The Bank of Japan (BOJ) started developing the proof of concept for a national CBDC in April 2020. In May 2021, they reported on the preliminary findings and moved to Phase 2, which investigates “more complex additional functions” and possible implications on financial stability and compatibility with the private banking sector. For the latter, the Liaison and Coordination Committee on CBDC was established that included members from the government, BOJ and the private sector.

In Phase 1 BOJ was mostly focused on the performance evaluation of three designs:

1) account-based (like that of Ethereum), with the ledger maintained by BOJ

2) account-based, with the ledger maintained by BOJ and intermediaries,

3) ID based or “token-based ledger” (like that of Bitcoin) with the ledger maintained only by BOJ.

The results of this experimental work showed a preference for first option over the second. The third option, while thoroughly considered because of its similarity to Bitcoin, was found to be difficult to scale. However only a fixed-value option of design number 3, where the coins tokens can be split and merged was evaluated, while flexible-value option could potentially bring an advantage over the account-based designs. The result report concluded that all three designs remain within the evaluation scope for the Phase 2.

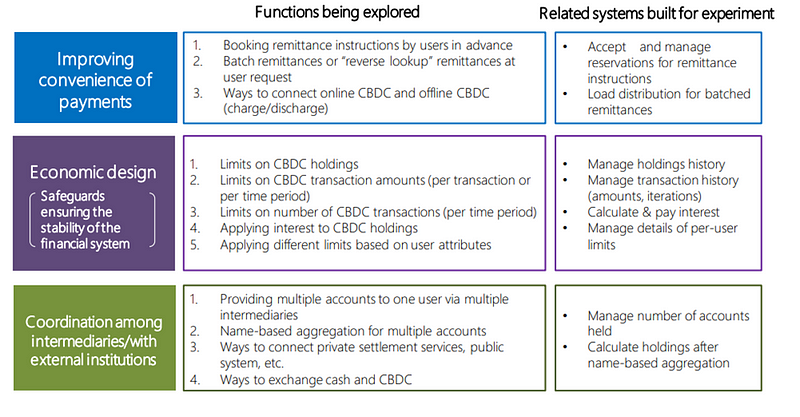

Phase 2 of the research looked at broader functions of CBDC such as convenience of use, economic designs that would ensure the financial stability and compatibility with private banks. The Liaison and Coordination Committee (LCC) interim report issued in July 2022 summarized the main experimental topics for the Phase 2:

In May 2023 it published the results of its Phase 2, that included such aspects of CBDC design as the management of the holding limits if a user has more than one account, a ‘swing’ function to sweep excess balances into bank accounts as well as scheduled and batched payments. It also investigated integration with point of sale systems and DLTs for tokenized asset settlement.

Also in April BOJ announced the final stage of the CBDC development path, pilot experiments with commercial financial institutions. The trials are expected to last several years.

More than ten selected financial institutions including the nation’s top banks, regional lenders and digital payment service companies are expected to take part in examining how transactions like deposits and transfers would work in practice using the digital currency.

The pilot program will mark the final phase in Japan’s consideration of a digital yen, which proponents say will give a boost to the digital economy in a country where cash still accounts for a major share of payments.

BOJ is a member of the CDBC coalition that includes seven Central Banks (US, EU, UK, Canada, Switzerland and Japan) and Bank for International Settlements, formed “to evaluate the feasibility of central bank digital currencies by major economies.” Each of these countries have their own workgroups and projects aimed at research for a national CBDC and BOJ emphasized the importance of following the developments in these countries. Additionally, LCC report looks at the work of Sweden e-krona, Cambodia BAKONG, the Bahamas Sand Dollar, Eastern Caribbean Dcash, Nigerian eNaira, Jamaican CBDC and Indian Digital Rupee.