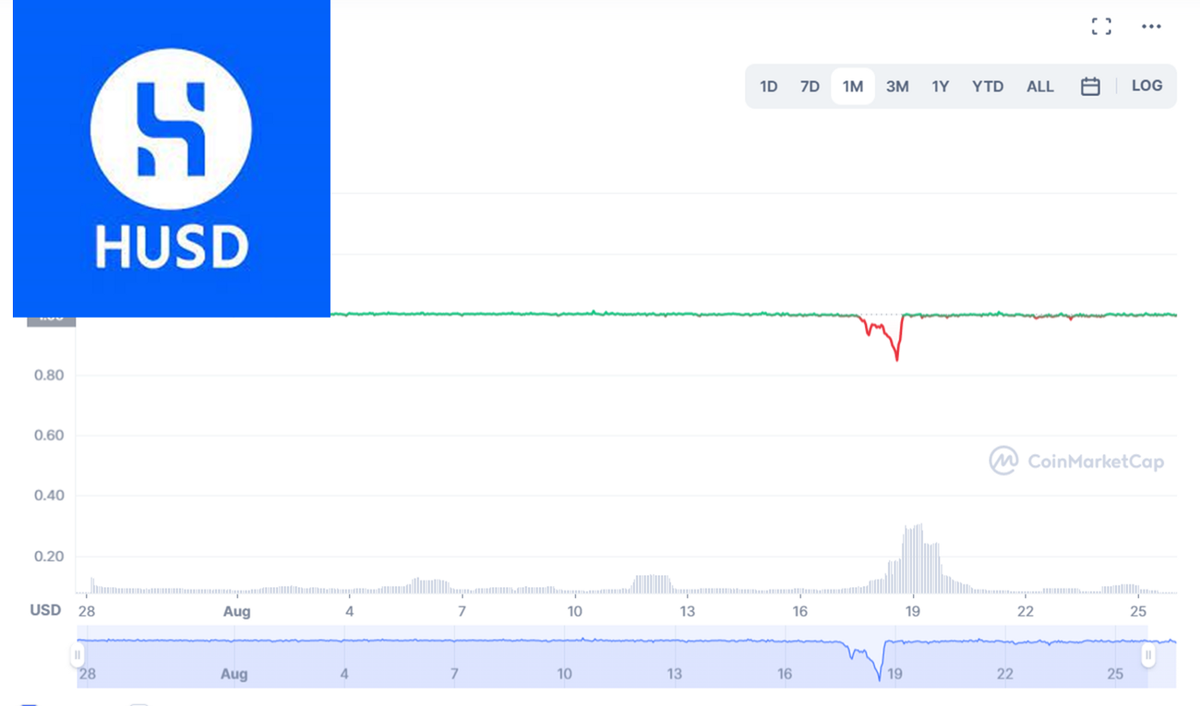

On August 18, HUSD stablecoin began to lose its peg to the dollar, which caused great concern to the community. But thanks to Huobi’s quick reaction, the situation was normalized by the morning of the next day.

The stablecoin HUSD lost its peg to the dollar. The lowest possible price for one HUSD during the run on August 18 was 0.82 dollars.

The price drop started in the morning, and the Huobi team got in touch and reported that the problem was already being solved together with Stable Universal.

HUSD is a stable coin on Ethereum, first launched in 2018 with a dollar reserve. The market capitalization before the depeg was $160 million.

After the dollar peg was restored, the HUSD team shared with users their thoughts on what caused the problems. They believe that HUSD lost its value due to the fact that the accounts of some market makers were closed. Since they belonged to different regions with different time zones, there was a variance in the opening hours of banks. According to the company, this eventually led to liquidity problems.

However, there is another version for the depeg reason. In 2019, HUSD entered into a close partnership with Paxos. Since then, the fiat reserves HUSD stable coin have been stored in the reserves of the Paxos Trust Company. In July 2020, Paxos shared with the community the results of a year’s work on HUSD together with Stable Universal:

«One year ago, Paxos partnered with Stable Universal and Huobi to launch a US dollar-backed stablecoin: HUSD. In that time, there have been more than $1.6 billion tokens issued and more than $3 billion worth of transactions processed.»

In the same Paxos blog post, it was said that all HUSD dollars are stored with them.

« Paxos is the custodian of all the dollars underlying HUSD tokens, so we can offer additional capabilities to users of HUSD.»

Despite their close connection, since the summer of 2020 there have been no more official statements about the interaction of HUSD and Paxos, and the stablecoin is no longer listed as a coin that Paxos is engaged in. You can see that these are quite old events. But also without official statements on the network. A few weeks ago, the FTX exchange removed HUSD from the list of traded stablecoins, and also stopped accepting HUSD as collateral. This could have provoked investors to sell their HUSD, and this in turn forced Stable Universal to stop the HUSD buyout.

“Usually, the rebalancing of the binding should occur naturally. However, if […] the issuer freezes the redemption of stablecoins for fiat, it might be impossible to restore the balance”, — said in the comments for Forklog representatives of Huobi.

We cannot be one hundred percent sure of any of these versions. Perhaps the situation will become clearer with time. We will continue to observe and share the news with you.