A few years ago, it was hard to imagine decentralized exchanges (DEXs) competing with centralized exchanges (CEXs). One of the challenges for on-chain engineering is in implementing advanced trading features of CEXs, such as futures trading.

Many projects have attempted to launch decentralized competitors to CEXs—offering perpetual trading with a similar user experience and liquidity—but only one has come close: Hyperliquid.

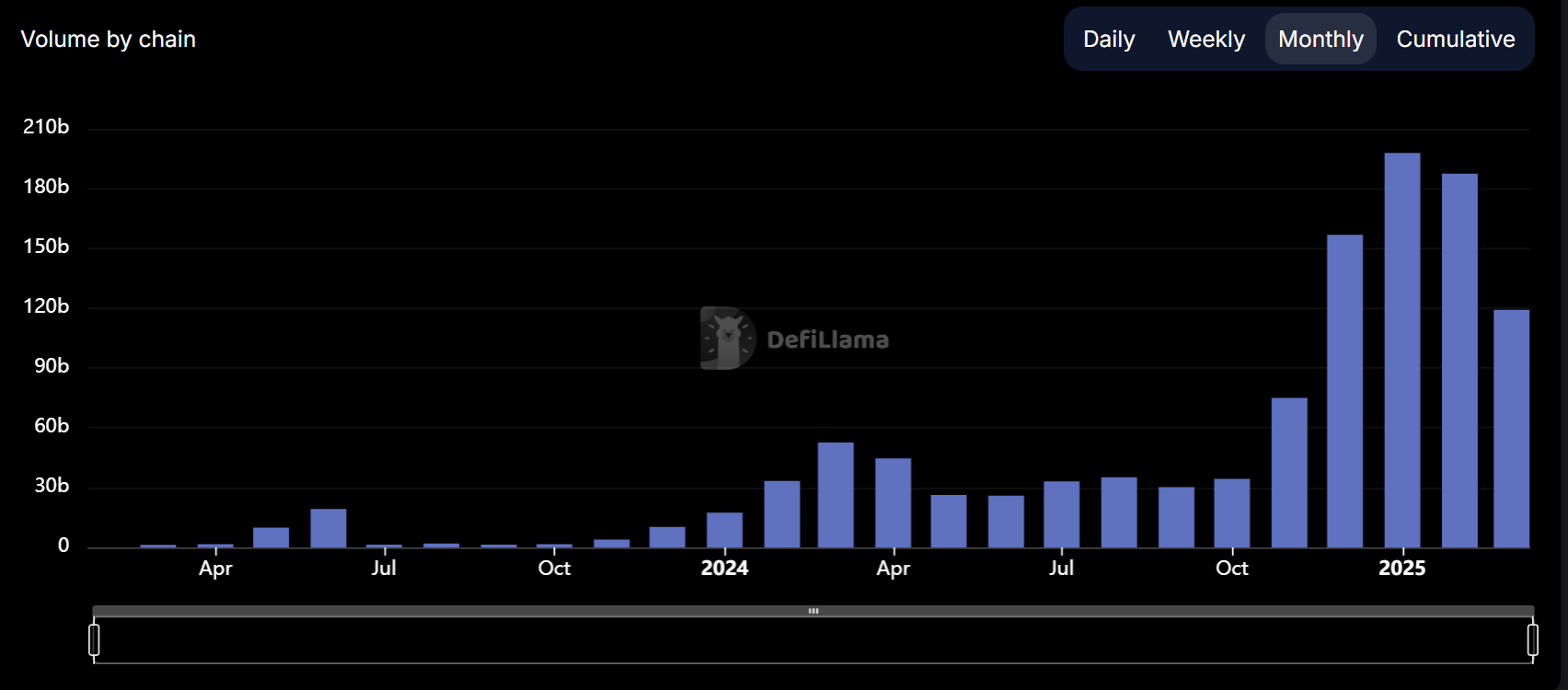

Currently, this perpetual DEX generates approximately $190 billion in monthly trading volume and continues to grow in popularity despite the broader market downturn, in which trading volumes are declining across all exchanges.

