BlackRock’s incursion into crypto assets is proving to be exceptionally successful. Just one week after launching, the BlackRock USD Institutional Fund (BUIDL) has already attracted over a quarter of a billion dollars.

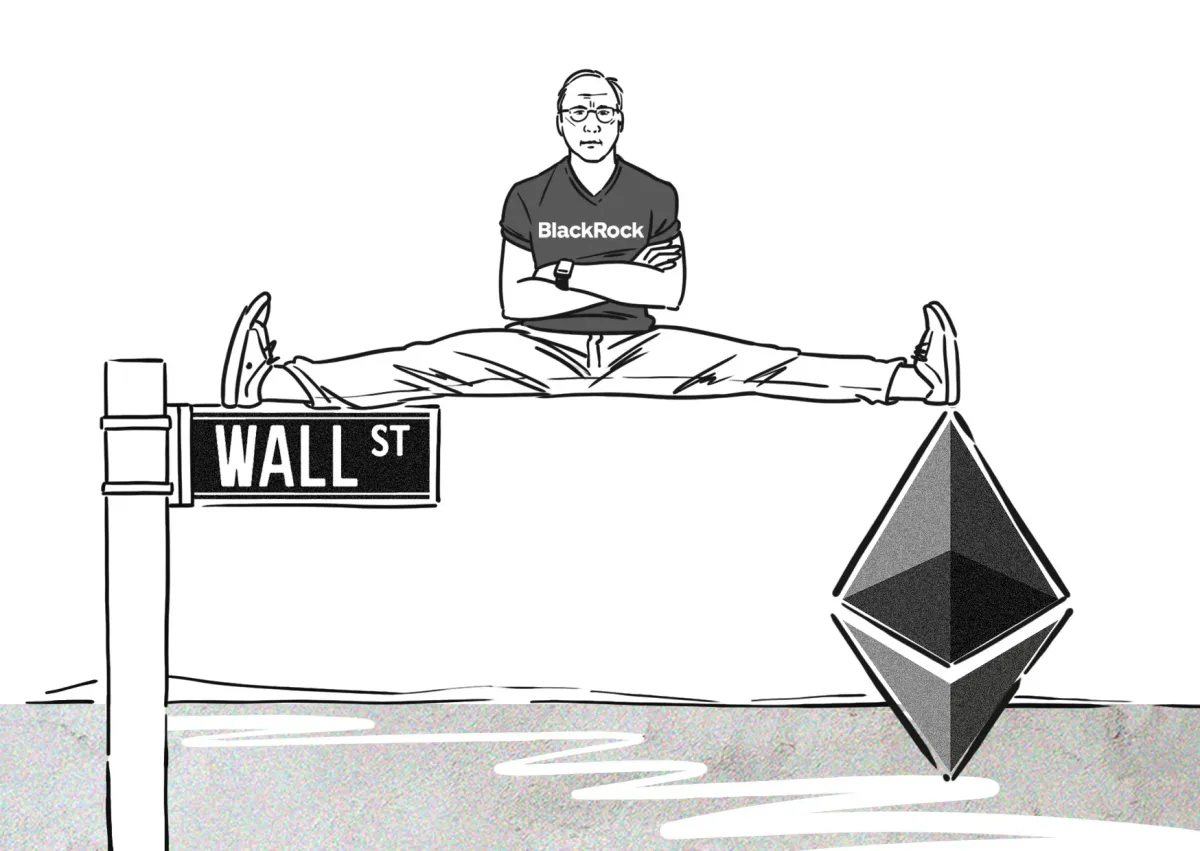

BUIDL is the second venture of the Wall Street company into the crypto world after launching a Bitcoin exchange-traded fund in January. Its iShares Bitcoin Trust presently holds over $13 billion, a little above 250 million Bitcoins.

Created in partnership with the tokenization specialist firm Securitize, and working with Coinbase as an infrastructure provider, the tokenized fund invests in cash, U.S. Treasury Funds, and repurchase agreements.

The first fund from BlackRock, directed at institutional investors, requires a minimum $5 million allocation. In return for funds, users receive BUIDL tokens, which the financial company has vowed to keep at parity with the U.S. dollar.

According to data from Etherscan, there are eight wallets with BUIDL tokens. Ondo Finance is one of them, having already transferred $15 million to Blackrock’s fund Ethereum wallet.

The real-world assets tokenization platform had its OUSG token backed by BlackRock’s iShares Short Treasury Bond ETF, which trades only during Wall Street business hours. To give its users more flexibility in redeeming time, the firm plans to transfer an additional $80 million of the backed assets to the Blackrock USD Institutional Fund, which is available 24/7/365.

“We’re excited to see BlackRock embracing securities tokenization with the launch of BUIDL, especially its broad cooperation with ecosystem participants,” the company said, on Wednesday.

BUIDL received a warm reception from investors, while the broader crypto community also welcomed on the news, with its unique sense of humour of course, sending $100 thousand in meme coins and NFTs to the fund's wallet.

The bullish stance of Blackrock’s CEO, Larry Fink, regarding crypto assets seems to be working well for the company. One called the “man behind the curtain” by writer William D. Cohan due to his immense power in geopolitics and world finance, Fink has been excited by asset tokenization for almost two years.

In an interview with El País in April 2023, Fink expressed his belief in blockchain technology, noting how tokenizing stocks and bonds “would be a great opportunity.”

In a New York Times event in November 2022, the CEO declared “the next generation for the market, the next generation for securities, will be the tokenization of securities.”