Around six months ago, Bitcoin and a number of digital assets reached all-time highs. Today it is a very different story: a great majority of cryptocurrencies are down more than 50% against the U.S. dollar.

Six months ago, bitcoin BTC touched an all-time high (ATH) at $69K per unit and today, it’s $29K (down more than 57% in USD value).

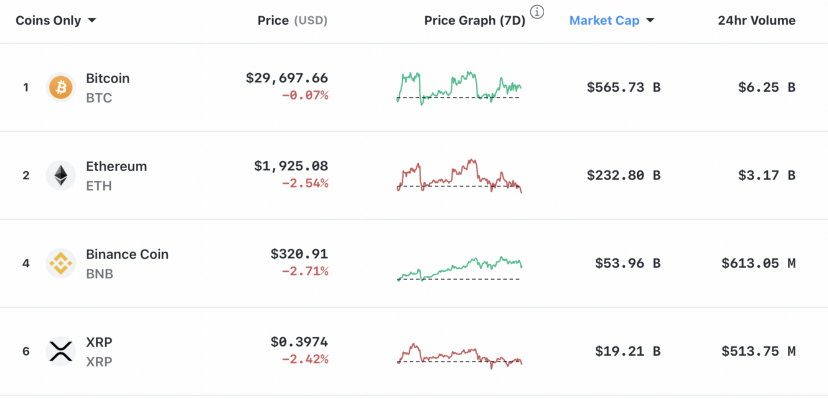

The second leading asset, ETH, has lost 59.85% after reaching $4,807 per ether six months ago. The fourth-largest crypto asset BNB is down 52.65%, XRP today is down more than 70% against the U.S. dollar from September 2021.

Cardano (ADA) hit its ATH nine months ago at $3.10 per ADA and currently, ADA is down 83.5% against the U.S. dollar. Solana (SOL) touched its ATH seven months ago and is down 81.5% in USD value.

Although the prices are down since 2021, crypto investors that purchased digital assets in 2020 have seen their cryptocurrencies rise. For instance, the price of bitcoin since 2020 is up 303.28% and ethereum is up 465.7%.

Recently cryptocurrencies have been correlated with equities markets and more precisely stock indexes like Nasdaq 100and the S&P 500. This could mean that the crypto bear market won’t end until the stock market bear run is finished. The correlation between Bitcoin and the NASDAQ strengthened from February to April. The closer correlation coincided with the start of the war in Ukraine and a marked shift in Fed monetary policy.

According to a widely followed definition, a bear market occurs when a market or security is down 20% or more from a recent high. Bank of America strategists, led by Michael Hartnett, have studied the history of 19 bear markets over the past 140 years, they found the average price decline was 37.3% and the average duration was about 289 days. If cryptocurrencies are to follow the same pattern, and if history repeats and digital assets continue to follow the current correlation with equities, it could mean the current downfall could last another three months longer. Unfortunately the price decline in the crypto prices is way stronger, the top ten crypto assets are down 57% to over 80% already.

Currently, crypto assets seem to be at a turning point. Further, the prices could consolidate around this level for some time, they could also rise back again or the value drops even lower. Anyway, if we consider the crypto economy as a part of the world economy and believe that it is going to follow familiar patterns (even with some differences), then panic is useless and we should just wait for bulls to replace bears and prepare ourselves to see many more swings on the crypto market as well as on all the other markets. Let’s be less dramatic!