other hand, appears to have partnered with CoW Swap. By securing these partnerships, these builders aggregated the most profitable transactions, offering higher rewards to validators and solidifying their dominance.

This dynamic created a “chicken-and-egg” problem that locked out new entrants. To succeed as a new block builder, one must secure exclusive order flow to gain a competitive edge. However, exclusive order flow providers prefer working with established builders who already have high market shares, as they can guarantee inclusion. This makes it nearly impossible for new entrants to compete.

The Ethereum community is aware of this issue and has proposed several solutions to decentralize the block builder market. However, no single proposal has gained significant traction, and the status quo is likely to persist for the foreseeable future. For now, the hope is that this situation will not lead to negative outcomes for the broader Ethereum ecosystem.