Uniswap, the largest decentralized exchange (DEX) on Ethereum, has announced the launch of its own Layer 2 network, Unichain. The new network is currently in the testnet phase. The mainnet launch is planned for the end of this year.

Unichain promises to reduce trading fees by over 95% compared to Ethereum’s Layer 1 and offers “sub-block” times of just 250 milliseconds for near-instant user experiences.

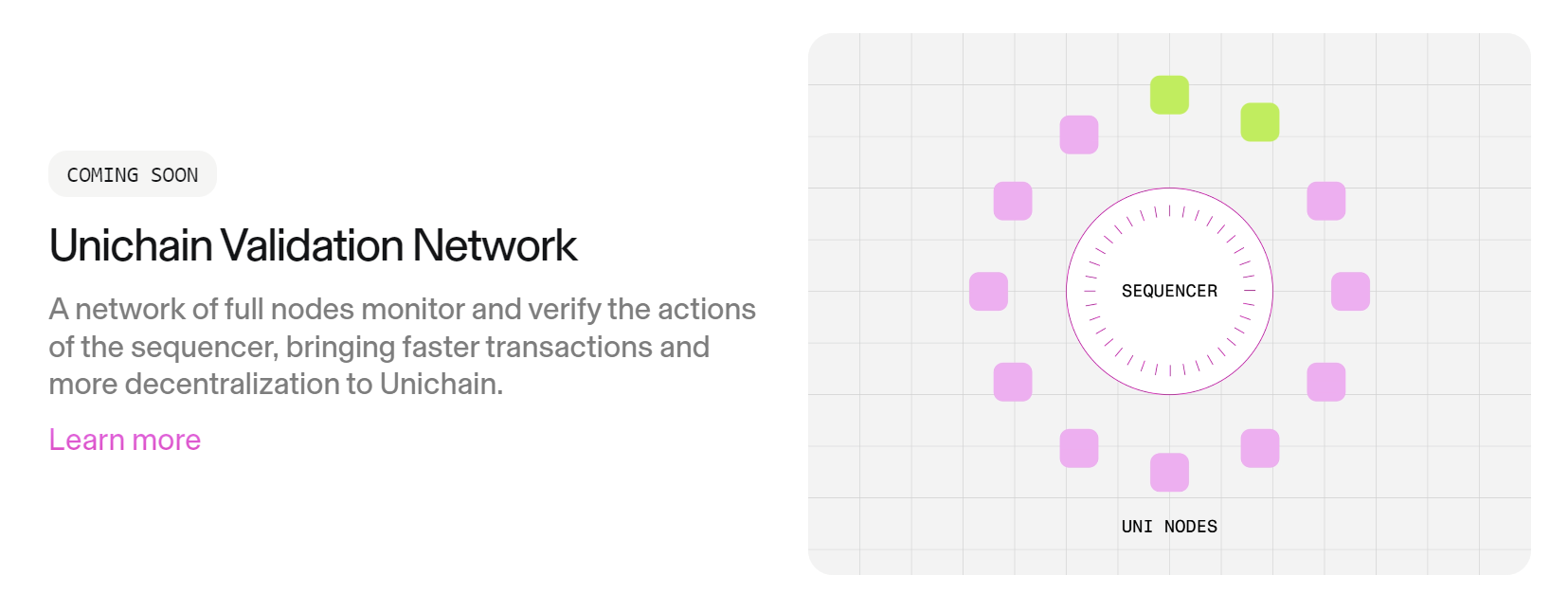

On the technical side, Unichain uses the Optimism stack, which was developed in collaboration with the Flashbots team. Unichain also distinguishes itself from other Layer 2 solutions by planning to introduce a decentralized sequencer from the beginning. This sequencer will be managed by the Unichain Validation Network, a decentralized network of node operators that independently validate the latest blockchain state.

This approach clearly shows the team's commitment to preserving the decentralization of the network, nevertheless, having its own blockchain provides Uniswap a higher degree of control than it had on Ethereum.

Although Layer 2 networks claim to be moving towards decentralized sequencers, many remain centralized in practice, leaving an option to halt them at any time.

Further Fragmentation of Blockchain Space?

Besides the loss of decentralization, application-specific Layer 2s are criticized for fragmentation of blockchain space. The Uniswap team has paid attention to this issue and ensured Unichain provides cross-chain interoperability for Uniswap users.

It is part of the Optimism Superchain network, so Unichain will benefit from seamless cross-chain interoperability of assets across the Superchain’s network of blockchains, including Base, ZORA, Debank Chain, Mantle, Celo, WorldCoin, and others.

For Layer 2 networks outside the Optimism Superchain, Uniswap plans to utilize ERC-7683, a cross-chain intent standard co-developed with Across Protocol. This will allow trading orders to be fulfilled by intermediary relayers/solvers, regardless of the chain they are on.

This advancement potentially eliminates the need for Uniswap to transfer its significant liquidity pool from Ethereum's Layer 1 to Unichain, thereby reducing the challenges of migrating its existing user base to a different chain.

According to Uniswap founder Hayden Adams, they are building cross-chain user experiences that surpass the experience of swapping within a single chain today.

Without these cross-chain features, launching a separate chain for Uniswap might not make sense, as moving assets to another chain can cause friction for users. Even Ethereum founder Vitalik Buterin has pointed out this potential issue.

I have a hard time believing this argument.

— vitalik.eth (@VitalikButerin) September 30, 2022

Uniswap's main value proposition is that you can just go and get a trade done in 30 seconds without thinking about it. A uniswap chain or even rollup makes no sense in that context. A copy of uniswap on every rollup does.

Good For UNI. Good For Uniswap?

The move to Layer 2 is expected to improve the value capture of the UNI token significantly. Currently, Uniswap generates approximately $368 million in settlement fees and around $100 million in MEV, all paid to Ethereum validators. With Layer 2, these fees will be captured by Uniswap’s sequencer and then distributed to UNI stakers. While the fees will be lower due to cheaper transactions on Layer 2, they will remain substantial.

Notably, the UNI token has reacted positively to the announcement, increasing by around 12% in the past week.

The primary losers in this scenario are Ethereum validators and the ETH network, as they will miss out on these fees with the launch of Uniswap’s Layer 2. However, the extent of this loss is still uncertain, as many Uniswap transactions will likely continue to occur on Ethereum Layer 1.

With Uniswap's move into its own blockchain, we can clearly see another phase of the decentralization movement. Established players in the industry will need to resist the temptation to consolidate their positions and become "more efficient" centralized entities.