"Bad money drives out good". The 500-year old law can now be applied to blockchains. Ethereum, the world's most advanced blockchain, is losing its clients to cheaper chains.

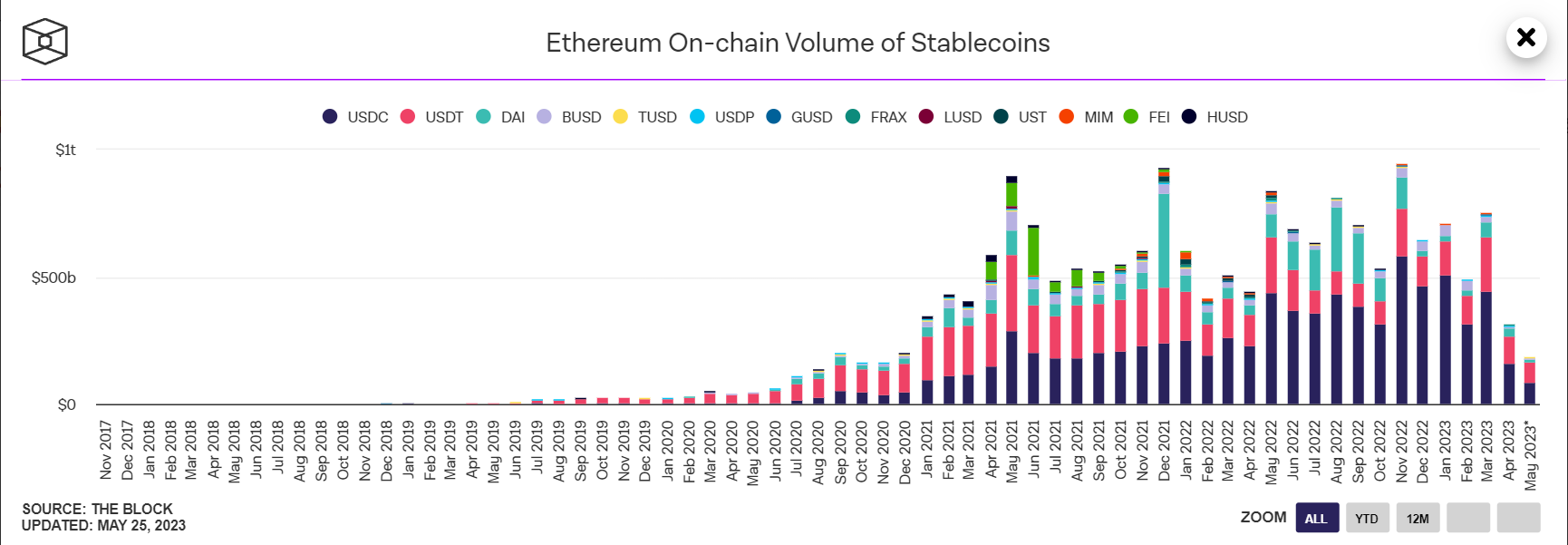

This is evidenced by the drop in the volume of stablecoin trading on the Ethereum network. It has retreated to 2020 levels and experts link the low activity of stablecoins on the network with the meme-coin trend that caused the price of fees for transactions on Ethereum to soar.

