Despite Do Kwon's problems with the law, users believe in LUNC, increasing its price. The belief in a bright future is also reinforced by Binance, which supported the token burn campaign.

The fall of Terra made a lot of noise, but even after a fatal mistake, people continue putting their money into the company by investing in the LUNC token, which is designed to revive the ecosystem after the collapse. As we wrote earlier, the Terra community and team came to the decision to burn an excessive amount of tokens by introducing a transaction tax. The idea was supported by many exchanges, among which was the well-known Binance exchange.

#Binance completes the first $LUNC burn, burning all trading fees collected from LUNC spot and margin trading pairs.

— Binance (@binance) October 3, 2022

For more details about the first burn and all future burns, please check the announcement linked below for weekly updates moving forward.https://t.co/Depz9nYDVO

After Binance tweeted on October 3 about the completion of the first burning of the LUNC, the token began to rise sharply in price, which is clearly visible on the chart.

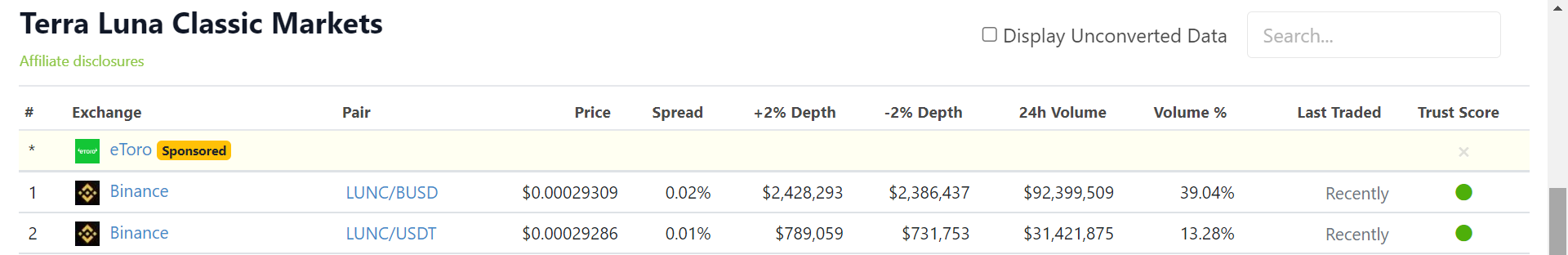

This fact does not seem surprising when you consider that according to CoinGecko, Binance accounts for more than 50% of the total LUNC trading volume, thanks to the LUNC/BUSD and LUNC/USDT trading pairs.

At the time of writing, according to CoinMarketCap, the market capitalization is 1,808,805,820 US dollars, and the trading volume per day is 254,762,970 US dollars. Also important, LUNC is still listed on most of exchanges and wallets, making it one of the most convenient tokens to operate.

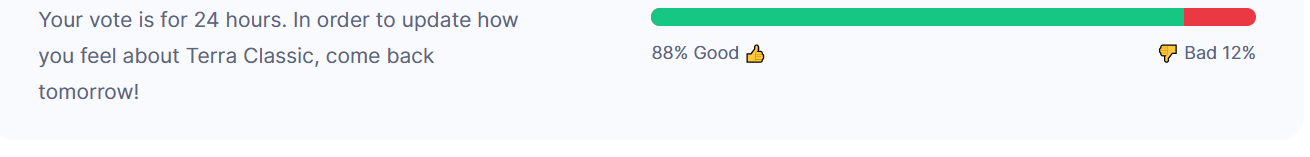

Interestingly, CoinMarketCap users clearly believe in LUNC and have a positive attitude towards the token. This is evidenced by a survey conducted by the same CoinMarketCap. Once a day, users can rate their attitude to LUNC as bad or good. As the results show, LUNC has a large support group. It can be assumed that a large number of supporters of stablecoin also helps it gain more popularity.

However, there are also those who try to warn about the danger of such investments. Some CoinMarketCap users write about price manipulation and unreliability of the coin, but this has not yet affected the positive trend in the growth of the asset price.

While LUNC is doing relatively well, Terraform Labs employees have clearly fallen on hard times. At the end of September, users were shocked by the news that the South Korean prosecutor's office was starting to freeze virtual assets of Kwon. According to Cointelegraph, we are talking about funds from a bitcoin wallet called "Luna Foundation Guard", from which 3313 BTC was withdrawn to the KuCoin and OKX platforms. If this information is true, then Do Kwon's words that all bitcoins belonging to the Luna Foundation Guard were used to eliminate the crisis situation with the stablecoin of Terra automatically become a lie.

However, Do Kwon accused the news outlet of lying, and also explained that no one had frozen his funds.

I don't get the motivation behind spreading this falsehood - muscle flexing? But to what end?

— Do Kwon 🌕 (@stablekwon) October 5, 2022

Once again, I don't even use Kucoin and OkEx, have no time to trade, no funds have been frozen.

I don't know whose funds they've frozen, but good for them, hope they use it for good 🙏 https://t.co/gSucKfqsxj

Following accusations of fraud with bitcoin intended to save Terra, the Ministry of Foreign Affairs of South Korea announced on October 6 that Do Kwon is required to surrender his South Korean passport. If the creator of Tera does not fulfil this requirement within 14 days, then his passport will be revoked without the right to be reissued.

It is very strange that despite the collapse of Terra, which affected the entire crypto market, and doubts about the honesty of the company's creator, Do Kwon, investors continue to buy LUNC. Time will tell what fluctuations in the price of the token and the actions by Kwon will eventually lead to. And we will continue our observations and share with you the most interesting aspects.