In May 2024 the U.S. securities markets will undergo the most significant structural change in recent years. The “move to T+1” will reduce the settlement period for U.S. stock market shares and bonds contracts from two days to one, leaving traders around the world with just a couple of hours to solve any issues with settlement instructions.

The “dramatic change” aims to help brokers cope with the sudden jumps in trade volumes that are becoming more frequent due to an increase in the popularity of meme-stocks amongst online communities.

Like GameStop, which was struggling financially at the time, online investor communities have jumped to try and save other dying companies. However, the meme-stock movement pertains to any securities that gain attention through social media and result in a flash increase in trade volume.

Researchers found that meme assets and the prices of Bitcoin and Ethereum influence one another, as investors in both types of assets have common behaviors and rationale, sharing the same information channels and often overlapping influencers.

Preparing for more Mementums

The structure of the U.S. stock exchange was not ready for January 2021's sudden increase in trade volume.

Brokers were asked to pay the collateral that preempts any issue with instructions; the great numbers of buying orders and, as experts argue, the large settlement window (T+2) gave rise to a bottleneck that prevented many investors from buying GameStop stocks.

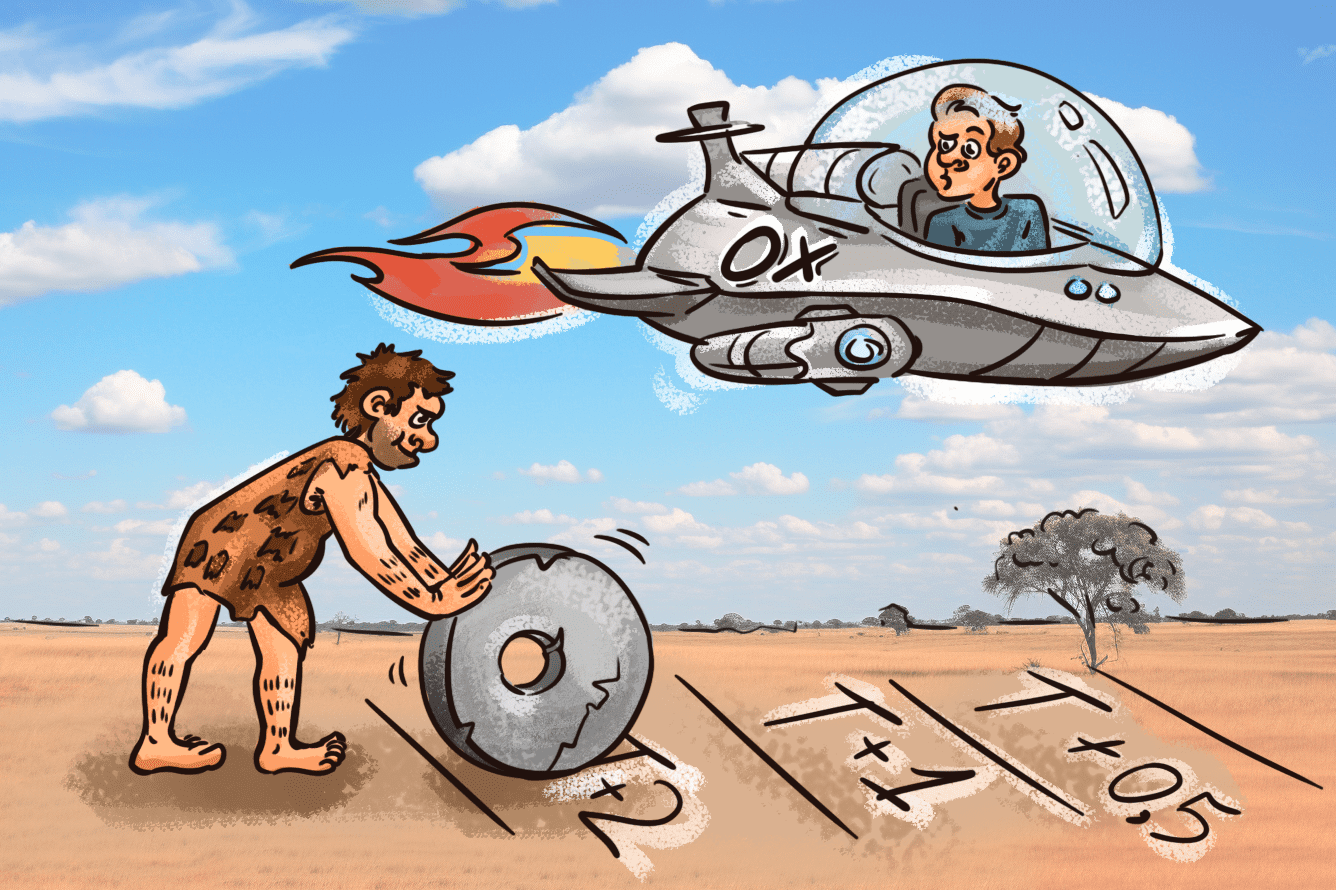

To be better prepared for future mementums, the U.S. decided to restructure a key component of the securities market: settlement time.

Decreasing from 48 to 24 hours the time it takes to settle trades reduces the funds the brokers need to cover potential losses, increasing the number of orders they can take per day.

The upcoming “move to T+1” forces securities markets worldwide to reconfigure their logistical strategies. Canada and Mexico will replicate the change of their neighbor. At the same time, other countries are either planning to open offices in the U.S. or update their technology to solve settlement issues in a shorter period.

The democratization of investment due to social media and new financial technologies and products is opening finance to the many. With this structure change, traditional markets are trying to catch up with the new paradigm set by blockchain-based technology.