The new report was prepared by Alexandra Born and Joseph M. Vendrell Simon, in which they described the risks associated with cryptocurrency, which is gaining popularity and financial importance. In the report, the authors talk in detail about the risks associated with stablecoins, decentralized finance (DeFi) and the negative impact on the climate, which is associated with a large carbon footprint.

Recently, a lot of events have been happening in the world of cryptocurrency. The collapse of Terra, which dragged many projects to the bottom, the crypto winter, which sent some people into panic and depression. But even in these difficult times, cryptocurrency is still popular among people from different countries, so regulators are paying more and more attention to it.

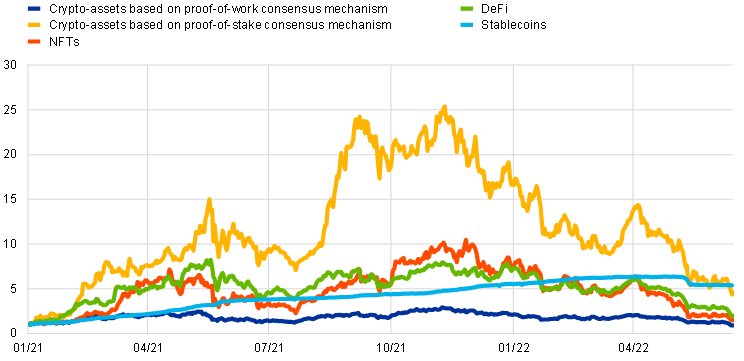

In their article, a group specializing in financial stability says that the crypto asset market is becoming increasingly popular, which in the future may become a threat to financial stability, as major disruptions occur in the digital economy and call for the early creation of special regulation. To demonstrate the growing popularity of the crypto market segments, the authors user data from the analysis of the Financial Stability Board (FSB) and the ECB.

Referring to the chart, the authors consider new types of crypto assets and their functions.

Stablecoins, for example, have created further interlinkages by serving as collateral in crypto-asset derivative transactions or as liquidity providers in DeFi. At the same time, interlinkages between the crypto-asset ecosystem and the traditional financial system have grown due to increasing institutional interest.

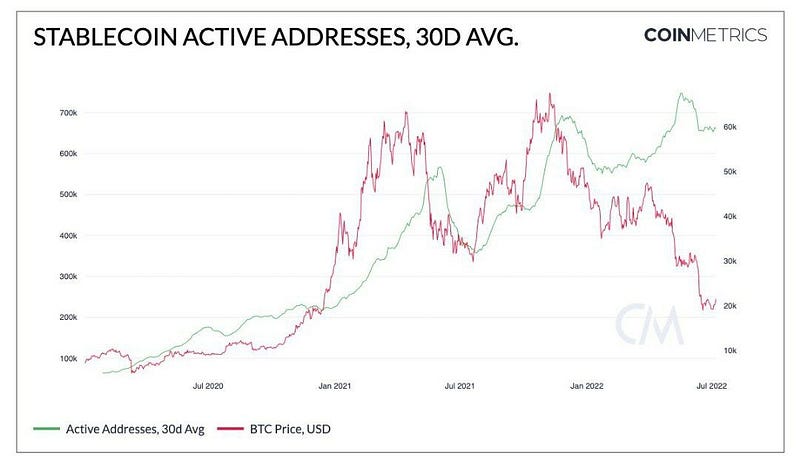

It is worth noting that the growth of the popularity of stablecoins can be tracked by Coin Metricks. The graph shows that the number of active stablecoin addresses has grown quite rapidly.

The main problem of stablecoins, according to the authors of the article, is the “contagion effect”. Analyzing the collapse of Terra, the authors say that it has affected the entire cryptocurrency system. But the “contagion effect” may also have affected the traditional economy, since the reserves of stablecoins include cash that is stored in regulated banks, commercial securities and bonds. It turns out that the fall of the stablecoins, with large amounts of traditional reserves, may have affected the financial system.

Stablecoins fall short of what is required of practical means of payment in the real economy. To date, stablecoins’ transaction speed and cost as well as their redemption terms and conditions have proven inadequate for use in real economy payments.

Speaking about stablecoins and the risks associated with them, the authors call for an early adoption of the European Regulation of Crypto Assets (MiCA).

Alexandra Born and Joseph M. Vendrell Simon also talk about the risks associated with DeFi. The authors see two problems here: vulnerabilities similar to traditional finance, as well as anonymity.

Among the vulnerabilities are excessive leverage and risk taking. And then there was the collapse of Terra, according to the authors, it demonstrated several vulnerabilities at once:

The crash of the stablecoin TerraUSD in early May exemplifies some of these vulnerabilities, as the size of DeFi measured by the sum of all digital assets deposited in DeFi protocols (“total value locked”) fell strongly in early May.

Speaking about anonymity, the authors emphasize that it prevents regulators from exercising supervision and performing effective regulation. In the final part of the article, the authors address the environmental problem associated with the activities of crypto assets i.e. its carbon footprint. According to the authors, «the functioning of certain crypto-assets (like bitcoin) uses a disproportionate amount of energy that clashes with public and private environmental policies and environmental, social and governance (ESG) objectives».

After analyzing this article, we can assume that the frequent mention of the collapse of Terra is proof that this event definitely forced regulators to pay closer attention to the world of stablecoins and decentralized finance. It calls for a speedy resolution to various areas of the crypto industry and an attempt to make it centralized and subordinate to prescribed laws. In the meantime, we will monitor the speed at which new laws will be adopted, and how this will affect the crypto asset market.