The recent collapse of the Silicon Valley Bank led to the instability of the USDC, which was the main reserve of the DAI stablecoin.

On March 11, following the USDC, the DAI stablecoin lost its peg to the dollar. In order to minimize losses and stabilize the peg to the dollar, the MakerDAO implemented emergency measures, including raising the commission from 0% to 1% on DAI - USDC swaps.

When the situation with the USDC and DAI dollar peg stabilized, the MakerDAO community was asked to roll back the PSM parameters and to vote for the diversification of reserves. Let's understand in more detail.

On March 17, a proposal was put forward to the MakerDAO community to roll back the PSM parameters and to decide on keeping the USDC as the main reserve asset or diversifying DAI reserves.

💡 Peg Stability Module (PSM) is a part of DAI stablecoin protocol, with which users can exchange other stablecoins for DAI and vice versa at the rate of 1:1. PSM consists of multiple vaults with USDC being the largest.

In the intro to the proposal, the MakerDAO team described the consequences of bank bankruptcy for stablecoins and the risks associated with it. However, it also suggested that despite all the problems with USDC, the risks have been significantly decreased and, in general, there were no problems with its stability.

“Among integrated stablecoins, USDP and GUSD seem to still have somewhat lower fundamental counterparty risk, with greater assurance of the stablecoins being bankruptcy remote and somewhat lower risk within their backing; GUSD bank deposits are held solely at systemically important banks, while Paxos has private bank deposit insurance to cover much of their deposit exposure that falls above FDIC limits. But despite this potential counterparty risk differential, risk of USDC has declined significantly since last week and further solvency concerns or depegs are not expected at this time.” - the proposal says.

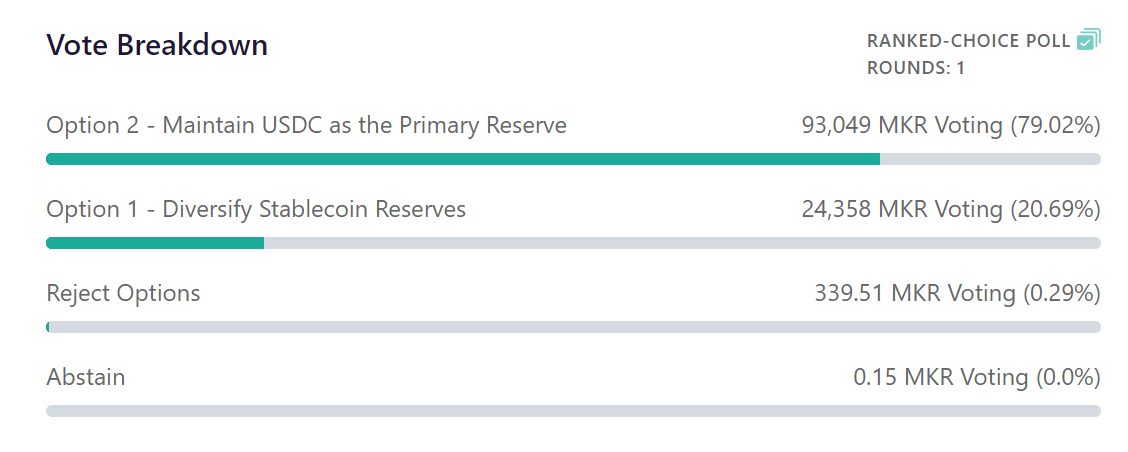

After the proposal was approved the MakerDAO the poll was opened, where the voting is done by the governance tokens - MKR. Two options were proposed:

- Diversify the reserves of stablecoins. This option assumed the distribution of the PSM reserves across multiple stablecoins.

“This poll option seeks to more evenly distribute Maker PSM stablecoin reserves across several assets. This has the benefit of increased risk diversification, where a single stablecoin facing impairment would have a lesser impact on DAI’s peg and underlying solvency conditions,”

2. Maintain USDC as a Primary Reserve. This option assumed keeping USDC as the main reserve for DAI, with certain adjustments to PSM fee parameters.

“This poll option seeks to normalize our PSM parameters more closely to their previous state, with USDC continuing to serve as Maker’s primary liquidity reserve. Elimination of the fee to swap USDC to DAI (tin) will improve market liquidity and UX, particularly for RWA counterparties who may be set up to use USDC rather than alternative stablecoins. USDC remains the most broadly adopted fiat stablecoin in defi, and there may be usability advantages to favoring USDC vs GUSD or USDP, ”

As a result of the vote, slightly more than 79% of participants voted to keep the USDC as the main reserve asset.

Interestingly, most of the comments on the initial proposal were in favor of the diversification option.

In the comments to the proposal, users stressed that the diversification of reserves should be a key decision.

“The event of the last WE showed us how damaging it could be to hold all our cash in only one uninsured bank deposit (USDC). Diversification should be key. We also need to work so that our RWA exposure isn’t just relying on USDC.”

In the comments to the vote, users also supported the diversification of reserves. One of the commentators stressed that diversification is a good strategy for quickly reducing the risks associated with issuers of stablecoins held in DAI reserves.

“Issuer diversification is one of the only immediate risk mitigation strategies MakerDAO can apply quickly in a rapidly deteriorating environment for U.S. regulated issuers and their stablecoin products. We do not subscribe to the philosophy that claims "well, if USDC or Circle goes down we are done anyway." Not only is this a ridiculous way to approach business risk assessment and tactical strategy, the view is also patently false.”

At the time of writing, the situation around USDC depeg has completely returned to normal. Its price has returned to normal, and the market capitalization, according to CoinGecko, is about $32 billion. But it's worth noting that this is the second time in the last twelve months that USDC caused problems for DAI. The first time this happened was when Circle blocked addresses associated with Tornado Cash.

It a is common sense in finance to keep the reserves in diversified assets so the MakerDAO's decision looks at least strange. It somewhat contradicts to the previous moves of MakerDAO where it was looking to increase the share of its Paxos USDP stablecoin reserves. Nevertheless, USDC remained its main reserve despite all the problems it has caused in the last year. This looks like an interesting case for future Observations...