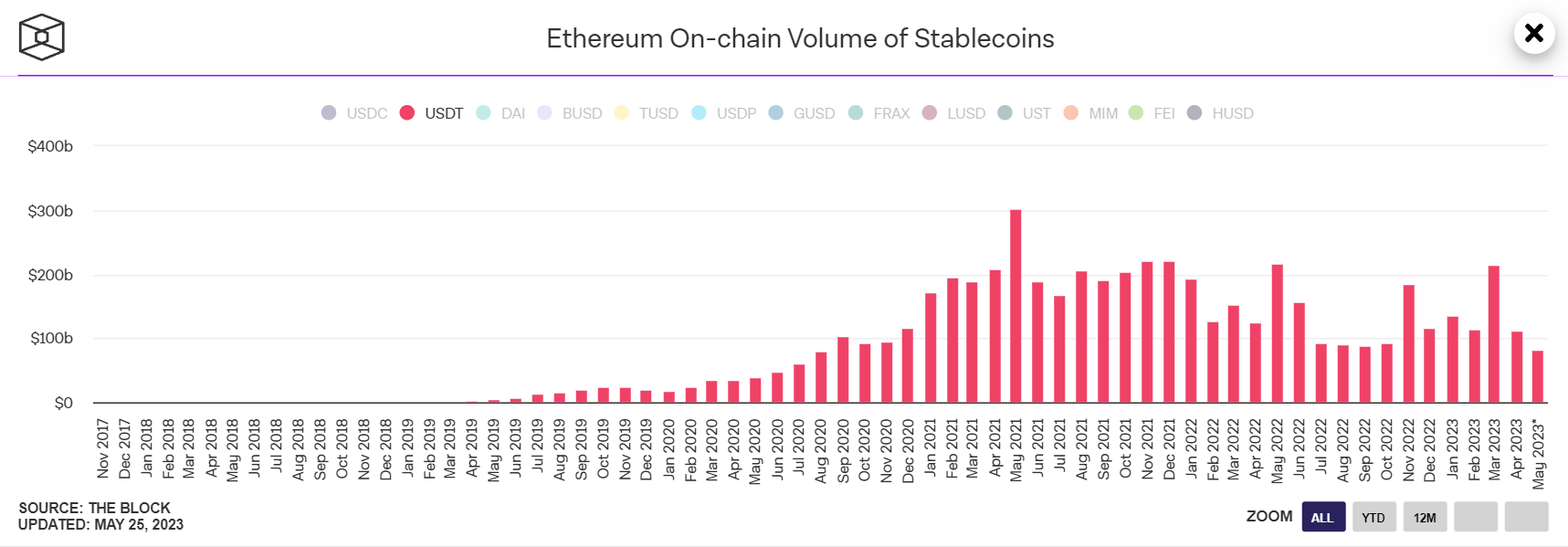

The volume of transactions for Tether's USDT on the Ethereum network decreased from $110.6 billion to $81.2 billion over the month, lower than during the crisis months of 2022.

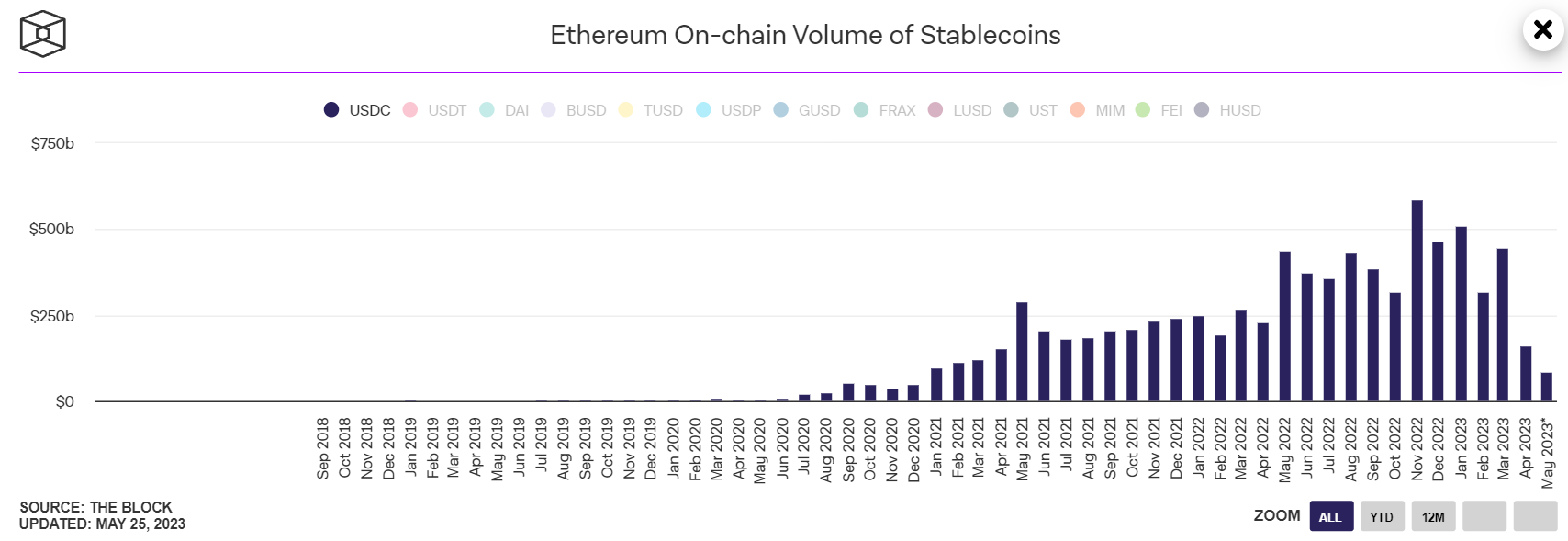

The second largest stablecoin, Circle's USDC, has also seen a record drop of $74.4 billion in a month, worsening April's fall in volume caused by the Silicon Valley Bank's crisis.

