Declining Market Share: Major Changes or Seasonal Trend?

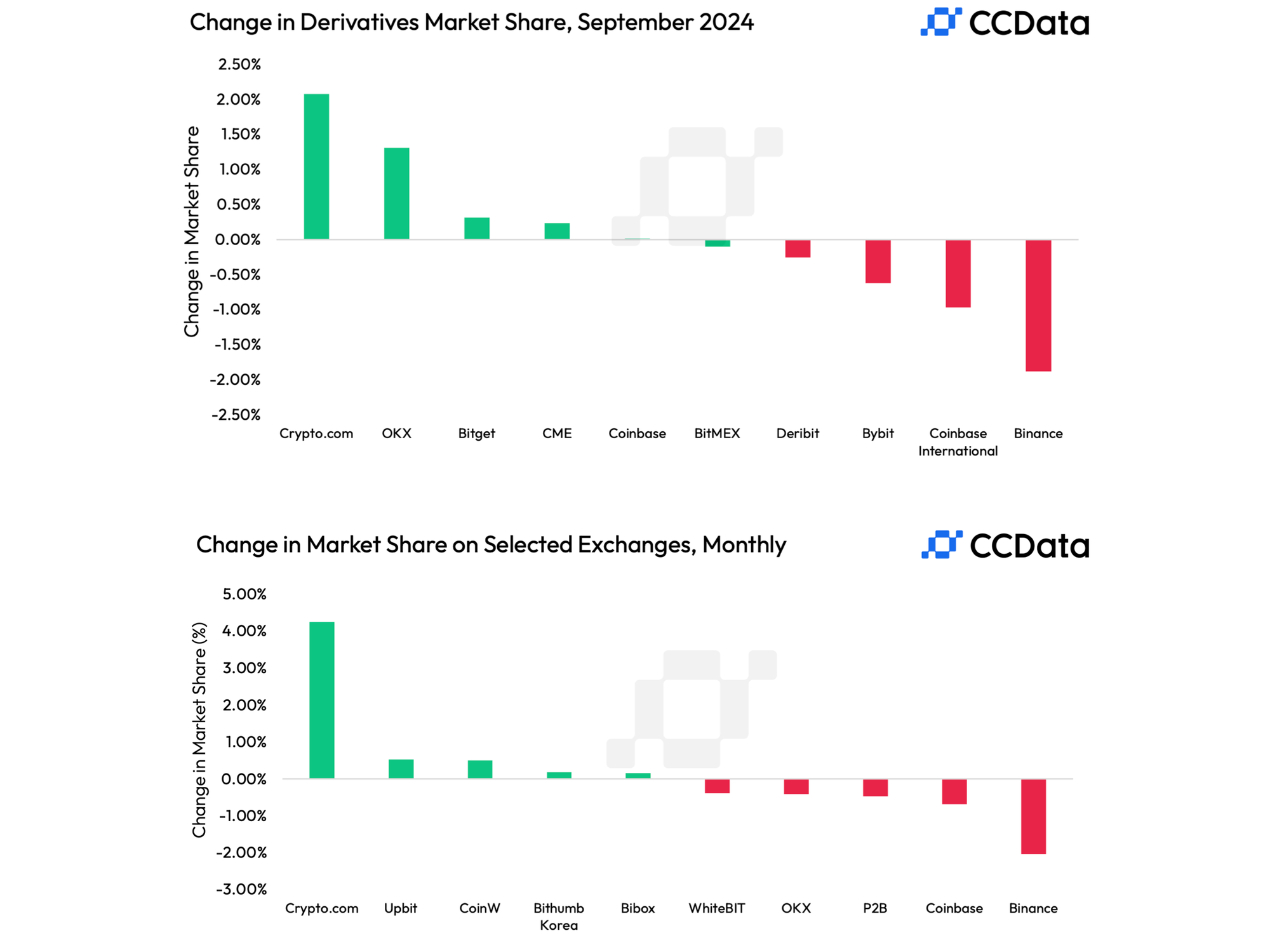

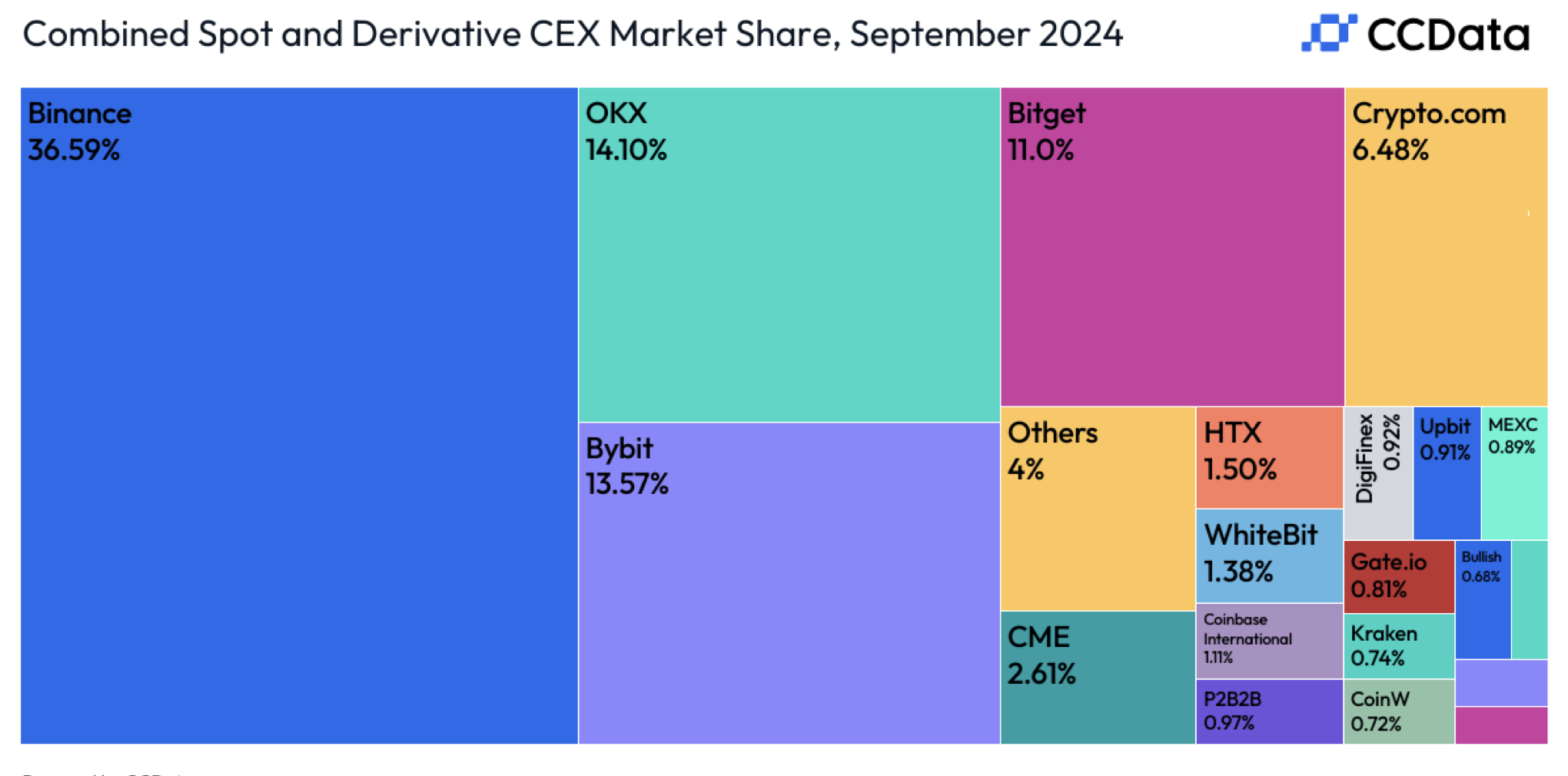

According to a CCData report, in September 2024, Binance, the world’s largest cryptocurrency exchange, experienced a notable decline in trading activity. This trend affected both spot and derivatives trading. Binance’s overall market share in combined spot and derivatives markets on centralized exchanges shrank to 36.6%, its weakest position in four years.

While Binance remains an undisputable leader in terms of trading volume, there are definitely causes for concern. Crypto.com’s market share surged to 11.0% this month, making it the fourth-largest centralized exchange by volumes. Several smaller centralized competitors, like Bybit and Bitget, also gained shares.

According to the report, Binance’s decline can be explained, in part, by a general seasonal trend. The combined spot and derivatives trading volume across all centralized exchanges fell 17.0% in September, but the experts expect the trading activity on centralized exchanges to rise in the coming months following the Fed’s interest rate cut and the upcoming U.S. election.

Still, the sharp decline in Binance spot and derivatives trading exceeds the market average. Could its commitment to compliance and regulation be contributing to this?

Compliant Global Expansion

In response to mounting regulatory pressure in key regions such as the U.S., Europe, and Canada, Binance has actively pursued a global expansion strategy. After the settlement with the U.S. authority and CZ’s departure, the exchange intensified its compliance efforts, so now it is moving to emerging crypto-friendly markets, bragging about fresh licenses. These moves are part of Binance’s effort to both replace lost user bases while following local regulations.