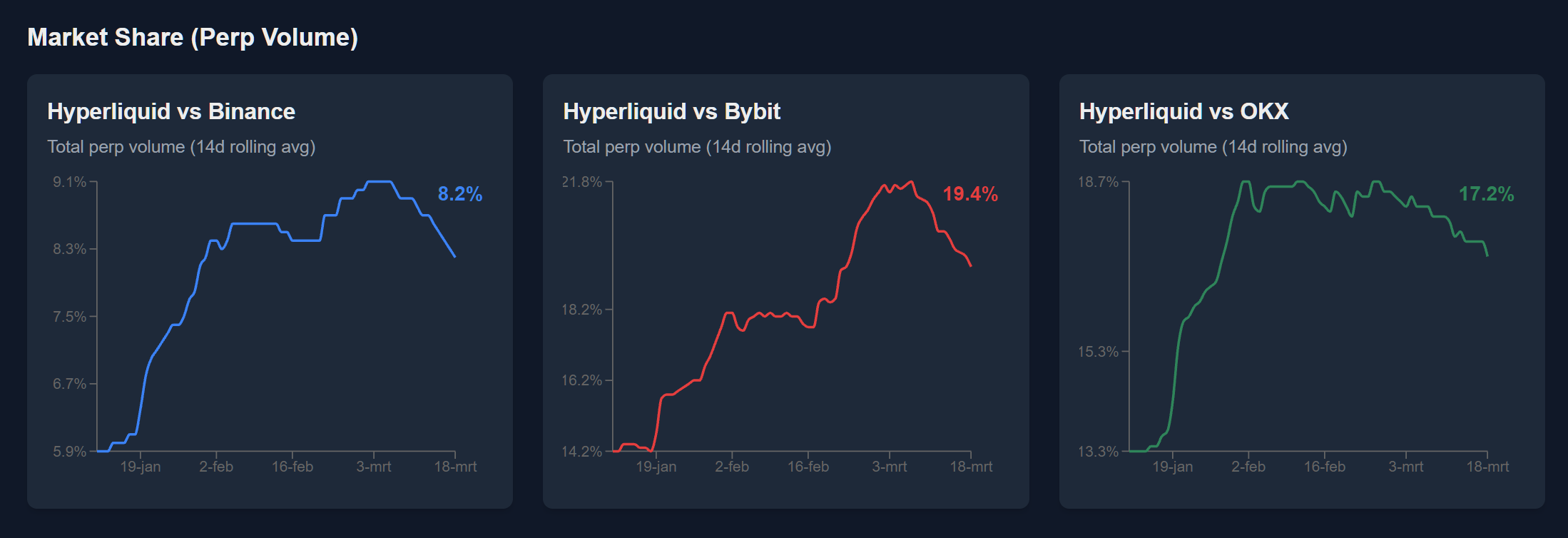

Looking at a 14-day rolling average, Hyperliquid has been rapidly gaining market share compared to CEXs and is now a significant player in the perpetual trading space.

However, Hyperliquid’s success didn’t come overnight. Launched in 2023, it took a few years to generate meaningful trading volume.

More Than Just a Perpetual DEX

The exchange runs on its own custom-built Layer 1 blockchain, using a unique HyperBFT consensus that can handle up to 200,000 orders per second. This blockchain is specifically built for high-performance, fully on-chain trading.

A key feature of Hyperliquid’s L1 is its decentralized trading. Unlike many competitors that use off-chain order books, Hyperliquid leverages HyperBFT consensus to maintain transaction order and transparency.

Beyond decentralized trading, Hyperliquid is also decentralizing market making. It has launched the Hyperliquidity Provider (HLP) vault, which runs market-making strategies. Anyone can add liquidity and share in the profits. While the strategy operates off-chain, key data—such as positions, orders, trade history, deposits, and withdrawals—is visible on-chain in real time for transparency.

Since early 2024, the HLP vault has generated roughly $60 million in profits. But with all market-making strategies, there is always some risk involved. This month, for example, the vault faced a $4 million loss due to price manipulation. A trader opened a $241 million leveraged long position, let it be liquidated on Hyperliquid, and simultaneously took a short position on another exchange, profiting $4 million from the price movement.

One trader VS. Hyperliquid’s HLP vault.

— Three Sigma (@threesigmaxyz) March 12, 2025

$4M gone. No bug. No exploit. Just a brutal game of liquidity mechanics.

Here’s how they pulled it off. 🧵👇 pic.twitter.com/ivkMBcwS2q

To avoid similar issues, the Hyperliquid team lowered the max leverage to 40x for BTC and 25x for ETH, along with stricter margin requirements for large positions. However, they didn’t classify the event as an exploit and reminded users that the HLP vault carries risk.

Expanding the Ecosystem

The Hyperliquid DEX was the very first app on the Hyperliquid chain, and the team has even bigger ideas for what is next. They have added Hyper EVM to make it easier for Ethereum developers to bring over their dApps. Once these dApps are on Hyperliquid, they can connect directly to both spot and perpetual futures order books on-chain. This should help the project to expand its ecosystem.

Seeing the growth, the team also plans to further improve its infrastructure so it can accommodate more users and large trading volumes. The plan is to be able to handle millions of trades per second.

Even though Hyperliquid’s trading volume is on the rise, its main token, HYPE, has fallen by about 60% from its peak in December 2024. This drop reflects a broader slump in altcoins and recent losses from the HLP vault. Currently, the project has a market cap of around $4.5 billion.