With Bitcoin recently breaking its all-time high, the extra liquidity in the crypto markets is spilling into more speculative investments and status assets. Meme-coins are breaking all previously set records in volume, price, and activity, and non-fungible tokens are heading the same way.

On Monday, one of the only 9 Alien CryptoPunks, CryptoPunk #3100, was sold to an anonymous buyer for 4,500 Ether (worth $16,032,959 at the time of sale). The sale is the second most expensive of the classic Ethereum collection and the 5th largest purchase of an NFT ever.

Back in 2021, when Ethereum was the blockchain of choice to trade and sell NFTs, the sale of a CryptoPunk had the definitive kick of the NFT mania that made digital assets rise to pop-culture prominence.

While the collection seems as well positioned as it was three years ago, the same cannot be said of the blockchain where it is hosted.

According to data from CryptoSlam, during the past week, only two of the top five collections by sales volume, CryptoPunks and Pandora, were based on Ethereum. The three others figuring in the top five were not even actual NFTs; they were Ordinals.

Since the Ordinal protocol was introduced in January 2023, a plethora of digital images attached to individual satoshis has been sold to an ever-increasing crowd of collectors.

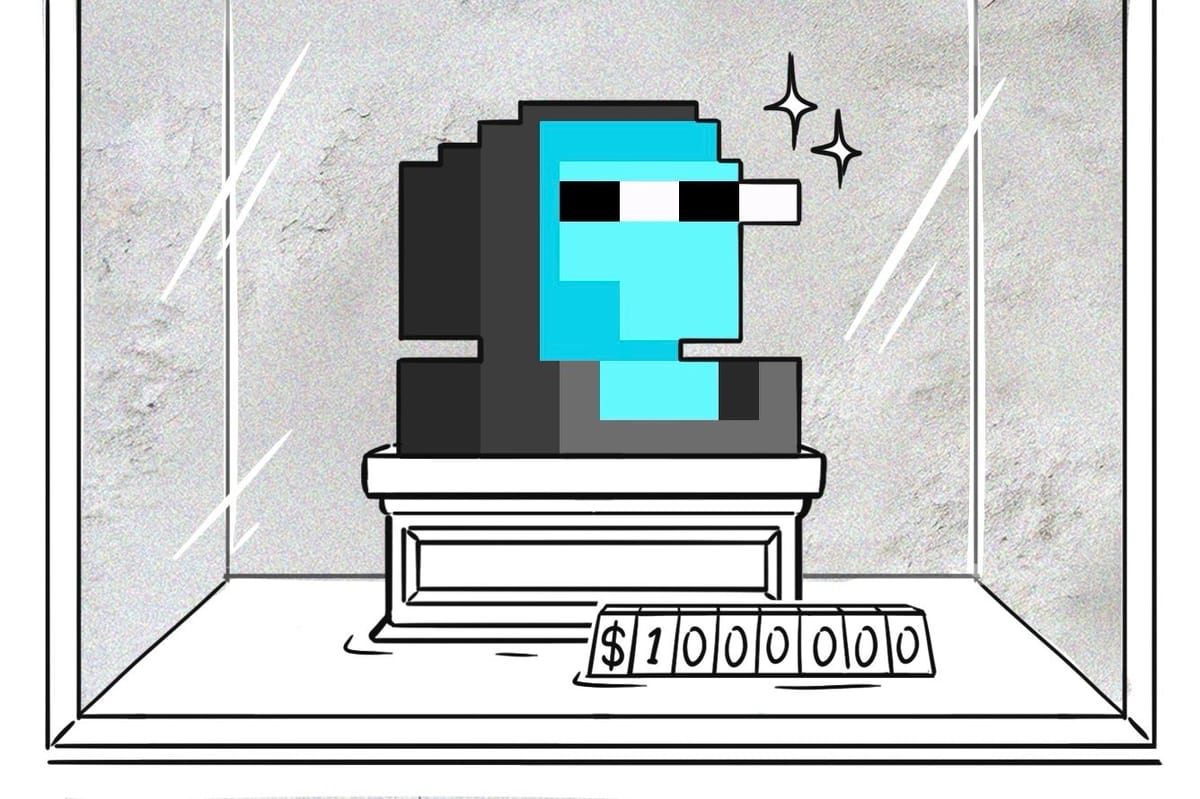

One of the first Ordinal collections to be launched, NodeMonkes, also saw a major milestone on Monday, when the Ordinal "Alien Hoodie" (#2769) was sold for 17 BTC ($1.08 million at the time). This was the first sale from the collection reaching above $1 million and the second most expensive Ordinal sale of all time. The price of NodeMonkes has skyrocketed in the past few weeks, and in just the last seven days the collection has drawn almost $50 million in sales.

Loose or uncategorized Ordinals, which don't belong to any collection, made on aggregate $48 million from more than 50 thousand transactions. Natcats, another popular BTC-based collection, also figured in the top five collections over the past week, making around $11 million in sales.

The rise in the popularity of Ordinals has led to Ethereum losing its place as the number one chain for non-fungible tokens to Bitcoin, in which digital token sales of the last seven days amount to $185 million, compared with $177 million on Ethereum.

Ethereum is also in second place in terms of activity. At 113,000 transactions during the past week, it falls more than three times short of the number of NFT buyers on Solana. This massive difference is likely due to the difference in gas fees between the two blockchains. Low prices on Solana allow for the sale of more affordable digital tokens, while the high fees on Ethereum disincentivize non-blue-chip collections from existing on the network.

When the last NFT frenzy was in fruition, Bitcoin's only use case was as a digital currency and nothing more. Other blockchains, while already showing incredible potential, were, at the time, still very far from the level of complexity and development of the Ethereum ecosystem.

Ethereum's top blue-chip collections - CryptoPunks, Yuga Labs' BAYC and MAYC, and Pudgy Penguins, still the utmost status symbols in the crypto world, are supported by ferocious loyal communities and enjoy a level of popularity that reaches far beyond the borders of Web3. This position is not easily challenged.

Nonetheless, during the prolonged bear market, developers on other networks experimented with new technology to create unique and exciting new products. As fresh NFT mania blossoms, Ethereum's dominant role in the digital assets market is far from assured.