A new survey suggests a lack of understanding about cryptocurrencies among top decision makers—and regulatory paralysis surrounding the issuance of exchange-traded funds—is holding back institutional investors in Japan.

Laser Digital, which is part of the Nomura Group, polled 547 investment managers in April and found just 25% have a positive impression of digital assets.

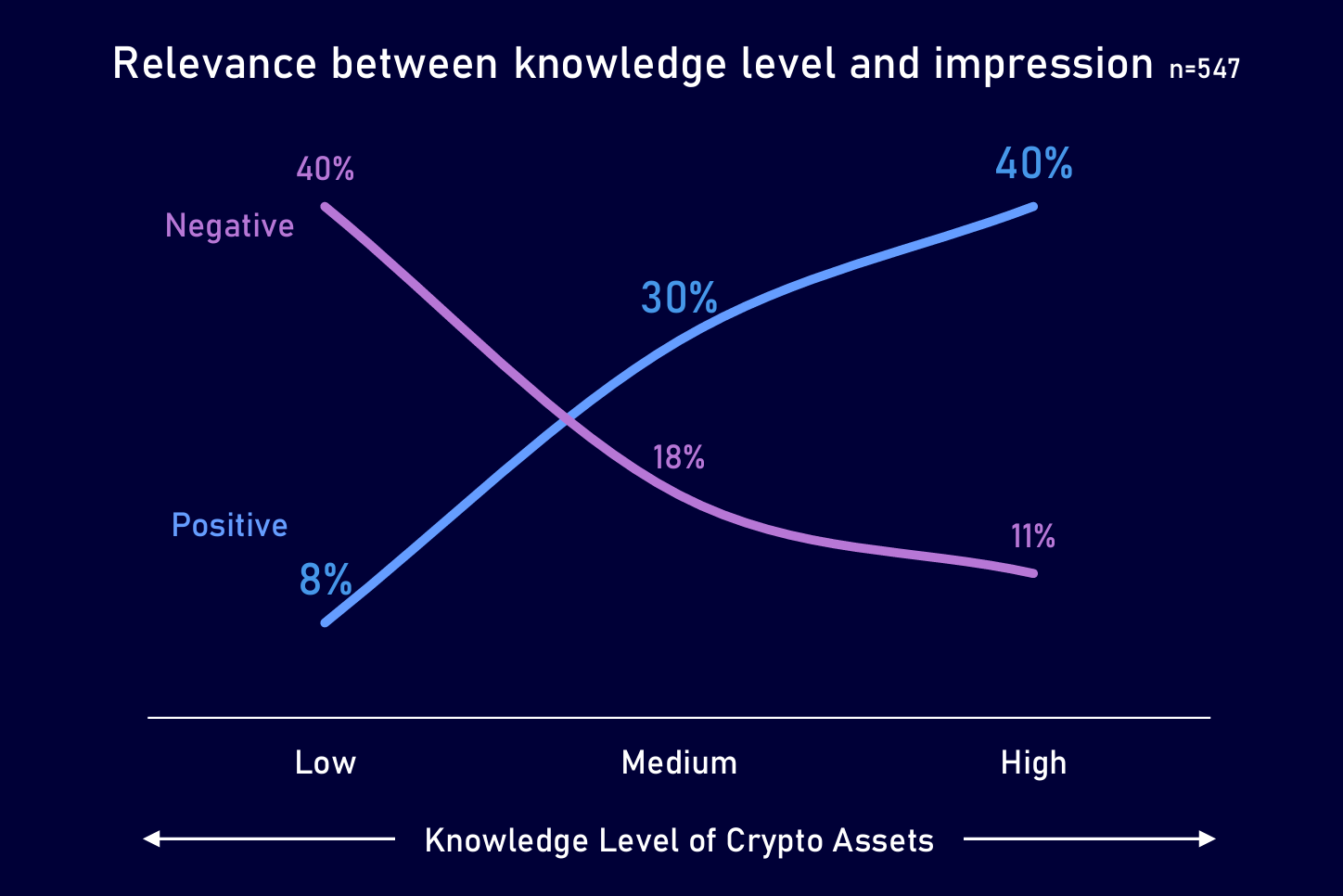

But this doesn't tell the entire picture. There's a clear correlation between how much someone knows about digital assets — and their likelihood to have a favorable outlook of the sector over the next 12 months.