In aggregate, the volume of transactions for the 13 largest stablecoins has decreased by $126.6 billion in the last month, touching December 2020 levels, of around $200 billion

The Block analyst, Rebecca Stevens, suggested that the volume of stablecoin transactions on Ethereum had decreased due to the high fees within the network caused by the influx of meme-coin traders.

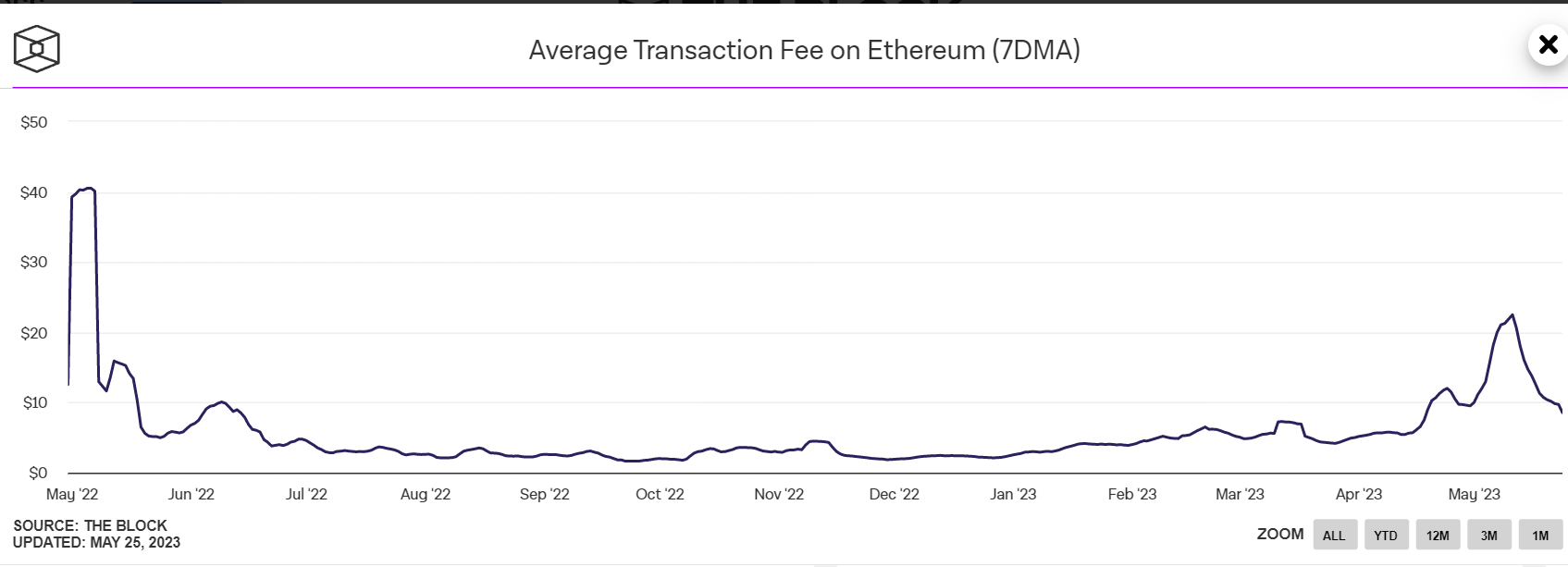

The transaction fees on Ethereum have indeed increased, at one point reaching $22.49. Even now that the fees have stabilized, they are still higher than long-term average rates.

Competing blockchain platforms seem to be benefiting from Ethereum's fee problems.

