Vitalik Buterin’s recent posts reflect a shift from idealistic decentralization toward pragmatic system design. Rather than rejecting Ethereum’s core principles, he questions where complexity, governance, and the current development path fail under real-world constraints.

Alex Harutunian

Hyperliquid is evolving from a perp DEX into a vertically integrated financial stack. By launching its own L1, native stablecoin, and spot markets, it prioritizes market fit over ideology. Started on Arbitrum, its roadmap reveals a larger ambition: to become the global base layer for all trading.

Alex Harutunian

Triggered by a routine macro shock, crypto once again unraveled faster than any other market. Not because of sentiment alone, but because CEX risk engines, DEX liquidation incentives, and always-on leverage turn small moves into cascading stress.

Alex Harutunian

From Polymarket’s stripped-down design to Kalshi’s regulatory breakthrough, prediction markets are turning collective opinion into a financial asset class — and a new battleground over who defines truth

Alex Harutunian

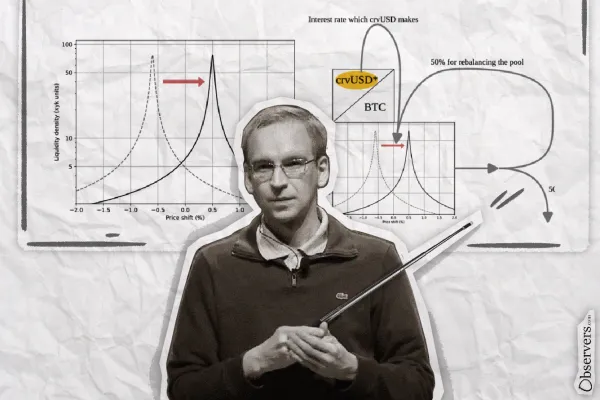

Curve Finance is launching Yield Basis with a $60M crvUSD credit line. The product aims to eliminate impermanent loss for liquidity providers, and at the same time transform CRV from a governance token into an income-generating asset with revenues shared back to holders

Alex Harutunian

Vitalik Buterin’s recent posts reflect a shift from idealistic decentralization toward pragmatic system design. Rather than rejecting Ethereum’s core principles, he questions where complexity, governance, and the current development path fail under real-world constraints.

Alex Harutunian

The digital euro is increasingly framed as a tool of EU sovereignty. China’s interest-bearing e-CNY shows no banking disruption so far. Tokenization goes mainstream as the ECB validates DLT collateral and the U.S. SEC distinguishes issuer-backed from wrapper tokens.

Bermuda is integrating USDC stablecoin into its economy. In a dollar-pegged island state, stablecoins aren’t replacing money—they’re upgrading the rails. If it works, dozens of “Other Bermudas” could emerge as the next growth engine for stablecoins.

• Tomasz K. Stańczak steps down as co-executive director of the Ethereum Foundation. • Swedish H100 acquires Adam Back–backed Swiss Bitcoin treasury firm Future Holdings AG. • Buterin shares on X his thoughts on prediction markets. • BlackRock brings its Treasury-backed BUIDL token to Uniswap.

01.01.2026 EU crypto tax transparency directive DAC8 takes effect, requiring crypto-asset service providers to report user data to national tax authorities. 01.01.2026 MiCA comes into force in Spain. 31.12.2025 Ethereum smart contract deployments hit a record high in Q4. 2026 OUTLOOK Haseeb Qureshi (Dragonfly

Balancer Protocol was exploited through a tiny rounding bug in its code. As losses neared $100 million, projects froze pools, rolled back blockchains, and clawed back funds—revealing the centralized and still untamed side of decentralized finance

01.12.2025 Telegram’s Pavel Durov announces Cocoon, a decentralized confidential AI compute network. 01.12.2025 SushiSwap CEO steps down as Synthesis invests $3.3M in the struggling DEX. 01.12.2025 Grayscale to launch the first Chainlink ETF in the US. 01.12.2025 Germany and Switzerland

29.10.25 Ondo Finance launches Ondo Global Markets on BNB Chain. 29.10.25 Ethereum Foundation launches portal to guide institutional adoption. 29.10.25 Securitize goes public via SPAC merger with Cantor Fitzgerald’s CF Acquisition Corp VIII. 28.10.25 Trump Media & Technology Group to launch

Kazakhstan launched a state-backed crypto reserve, Alem Crypto Fund, partnering with Binance Kazakhstan and starting with an investment in $BNB. SWIFT is building a blockchain ledger with 30+ banks using Consensys. Polish lawmakers passed a Crypto-Asset Market Act, aligning rules with the EU’s MiCAR. Vitalik Buterin opposes EU’s

Uniswap’s Unichain has boosted L2 volumes past $40B, but liquidity tells a different story. TVL has halved since July, exposing the limits of incentive-driven growth. Despite cheaper fees, users remain on Ethereum—where Uniswap continues to be one of the network’s largest revenue engines.

