The history of finance tells many tales, one of the most impressive being the path of cryptocurrencies from the dark side of the internet to the vanguard of technology. As the price of tokens grew, millions were drawn into the steadily expanding market.

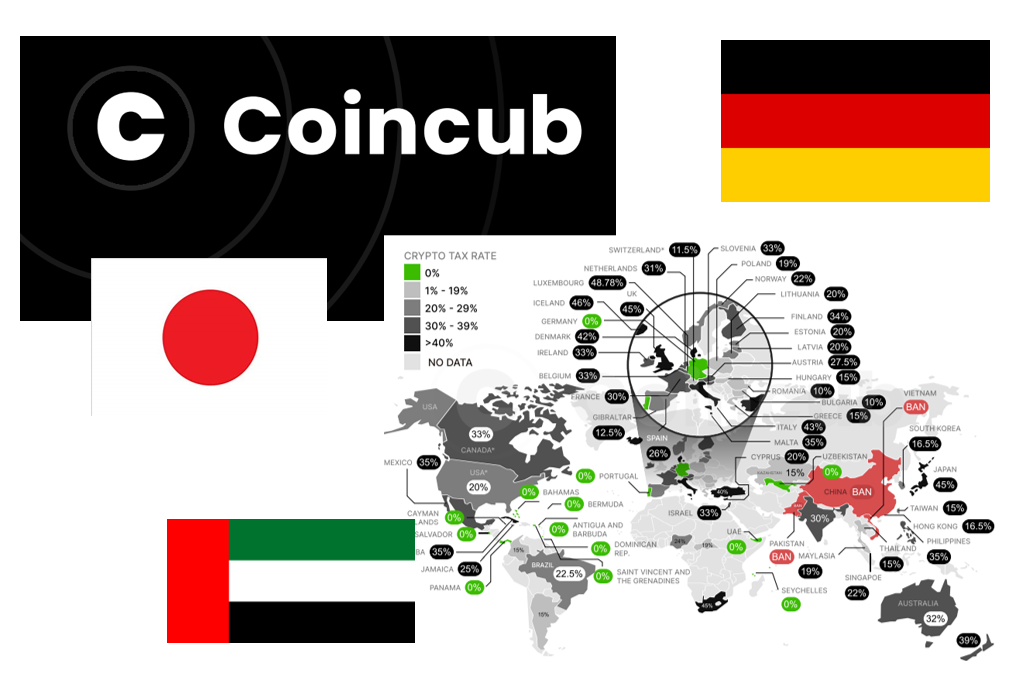

The increasing relevance of cryptocurrencies also awoke the interest of governments worldwide. Despite the two largest world economies, the U.S. and China, taking strong legal stances against them, other major economies such as Japan and Germany are reshaping their traditional taxation guidelines to welcome crypto investors and the innovation that follows.

A new report by Coincub ranks the best countries in which to hold cryptocurrencies; in doing so, it shines a light on the adaptation struggles that governments have been going through to decipher how to best profit from decentralized currencies, both from a financial and from an economic and social point of view.

What are the best countries to hold crypto?

United Arab Emirates (#1) is the country with the lowest taxes on crypto assets. The UAE doesn’t miss any gold version, be it dark gold, actual gold, or digital gold. The small country in the Arabic Peninsula is diversifying its economy in the hopes of becoming the region’s financial hub. Although that is a formidable challenge, an absent income taxation system rids individuals of paying any tax on their crypto gains. At the same time, free zones allow temporary tax exemptions for corporate income taxes.

Unsurprisingly, following UAE are the countries known to be the world’s tax havens, where income and capital gains taxes are close to nill both for individuals and enterprises. They are the Bahamas (#2), Bermuda (#3), Cayman Islands (#4), Seychelles (#5), Panama (#7), Gibraltar (#11), and Liechtenstein (#12).

As the first country to adopt Bitcoin as legal tender, El Salvador slots in at number 8. The country’s government is betting on crypto to make El Salvador the El Dorado of decentralised tech, and a policy of no taxes on crypto capital gains is aligned with an ambitious innovation strategy.

Indonesia (#6) and Singapore (#14) are the only Asian jurisdictions to make the top 20. In Indonesia, all crypto-related taxes are about 0.1%, whether crypto purchases, capital gains, or VAT. Singapore made the list because of its low taxes (22% on earnings and 0% on capital gains) and because it is one of the most crypto-friendly destinations worldwide.

Unlike neighbouring Japan, where high taxes have discouraged Web3 companies from setting up shop in its territory, Singapore offers a thriving business environment where crypto is taking over from other forms of currency as a daily means of payment.

Surprises start showing up as we scroll through the list, finding Germany (#13) as one of the best countries to hold crypto.

The largest European economy is a traditionally high-tax country, and to be clear, short-term trade of cryptocurrencies will be heavily taxed - depending on your earnings, you can pay up to 45% of income tax.

Yet, after a surprising decision to let its risk-averse pensioners’ funds include cryptocurrencies in their institutional portfolios, the country’s government announced that long-term (>12 months) cryptocurrency investors would be exempted from paying taxes on their gains.

A similar taxation policy is being implemented in fellow EU country, Portugal (#17). The country where digital nomads go to settle had a tax-free policy on crypto up until last year, and although pressure from the unions led it to make some changes, it opted for light touch regulation. Besides long-term investors, casual investors also enjoy a free-tax scheme.

The make-up of the remaining top 20 countries is intriguing as most are members of the European Union. Malta (#10) is as appealing as it is confusing to investors. “Blockchain Island” has a complex tax scheme with multiple distinctions between assets and several layers of taxation that might be hard to navigate. Nonetheless, it doesn’t charge tax on long-term investment and brands itself as a crypto-friendly destination.

Then we have the Balkan states of Romania (#17), Bulgaria (#18), and Hungary(#19), that charge light taxes - between 10% to 15%. Rounding out the top 20 is Greece (#20), where investors pay just 15% of their capital gains to the state.

What are the worst countries to hold crypto?

It’s a wonderful world, but crypto investors might want to stay out of some of its corners.

The U.S. is a no-go zone for crypto investors. The country enjoys unsurmountable political and economic power due to the dollar’s supremacy over all other currencies, and it is pursuing a legal ‘War on Crypto’ to maintain that privileged position.

If one is to look solely at percentages, for the short-term there are regions, such as Puerto Rico, Florida, or Wyoming, where investors get to keep most or all of their gains with crypto.

The other no-go zone is China. The People’s Party, the ruling political force, is known to hold a tight grip on every technological or financial endeavour within its borders. Although Bitcoin mining was fleetingly within its control, the world’s second-largest economy essentially banned cryptocurrencies in 2021.

Some countries have several restrictions or an unclear legal framework surrounding cryptocurrencies, such as Colombia and Cuba in South America and Pakistan and Vietnam in Asia. While crypto is widely popular in some of these jurisdictions, don’t think twice if you can escape them.

The European Union is a patchwork of taxation where countries with low taxation border countries with some of the highest taxes out there. In Luxembourg, investors face a 45.78% tax on capital gains, equally high are the taxation rates in the Nordic countries of Finland (30% to 34% on profits), Denmark (35% to an astronomical 52%) and Norway (progressive tax starting at 22%). The Netherlands, Belgium, and France have taxes starting at 30% and going up to 50% for professionals, although there are ways to escape the heftiest taxes.