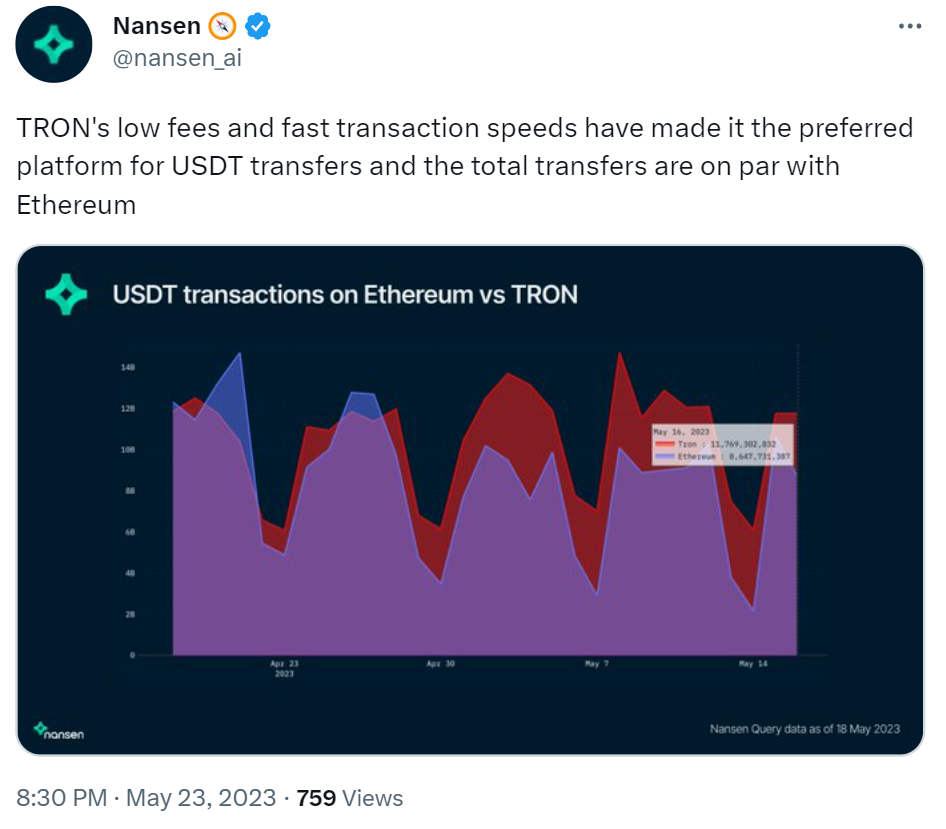

In a recent interview, the CTO of Tether Paolo Ardoino noted that TRON blockchain is increasingly used for USDT transactions due to low fees and high speed. He noted that a significant portion of Tether transactions comes from poorer countries hit by excessive inflation, where stablecoins often replace local money. For such users even half dollar differences in transaction fees can be a deciding factor in choice of blockchain.

Analysts from Nansen posted a visual, showing that Tron had flipped Ethereum in Tether's USDT stablecoin transactions.

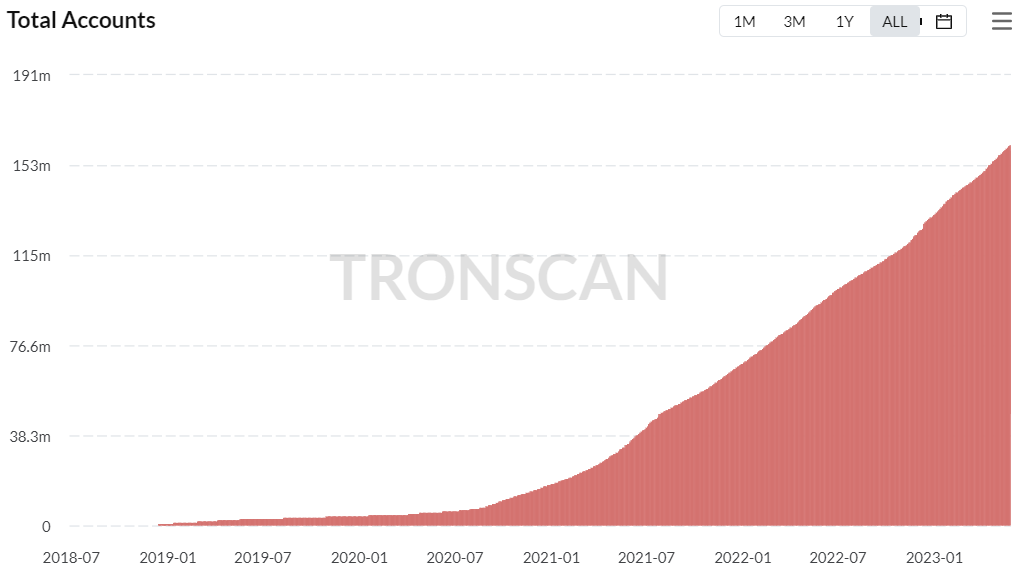

Overall, Tron blockchain keeps a strong adoption trend as can be seen by the growth in the number of registered accounts.

According to statistics from Tronscan, the number of new accounts opened daily has almost doubled for the last month, reaching 240,000 per day.

BNB Smart Chain, Polygon and Solana are also among the chains that have seen an increase in stablecoin transactions, however at a lower scale.

Ethereum has seen fee spikes before. The earliest attack that clogged the network was back in 2017 when CryptoKitties hit the scene. During the 2021 -2022 bull run and NFT season, fees were at $20-30 levels spiking up to $50 per transaction. At that time Vitalik Buterin was promising higher throughput after the network's transition to Proof-of-Stake.

Gresham's Law "Bad money drives out good" referred to cases in the middle ages when people were using cheaper coins for everyday transactions while hoarding silver and gold coins of the same face value. Will there one day be cheap blockchains for everyday transactions and 'golden' chains for more important things (and meme-coins)? We will continue to Observe.