On June 24, Mt.Gox released a notice concerning the commencement of repayments in BTC and BCH. The Rehabilitation Trustee has reportedly completed all preparations and has promised to start repayments at the beginning of July. The repayments will first be made to unspecified exchanges with which the Trustee has completed “the exchange and confirmation of the required information.”

In May, the exchange transferred over 140,000 BTC, valued now at approximately $8.6 billion, from cold wallets to an unknown address in 13 transactions as part of the preparations. Approximately the same amount of BCH created during the “fork wars” of 2017, now valued at $50.6 million and over $400 million in fiat, is also expected to be distributed. This amount is significantly less than the total lost but represents a substantial recovery as the BTC price surged over the last decade.

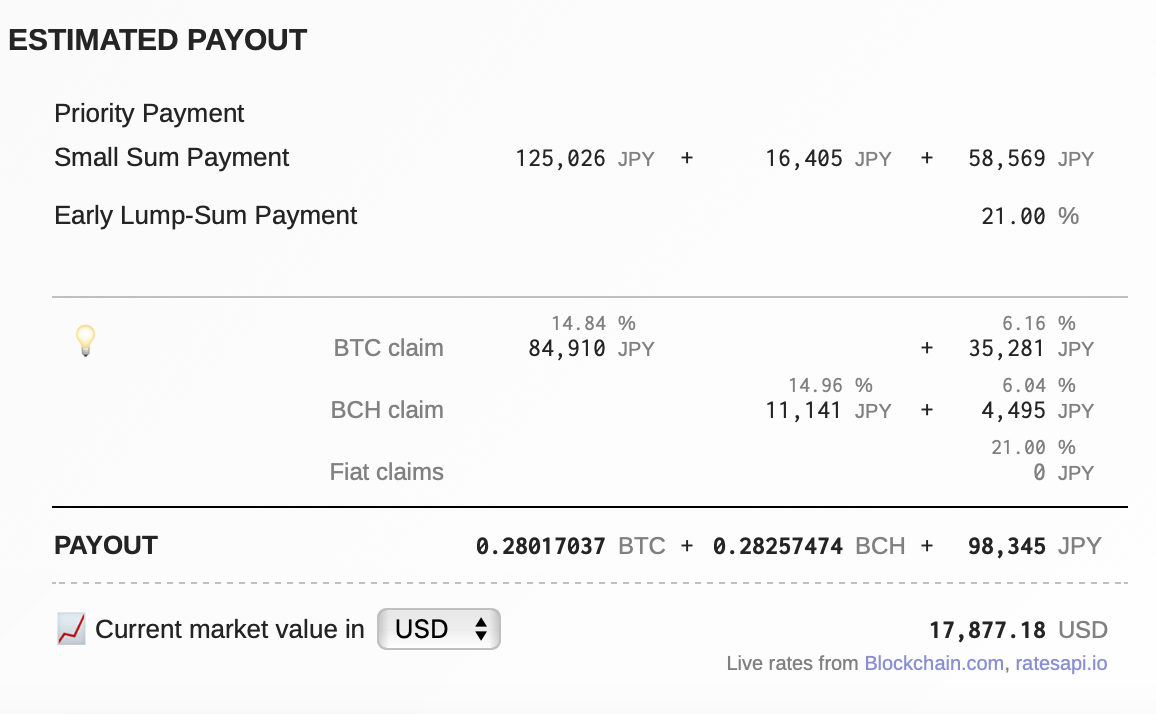

According to the rehabilitation plan, every BTC is valued at around $4,700, compared to the original $300 indicated during the bankruptcy proceeding. In a nutshell, fiat claims will be repaid in full plus delay damages, small sum payments (up to $1250) will also be paid in full, and then users can get up to 23-24% of the rest. About 75% of all funds should be paid to creditors who elected early lump-sum payments before November. They will get reimbursed first at a discounted fixed rate of 21%. Others will wait a couple of years and might get a little bit more. The payments will be made using a combination of fiat and BTC/BCH. Thanks to the surge in the BTC price (around 1200% from the basis price), the part paid out in Bitcoin will bring former clients the main profit.

It hasn't been an easy wait for creditors. This April, some reported a fraudulent scheme after receiving suspicious e-mails impersonating the Mt. Gox team. Creditors were asked to click a “Begin Now” button to visit a “uniquely generated withdrawal” page and connect their wallets. As things are heating up, scammers might intensify their attacks.

Mt. Gox handled over 70% of all Bitcoin transactions worldwide when it collapsed in 2014, impacting nearly 24,000 customers. The company reported losing almost 750,000 of its customers’ bitcoins and around 100,000 of its own due to an alleged hack. The investigation into the hack is still ongoing, and new suspects were charged last Summer.

In 2021, the Mt. Gox trustee announced that creditors had approved a rehabilitation plan. After significant and repeated delays, the early payout deadline was set for October 31, 2024. At the end of last year, we observed the first funds received by Mt. Gox creditors. Ironically, even this process didn’t run smoothly and was marred by accidental duplicate PayPal payments to some users. In January, creditors received e-mails confirming upcoming payments in BTC or BCH, while some were asked to verify their accounts to receive funds. Later, creditors reported receiving bank transactions with first fiat repayments.

The repayment promises seem real this time, but as the Mt.Gox story shows, the current deadline might face further delays. After ten years of waiting, many creditors remain skeptical and expect more troubles and mishaps. We will observe how the repayment goes, whether those who get refunds opt to sell or hold, and how the market will react.

Many experts expect turbulence in the Bitcoin and Bitcoin cash markets as the release of such large sums will add selling pressure, while others believe that most of the transferred coins will be held by creditors. Polls on Reddit show that most voters will opt for the ‘hold’ option. After the release of the above-mentioned notice, the BTC price has started to decrease, falling below $61,000 for the first time since the beginning of May. We expect that there will be a further slump as the repayments start.