Recent Ethereum wallet upgrades greatly improve usability but also introduce new risks: hackers can now exploit a single signed off-chain message to compromise your wallet. In response, the Ethereum Foundation has launched the Trillion Dollar Security initiative to strengthen the network’s defenses

Alexander Mardar

As the crypto space obsesses over price and hype, Filecoin quietly evolves into essential Web3 infrastructure. From decentralized storage to powering AI, RWA tokenization, and enterprise-grade solutions, Filecoin’s expanding Layer 2 ecosystem is driving real-world adoption

Observers

Tether’s omnichannel USDT0 rapidly expands across multiple chains. Built on LayerZero’s Omnichain Fungible Token standard and supported by Legacy Mesh, USDT0 unifies liquidity across blockchains. Unlike Circle’s Bridged USDC, it offers decentralized, flexible, and incentivized cross-chain support.

Alexander Mardar

The project has just recorded one of its strongest quarters in terms of user growth and activity, and it shows no signs of slowing down.

Alexander Mardar

How the memecoin trading landscape evolved from Telegram-based trading to full-fledged professional terminals, offering traders a wealth of data for informed decision-making.

Alexander Mardar

The Ethereum Foundation is restructuring its management approach, with a renewed focus on scaling Layer 1 as its top priority.

Alexander Mardar

The digital euro is increasingly framed as a tool of EU sovereignty. China’s interest-bearing e-CNY shows no banking disruption so far. Tokenization goes mainstream as the ECB validates DLT collateral and the U.S. SEC distinguishes issuer-backed from wrapper tokens.

Bermuda is integrating USDC stablecoin into its economy. In a dollar-pegged island state, stablecoins aren’t replacing money—they’re upgrading the rails. If it works, dozens of “Other Bermudas” could emerge as the next growth engine for stablecoins.

• Tomasz K. Stańczak steps down as co-executive director of the Ethereum Foundation. • Swedish H100 acquires Adam Back–backed Swiss Bitcoin treasury firm Future Holdings AG. • Buterin shares on X his thoughts on prediction markets. • BlackRock brings its Treasury-backed BUIDL token to Uniswap.

01.01.2026 EU crypto tax transparency directive DAC8 takes effect, requiring crypto-asset service providers to report user data to national tax authorities. 01.01.2026 MiCA comes into force in Spain. 31.12.2025 Ethereum smart contract deployments hit a record high in Q4. 2026 OUTLOOK Haseeb Qureshi (Dragonfly

Balancer Protocol was exploited through a tiny rounding bug in its code. As losses neared $100 million, projects froze pools, rolled back blockchains, and clawed back funds—revealing the centralized and still untamed side of decentralized finance

01.12.2025 Telegram’s Pavel Durov announces Cocoon, a decentralized confidential AI compute network. 01.12.2025 SushiSwap CEO steps down as Synthesis invests $3.3M in the struggling DEX. 01.12.2025 Grayscale to launch the first Chainlink ETF in the US. 01.12.2025 Germany and Switzerland

29.10.25 Ondo Finance launches Ondo Global Markets on BNB Chain. 29.10.25 Ethereum Foundation launches portal to guide institutional adoption. 29.10.25 Securitize goes public via SPAC merger with Cantor Fitzgerald’s CF Acquisition Corp VIII. 28.10.25 Trump Media & Technology Group to launch

Kazakhstan launched a state-backed crypto reserve, Alem Crypto Fund, partnering with Binance Kazakhstan and starting with an investment in $BNB. SWIFT is building a blockchain ledger with 30+ banks using Consensys. Polish lawmakers passed a Crypto-Asset Market Act, aligning rules with the EU’s MiCAR. Vitalik Buterin opposes EU’s