Securities and Exchange Commission (SEC) Chair Gary Gensler hinted at his departure in a speech Thursday, just as 18 states sued the regulator over its cryptocurrency enforcement actions.

Speaking at the Practicing Law Institute's 56th Annual Institute on Securities Regulation in New York, Gensler delivered what could be interpreted as a farewell address amid mounting pressure from state regulators and the incoming new U.S. administration.

President-elect Donald Trump secured over $20 million in crypto donations after promising to end what he called the Biden Administration's "war on crypto." In January, he vowed to dismiss Gensler on his first day in office. While SEC chairs traditionally resign during administration changes, Gensler could technically serve until 2026.

On Thursday afternoon, 18 Republican state attorneys general filed suit against the SEC and its commissioners in a Kentucky federal court, alleging unconstitutional and gross overreach in regulating the digital asset industry. The lawsuit, filed in partnership with crypto advocacy group DeFi Education Fund, which sued the SEC last month, claims the agency's industry-wide crackdown violates fundamental principles of federalism.

Kentucky Attorney General Russell Coleman, who led the filing alongside attorneys general from Florida, Texas, and fifteen other states, said the action aims to push back against federal overreach:

"The Biden-Harris Administration's unlawful crypto crackdown has targeted the tens of millions of ordinary people who are taking part in this vibrant digital market."

The lawsuit alleges that the SEC's actions have introduced "significant risks" to one of the United States' fastest-growing economic sectors by imposing penalties without a proper regulatory framework. It argues that Congress intentionally refrained from granting broad regulatory authority over digital assets to federal agencies, preferring state-led regulation.

"The SEC's regulatory overreach defies basic principles of federalism and separation of powers. Still worse, by attempting to shoehorn digital assets into ill-fitting federal securities laws and inapt disclosure regimes, the SEC is harming the very citizens it purports to protect."

In his speech, Gensler remained firm on crypto regulation. "Court after court has agreed with our actions to protect investors," he said. While finally acknowledging Bitcoin is not a security, he emphasized that many other digital assets require SEC oversight.

"Our focus, rather, has been on some of the 10,000 or so other digital assets, many of which courts have ruled were offered or sold as securities. Putting this in context, aside from bitcoin, ether, and stablecoins, the rest of this market approximates $600 billion. That’s less than 20 percent of the whole crypto market and less than one quarter of one percent of the worldwide capital markets."

He added that beyond speculative trading, "the vast majority of crypto assets have yet to prove out sustainable use cases."

His defense of market regulation turned to analogies about traffic laws and football referees. "I've slept better knowing that when one of my three daughters borrows the car keys, there are common-sense rules of the road to protect them," Gensler said, drawing parallels to his oversight of the $3 trillion cryptocurrency market.

Several candidates have emerged as potential replacements. Former SEC Commissioner Daniel Gallagher, currently Robinhood Markets' legal chief, reportedly leads Trump's shortlist for the role. Other contenders include current SEC Commissioner Mark Uyeda, who branded Gensler's crypto policies "a disaster for the whole industry," former Commissioner Paul Atkins from Trump's 2016 transition team, and Robert Stebbins, who served as SEC general counsel during Trump's first term.

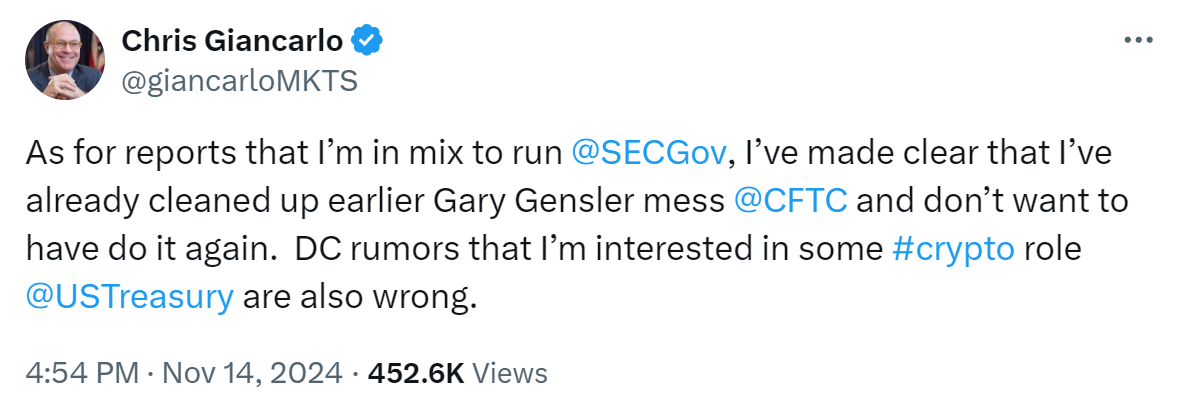

Former Commodity Futures Trading Commission (CFTC) Chairman J. Christopher Giancarlo, known as "Crypto Dad" for his blockchain advocacy, quickly dismissed speculation about his candidacy on X. Giancarlo also rejected rumors about taking a crypto role at the U.S. Treasury.

In what seems to be a final review of his tenure, Gensler noted the SEC's recent changes: shortening stock settlement times to one day, implementing Treasury market clearing reforms, and introducing new disclosure requirements for cyber incidents, executive compensation, and significant ownership stakes. He also mentioned securing access for U.S. regulators to inspect Chinese companies' auditors, ending a two-decade standoff.

Yet Gensler's legacy will likely be defined by his unyielding stance on cryptocurrency regulation, which triggered unprecedented pushback from state regulators and left the industry in regulatory limbo.