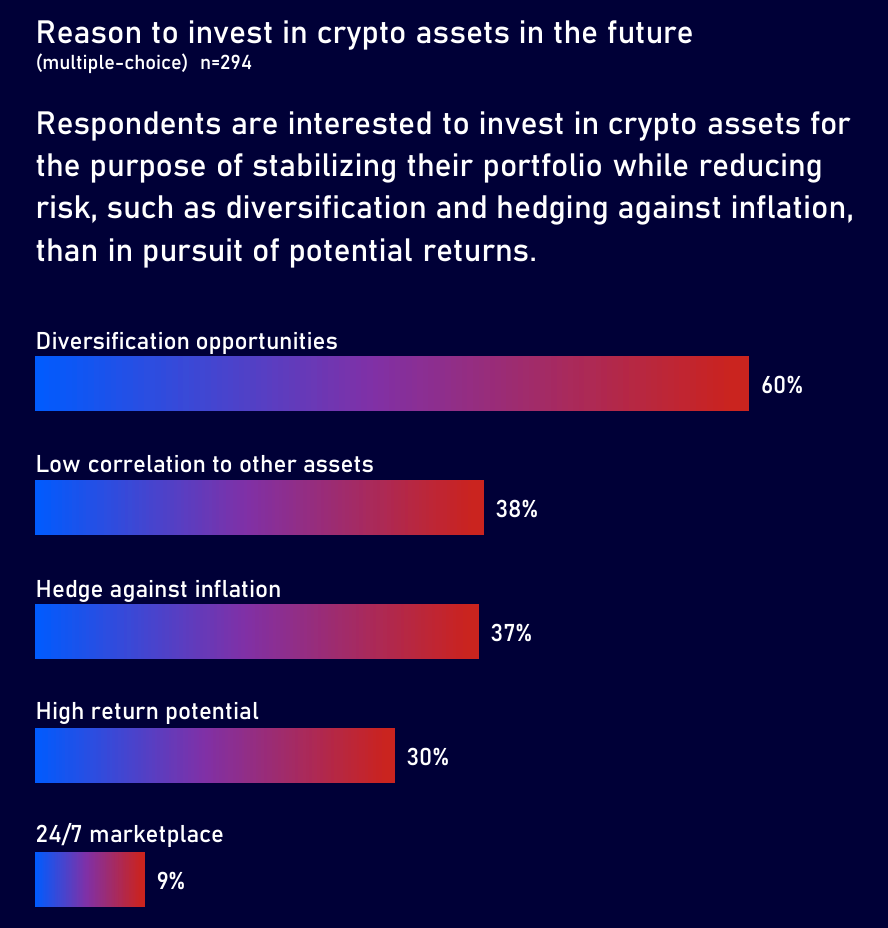

Even though a sizeable chunk of those surveyed appear distrustful of major coins like Bitcoin and Ether, many are still open to gaining exposure. Overall, 62% revealed that they see diversification opportunities. The potential for high returns and a new approach to fundraising are cited as the main use cases, but tellingly, just 16% believe they have the potential to replace reserve currencies. "Many respondents perceive crypto assets as an investment asset class rather than a means of exchanging value," the authors noted.

That brings us to perhaps the most significant figure of all: 54% of institutional investors are planning to invest in crypto between now and 2027. It's interesting to see the rationale behind this newfound demand for digital assets—but the long-running narrative of BTC serving as a "hedge against inflation" doesn't seem to have cut through in a meaningful way.

Given crypto's infamous volatility, it's surprising that 66% of those planning to invest would only allocate between 2% and 5% of the assets they have under management—enough to enjoy outsized returns in the event of a rally, while preventing a downturn from having a devastating impact on the rest of a portfolio.