Recently, the exchange obtained a VASP license and became fully operational in Argentina while securing a full trading license in Kazakhstan. In the last few months, the exchange also secured licenses in India and Indonesia. In total, the exchange is licensed in 20 jurisdictions worldwide.

Despite the flurry of license activity, it has not been sufficient to offset the broader decline in users and volumes.

Data show that Binance has continued operations in Russia despite the sanctions against the country. The exchange announced a complete exit from Russia in 2023 but reportedly still offers services to local customers. This reflects the tension between Binance’s ambitions to expand and its need to adhere to Western regulatory frameworks.

Leadership and Image Issues

In September, the U.S. Securities and Exchange Commission (SEC) submitted an updated complaint against Binance, focusing on the exchange’s token listing procedures. This comes on the back of the June 2023 lawsuit where the SEC accused Binance of functioning as an unregistered broker and trading platform while offering unregistered securities. The suit saw its founder, Changpeng "CZ" Zhao, jailed. While SEC lawsuits are not unusual for crypto platforms, Binance has suffered some high-profile cases.

Although CZ was recently released after serving time for those regulatory violations, he is prohibited from managing the exchange. His absence, alongside the new compliant version of the exchange, has surely prompted some users to move on.

While Binance remains the dominant player in the cryptocurrency exchange market, it's clearly facing a serious slowdown. The company’s expansion into new regions and the new compliance-driven strategy may stabilize its position in the long term, but for now, the combination of regulatory issues and leadership transitions means its dominance is in real danger of being challenged.