It’s no secret that the U.S. Dollar makes up lion’s share of global foreign-exchange reserves. Let’s get some sort of perspective on how the world came to this, what current circumstances are, and what to expect from the most widely used currency.

The U.S. dollar has been the world’s dominant currency since the end of World War II when 44 allied countries agreed at the 1944 Bretton Woods Conference to peg it to a rate of $35 per ounce of gold. Before then, most countries were on the gold standard.

Since the US held most of the world’s gold supply and was the only country unscathed by the war, it was agreed that the US dollar would be the official reserve currency backed by gold.

This lasted until the early 1970s, when the United States began to cover its deficit by flooding the market with paper money, thus depreciating the value of the dollar. Foreign countries asked the US government to convert their country’s dollar reserves into gold.

That’s when President Nixon made the final decision to sever the tie of the US dollar to gold. By that time, the dollar had already become the world’s dominant reserve currency.

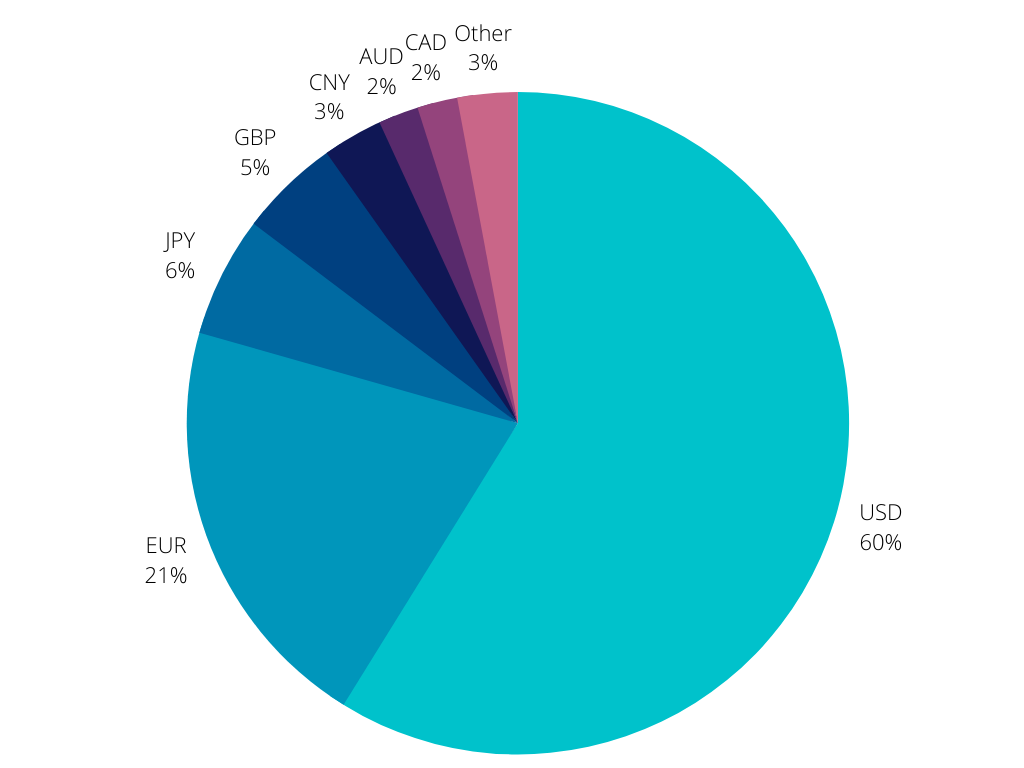

Fast forward to the present, in 2021, the dollar comprised 60 percent of globally disclosed official foreign reserves. This share has declined from 71 percent of reserves in 2000, but still far surpassed all other currencies including the euro (21 percent), Japanese yen (6 percent), British pound (5 percent), and the Chinese renminbi (3 percent).

Foreign Exchange Reserves by Currency

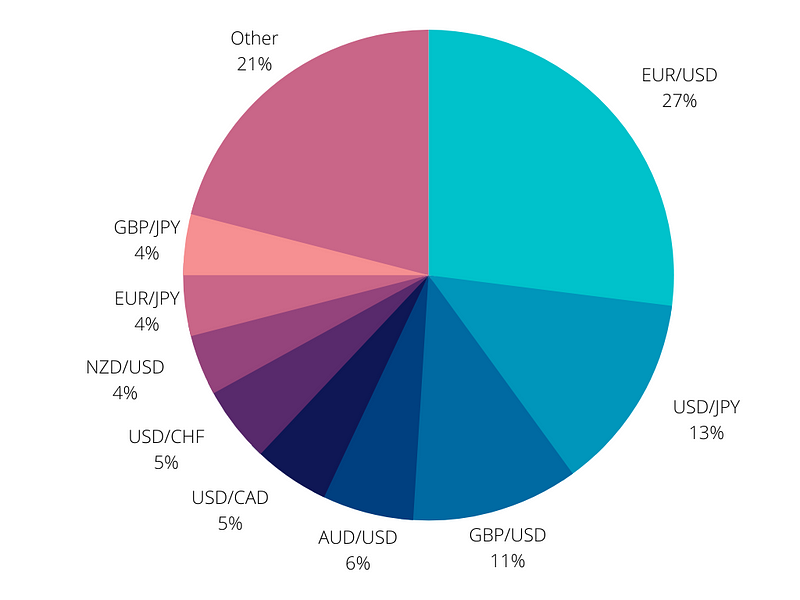

The U.S. dollar is also overwhelmingly the world’s most frequently used currency in global trade. An estimate of the U.S. dollar share of global trade invoices exceeds 70% of this volume that is generated from the top seven currency pairs, all of which involve the U.S. dollar.

The World’s Most Traded Currency Pairs

Today, we can observe some signs of de-dollarization across different countries. Russia and China have been working towards a closer financial alliance. Israel shifted part of its reserves from the dollar to other currencies. If we consider the international trade within the European region, we will see the dominant position of the euro: over 65% of trades are already held in the local currency.

We are witnessing the dollar losing its position within particular regions, but only time will tell if its global domination is to change anytime soon.