Helius, a Solana infrastructure provider, released a report detailing the economic challenges faced by the majority of validators on the Solana network. The report revealed that if the Solana Foundation were to discontinue its Foundation Delegation Program (SFDF), 897 of its participants—representing 57% of all Solana validators—would no longer be profitable.

The Solana Foundation Delegation Program was established to support validators by delegating SOL tokens to them. This allows validators to operate without needing to hold a large number of SOL tokens themselves. Validator selection is based on performance metrics.

Operating a validator incurs several fixed and variable costs. The most significant operational cost is vote transactions, which are crucial for maintaining on-chain consensus. These transactions cost approximately 2-3 SOL per epoch, which adds up to about 300-350 SOL annually.

Other significant expenses include data bandwidth, which costs between $0.64 and $3.60 per TB depending on location, and hardware maintenance, which can range from $370 to $470 per month. Additionally, labor costs are substantial, requiring expertise in blockchain technology and DevOps. Validators must also maintain continuous operations and perform regular updates to avoid penalties.

Validators earn money through block rewards, commissions, and Maximal Extractable Value (MEV). However, to just break even, a validator needs about 35,000 SOL staked on them.

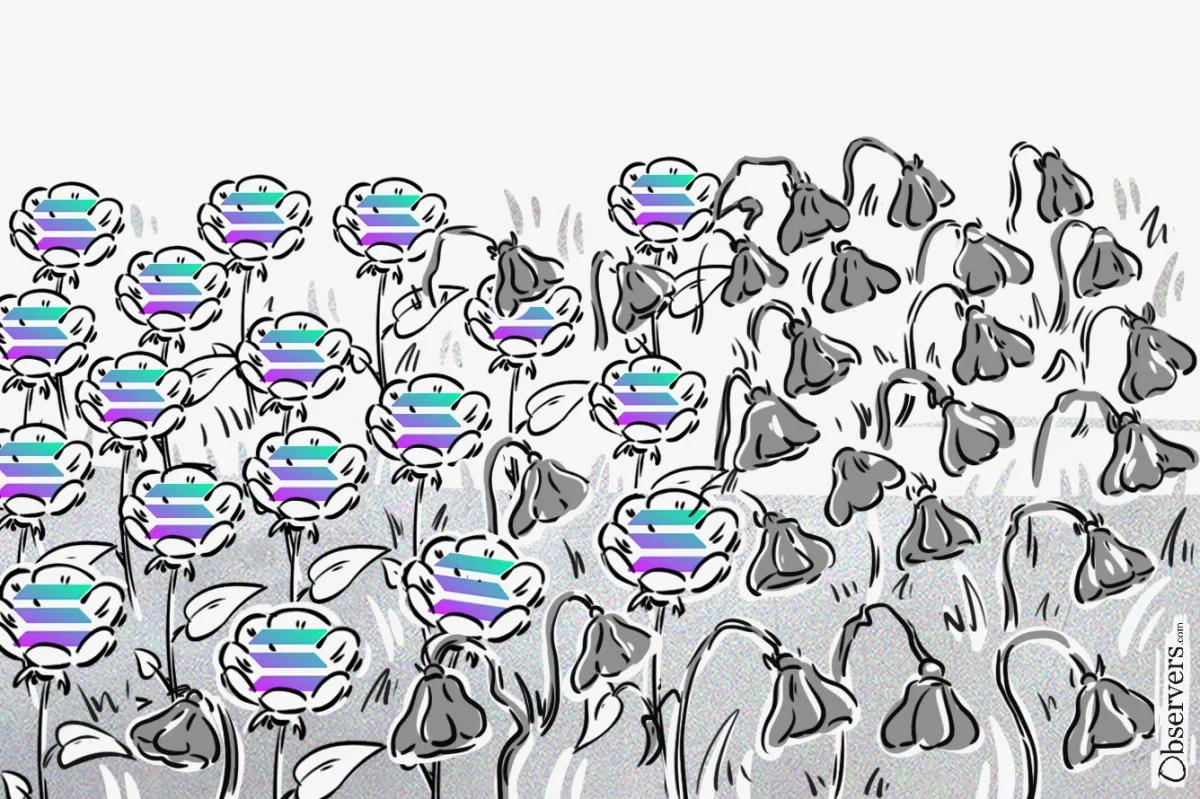

This is a major problem for many validators, as they struggle to attract enough SOL to sustain their operations. SFDP addresses this issue by assisting smaller validators. However, without the SFDP stake, the majority would find it challenging to cover their operating costs and remain profitable.

Although this financial instability indicates potential business risks, it doesn’t necessarily mean that the Solana network is at risk of failure. Validators can and will continue to operate, even if they are not profitable. As long as there is sufficient activity on Solana, there will always be entities willing to run validators. Various dApps and projects on Solana generate enough profit to cover all the costs of operating validators and are directly incentivized to do so.

However, this situation still impacts the decentralization of the network. Currently, Solana has only about 1,424 validators in total. If more than half of them were to go out of business, it could threaten network stability. For perspective, Ethereum has over 1 million validators.

According to Solana, their endgame architecture aims to have over 10,000 validators, but this goal seems far off. The number of active validators has actually decreased this year, partly because they were not able to generate sufficient profits.

Additionally, several months ago, the Solana Foundation expelled a number of validators from the SFDP due to their involvement in MEV practices, like executing sandwich attacks on retail users. The loss of both MEV revenues and SFDP support caused many of these validators to go offline.

Unsurprisingly, Solana’s speed comes at the cost of decentralization. While this might not seem like a big issue currently, and some might even dismiss decentralization as just a “meme,” the long-term implications of this trade-off remain questionable.