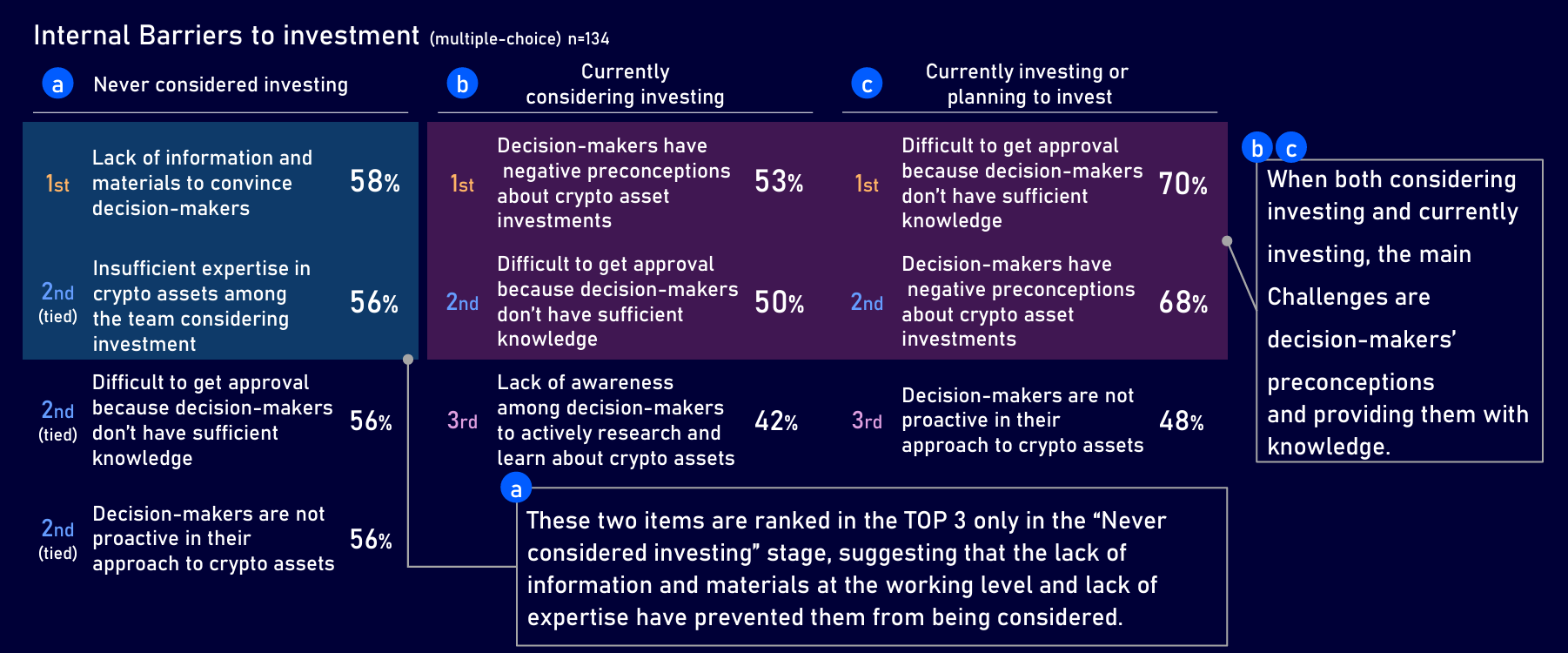

Despite the fact that 76% plan to start entering the market gradually within the next one to three years, several factors are holding investment managers back.

The lack of fundamentals for valuing digital assets came out top as the biggest reason for not investing in crypto already—followed by counterparty risk, high volatility, internal hurdles and regulatory bottlenecks.

And it's worth zooming in on the resistance that forward-thinking investment managers face within their institutions. A whopping 57% said that they struggle to get approval from key decision makers because they lack understanding about crypto—and as we know, that means they're likelier to have a negative perception of this sector to begin with.

When it comes to shifting the dial and encouraging greater levels of adoption, some of the biggest drivers identified in the poll include:

- Having a range of investment products to choose from

- Seeing other companies lead by example

- An increasing number of use cases for cryptocurrencies

While the U.S. has led the charge by approving ETFs based on Bitcoin's spot price, leading to billions of dollars in inflows, this is currently banned in Japan. One respondent to the Laser Digital poll said:

"If ETFs are approved in Japan, there could be an explosion of investment both as an inflation hedge and potential returns."

There's also plenty of curiosity about crypto investments that could generate returns beyond price movements—with 54% saying they're interested in staking, 51% citing mining, and 60% mentioning lending.

Although there is work to do, Laser Digital concluded by saying the outlook is bullish in the world's fourth-largest economy.

"In Japan, digital asset laws and regulations are being developed ahead of the rest of the world, and corporations are also moving toward the development of an investment environment."