While attention in the crypto world is generally skewed more towards the infrastructure layer, the application layer is often overlooked. However, infrastructure is being built for the application layer, and the appearance of new promising applications that use the latest and fancy crypto infrastructure is what makes the whole crypto sector valuable.

The latest example of such a collaborative effort and integration of cutting-edge crypto infrastructure is the Mass mobile application. This app is built to simplify DeFi and make it accessible to everyone, no matter their experience level.

The project has developed the first consumer mobile app that allows users to trade stocks, crypto, and commodities all in one platform. This achievement was made possible through collaboration with Arbitrum, Pyth Network, Synthetix, DeBridge, and Dinari.

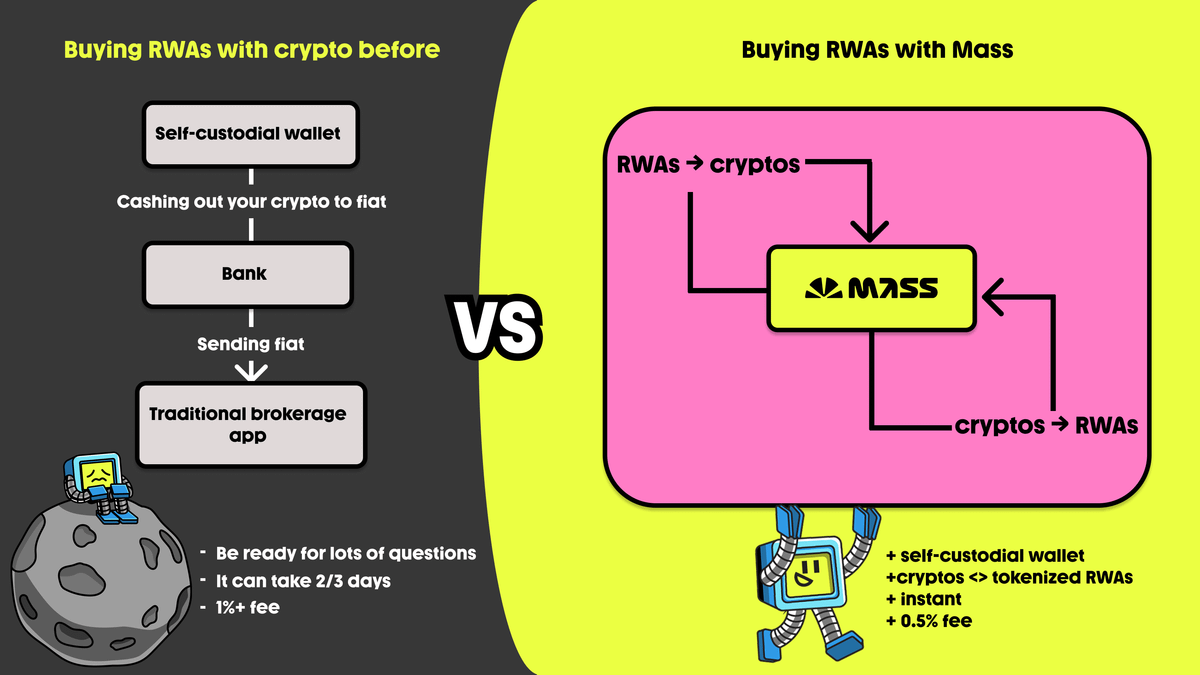

While crypto traders are accustomed to trading crypto spot and futures markets, trading stocks was not an available option and required registering a separate account with a brokerage firm, sending fiat through a bank, and navigating many other difficult steps.

However, in partnership with Dinari, Mass was able to abstract away all of these complexities for its traders. Dinari is a U.S.-based SEC-registered transfer agent that tokenizes stocks and ETFs to provide access to them for investors around the world. The project now offers access to 100+ tokenized stocks, ETFs, and commodities for its users.

Dinari tokenizes stocks into dAssets and brings them on-chain, allowing crypto users to freely trade shares of McDonald’s (MCD), NVIDIA (NVDA), Apple (AAPL), S&P (SPY), and many others. Moreover, in 2024, the project also launched its stablecoin USD+, a yield-bearing stablecoin backed 1:1 by US Treasury Bills. Users on Mass can now receive dividends from their stocks in the USD+ stablecoin.

Besides stocks, Mass also allows trading of regular crypto assets on spot and futures markets. For the latter, Mass has integrated Synthetix’s perpetual trading infrastructure into its app, enabling users to trade over 90 perpetual contracts with up to 25x leverage.

Notably, while tokenized stock trading is currently only available after KYC, spot and perpetual trading are accessible without KYC.

Since trading on Mass occurs on-chain, users need crypto to pay gas fees on various networks. In the traditional crypto world, where user experience often falls short, users need to own ETH or another gas token to perform any action.

However, the project has abstracted away that problem and allows users to have a wallet “gas tank” which they can fill with any cryptocurrency on any network. Once filled, users don’t have to worry about gas fees until their gas tank balance is running low.

Besides various crypto integrations, Mass has also integrated traditional banking on/off ramps, allowing users to top up their app balances with regular debit/credit cards. The project also plans to issue its own crypto debit card in the near future.

Overall, the app appears to be the first DeFi application that allows you to care less about the infrastructure and more about the actual trading you want to do. This is something DeFi has been trying to achieve for many years by abstracting away the infrastructure layer, and it is hopeful that we are starting to see such applications in 2025.