A year-end overview of decentralized stablecoins with market caps between $50 and $500 million.

Eva Senzaj Pauram

Tether should be on the verge of delisting due to new regulations, but major exchanges are still not communicating clearly with users.

Rebecca Denton

The new update is a response to the Chainalysis leak, in which the company revealed a method for tracing some of Monero’s transactions.

Alexander Mardar

Analytics suggest that sophisticated market makers on Aerodrome DEX are behind the high trading volumes on Base.

Sasha Markevich

Polygon investors face uncertainty as Lido exits due to adoption struggles and increased competition, while Aave considers following suit amid governance disputes.

Alexander Mardar

A year-end overview of decentralized stablecoins with market caps between $50 and $500 million.

Eva Senzaj Pauram

It was beginning to look a lot like Christmas until Jerome Powell surprised markets on Wednesday with what he said was the last interest rate cut for a while. The Fed’s chair comments propelled the prices of both traditional stocks and crypto assets to fall, and Bitcoin, which reached

Happy Sunday Observers! It has been almost a year since Bitcoin spot BTFs were approved, but still, nothing excites the crypto community more than seeing the big sharks from traditional finance and international politics validate their industry. The market surged on Thursday following World Liberty Financial's crypto Christmas

Every day now, hundreds of crypto users are falling victim to scams and rug pulls that either derive from cyber attacks on unsuspecting influencers or from influencers themselves.

The National Center for Public Policy Research told Amazon: "Put 5% of Your Cash in Bitcoin". If you're expecting Amazon's board to read this and have some sort of Damascene conversion, think again.

Another U.S. state pushes for CBDCs to be banned — as a tokenization platform secures a crucial license for rolling out in the EU. Also in this issue: an overview of developments in China, Russia, and the EU central bank digital currencies.

Happy Sunday, Observers! This has been a major week for crypto, with Bitcoin finally surpassing the $100k mark following Donald Trump’s nomination of Paul Atkins as the next Chair of the Securities and Exchange Commission. The market was further energized on the day following Atkins’ appointment when Trump announced

The man who promised to "unbank" millions and created one of the worlds largest crypto lending platforms now faces up to three decades in prison after admitting to extensive market manipulation and fraud.

The imposition of martial law in South Korea on December 3rd led to an erratic market.

Jito is about to release tokens that will more than double the project's circulating supply, a move which has investors worried about the $JTO token price.

Uniswap is considering a $12M investment in Ekubo, a dominant AMM exchange on Starknet. Despite majority support, key governance members have questioned the deal's details and valuation.

Alexander Mardar

Thai institutional players are moving into crypto and Web3, while local investors are trading crypto with the help of gods and astrology.

Sasha Markevich

South Africa has won a record-breaking fourth Rugby Union World Cup Final, beating the All Blacks of New Zealand in Paris's Stade de France Stadium. Despite the All Blacks scoring the only try of the match in the second half, it wasn't enough to break the

Jack Martin

Wallet addresses connected to Alameda Research and FTX transferred over $10 million of crypto to Binance and Coinbase, presumably preparing for their sale in order to raise more funds to compensate customers.

Sasha Markevich

The Series A funding round led by Polychain Capital will enable developer Neon Machine to polish the Web3-based first-person extraction shooter before launch.

Jack Martin

Elliptic denounced misinterpreted data on crypto donations to Hamas, while U.S. lawmakers seek an investigation into Binance and Tether's potential links to terrorism funding.

Mathilde Adam

The Universal Digital Payments Network allows blockchain-based stablecoins and CBDC networks to interoperate with each other. Deutsche Bank and SC Ventures have been testing the system with on-chain swaps using USDC and EURS stablecoins.

Jack Martin

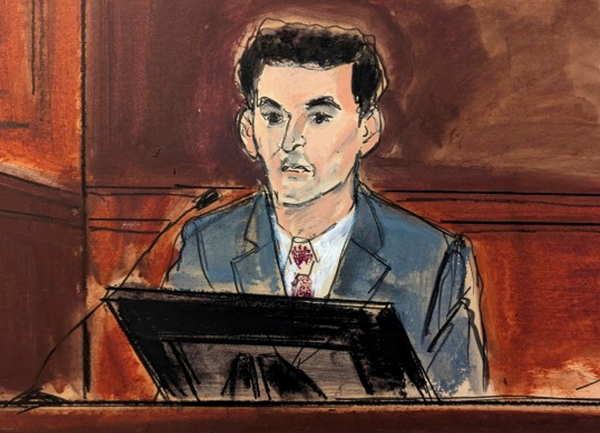

This week, the court was in session for just two days but saw the conclusion of the prosecution's case and the beginning of Sam Bankman-Fried's personal testimony.

Sasha Markevich

It was beginning to look a lot like Christmas until Jerome Powell surprised markets on Wednesday with what he said was the last interest rate cut for a while. The Fed’s chair comments propelled the prices of both traditional stocks and crypto assets to fall, and Bitcoin, which reached

Happy Sunday Observers! It has been almost a year since Bitcoin spot BTFs were approved, but still, nothing excites the crypto community more than seeing the big sharks from traditional finance and international politics validate their industry. The market surged on Thursday following World Liberty Financial's crypto Christmas

Every day now, hundreds of crypto users are falling victim to scams and rug pulls that either derive from cyber attacks on unsuspecting influencers or from influencers themselves.

The National Center for Public Policy Research told Amazon: "Put 5% of Your Cash in Bitcoin". If you're expecting Amazon's board to read this and have some sort of Damascene conversion, think again.

Another U.S. state pushes for CBDCs to be banned — as a tokenization platform secures a crucial license for rolling out in the EU. Also in this issue: an overview of developments in China, Russia, and the EU central bank digital currencies.

Happy Sunday, Observers! This has been a major week for crypto, with Bitcoin finally surpassing the $100k mark following Donald Trump’s nomination of Paul Atkins as the next Chair of the Securities and Exchange Commission. The market was further energized on the day following Atkins’ appointment when Trump announced

The man who promised to "unbank" millions and created one of the worlds largest crypto lending platforms now faces up to three decades in prison after admitting to extensive market manipulation and fraud.

The imposition of martial law in South Korea on December 3rd led to an erratic market.