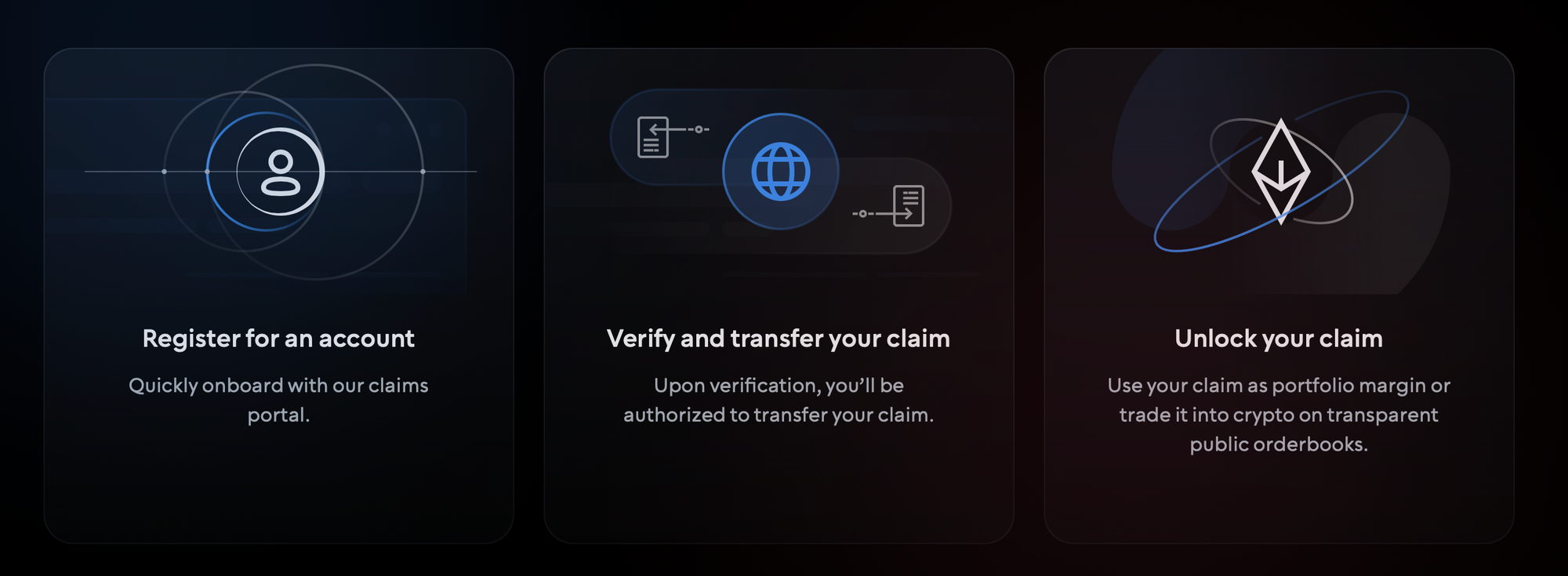

OPNX was opened on April 4, 2023. It is built for “over 20M users who currently have $20 billion of claims trapped in bankruptcy proceedings”, - says the website of the newly launched exchange OPNX. The idea is to use your claim as portfolio margin or convert it into crypto via public orderbooks.

The idea is smart: right now there are a lot of “goods” to trade on that kind of exchange, but the question is, who would buy the claims taking into account that bankruptcy proceedings may take years?

Now you can only trade spots and futures on the exchange. Claims aren't listed on OPNX yet, but they're coming soon, the exchange promises. Celsius will be the first one, according to Su Zhu trading will start this May. We’ll keep an eye on it and will let you know as soon as the option of trading out your “problems” becomes available.

The most controversial fact is that OPNX was launched by Su Zhu and Kyle Davies, the founders of Three Arrows Capital (3AC) which defaulted in 2022 dragging Voyager and Celsius along and then were accused by the crypto community of running away from legal action. Funny fact: 3AC claims will be traded on OPNX as well. Another founder is Mark Lamb, the CEO of CoinFLEX, which is now going through restructuring (actually, CoinFLEX became the basis for OPNX). And maybe “controversial” is not the right word:

So @zhusu and Kyle Davies are trying to steal more money! One the one hand, I can’t say I’m surprised: scammers gonna scam.

— 𝙽 𝙸 𝙺 𝙱 (@nbougalis) January 16, 2023

But on the other hand, this is so far beyond insane that there’s no word for it. The hubris and arrogance of these pricks truly knows no bounds. https://t.co/h2jpiKPmCr

The founders’ bad reputation predictably led to some troubles for the project. As soon as OPNX announced its investors, many of them including DRW, Nascent, MIAX and Susquehanna started denying its participation in Su Zhu’s new platform.

Just to clarify, Nascent did not participate in an OPNX fundraising round, we invested in FLEX tokens in early 2021.

— Nascent (@nascentxyz) April 21, 2023

DRW is not an investor in OPNX nor are any of its affiliates investors in OPNX.

— DRW (@DRWTrading) April 21, 2023

We are backers of CoinFlex and were supportive of Mark to rebuild for stakeholders. Our equity is being forcibly converted to OPNX and we have not committed capital to the new entity. We never met Su Zhu or Kyle Davies and do not support what they did during the last days of 3AC

— AppWorks (@AppWorks) April 22, 2023

According to OPNX’s intern, investments were both directly into OPNX, as well as through CoinFLEX which might have led to this confusion. But we believe that such confusion is not possible when we are talking about $25 million in funding. More likely the investors just didn’t want to have anything in common (at least publicly) with notorious OPNX founders.

OPNX reacted quite calmly insisting on their transparency and saying that that kind of investors’ behaviour is “disgusting as it is disappointing” and promised to “review their investments”.

I’ve gotten all but 4 hours of sleep dealing with the nonsense that has ensued from transparent communications, so I’ll get straight to it.

— Leslie Lamb (@therealleslamb0) April 22, 2023

Investors want all the upside with little to no risk. But I’m here to remind everyone that’s not how entrepreneurship works, if it isn’t…

This threats sounded a bit childish and also caused some discontent:

BTW, genuine question, how do you expect depositors to trust you if you make veiled threats about pulling investments/equity just because someone tagged you in a mean tweet? Like, do you (or your marketing guys) have any understanding of how bad blackmail tactics like that look?

— FatMan (@FatManTerra) April 22, 2023

Right now the OPNX website still lists some of the abdicated investors.

Well, the supply on the exchange will definitely be enormous taking into account all the recent collapses. But do you think, there will be enough demand for claims? And would you trust your funds to Su Zhu and the team again? Share your thoughts in the comments and follow up for more.