The Bank of International Settlements announced on Wednesday that the Central Bank of Saudi Arabia has become the fifth full member of the mBridge project.

mBridge, a project exploring the technical feasibility of cross-border CBDCs, is a collaborative project of central banks (China, Hong Kong, UAE, Thailand and now Saudi Arabia) with the participation of the Swiss-based Bank of International Settlements (BIS) and 26 observers. However it is significantly influenced by China, as the technical development and major components, such as the consensus algorithm, are authored by the Chinese.

In the same announcement, BIS reported the transition of the project's platform from a prototype to MVP (Minimum Viable Product) form and invited private sector firms to propose use cases for it.

Financial Inclusion and Digitalization Aren't the Only Motives for CBDCs in the Middle East and Asia

With 19 countries in the Middle East and Asia now exploring a central bank digital currency, a question worth asking is this: what are their motivations?

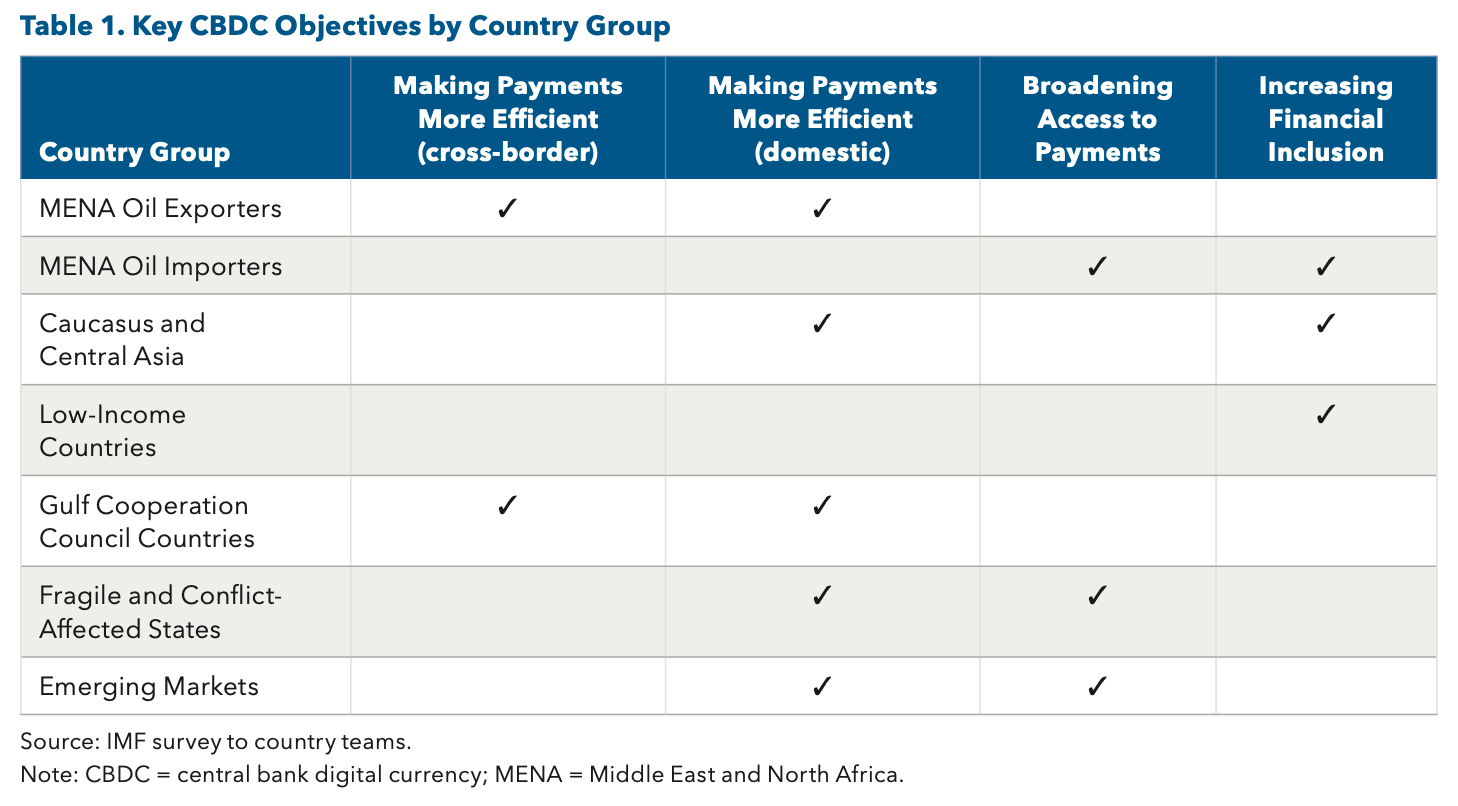

A recent report by the International Monetary Fund shows that rationale in the region varies wildly. While improving domestic payments is a common theme, there are other touted benefits too:

It's telling that oil exporters in the Middle East and North Africa, along with members of the Gulf Cooperation Council, are looking to develop CBDCs that make international payments more efficient.

This can be interpreted as another clear sign that Gulf states are seeking to build economic infrastructure that would reduce their reliance on the dollar. As the International Institute for Strategic Studies noted last year, US-Saudi relations are under strain — with China pushing GCC members to dedollarize oil and gas sales:

"Central bank digital currencies appear to be a potentially promising new tool for reducing dollar dependency for regional and trans-regional cross-border exchanges. These initiatives will likely become more common and widespread in the Gulf."

In other cases, the concerted push to roll out a CBDC needs to be examined through the prism of current financial systems.

Iran already has high levels of digital payments usage, the IMF says. At 85%, it actually boasts the biggest rate of adoption in the region. And as Al Jazeera noted in a 2022 report, existing banking systems give authorities there "enormous supervision capabilities" — powers that could be expanded with a CBDC.

All of this comes against a backdrop of nationwide protests and mass unrest that led to hundreds of deaths and thousands of arrests.

While it is unclear whether Iran would intend to go down a similar path, there's one thing we do know: the digital rial wouldn't be a tool that could be used to sidestep punishing economic sanctions imposed by Washington. That's because it will only be possible to use this CBDC within Iran's borders.

mBridge is particularly focused on achieving non-USD-based settlements. Currently, it doesn’t support US dollar payments so if mBridge’s solve exchange rates and FX liquidity problem, Iran and many other countries may follow the path of Saudi Arabia.