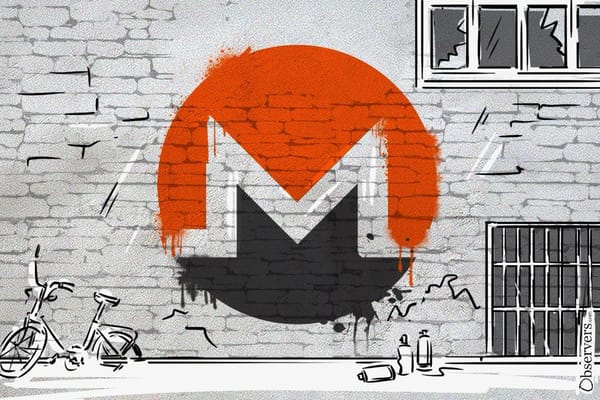

The new update is a response to the Chainalysis leak, in which the company revealed a method for tracing some of Monero’s transactions.

Alexander Mardar

Analytics suggest that sophisticated market makers on Aerodrome DEX are behind the high trading volumes on Base.

Sasha Markevich

Arthur Hayes envisioned a stablecoin independent of the fiat banking system. Ethena, inspired by his ideas, still relies on centralized systems like USDT, falling short of full decentralization.

Alexander Mardar

Trump's nominee may end Gensler's war on digital assets, but legacy Democratic appointments and banking hesitancy could challenge the pro-crypto agenda.

Mathilde Adam

The DePIN project wants to provide 5G internet coverage to everybody on earth.

Eva Senzaj Pauram

The new update is a response to the Chainalysis leak, in which the company revealed a method for tracing some of Monero’s transactions.

Alexander Mardar

It was beginning to look a lot like Christmas until Jerome Powell surprised markets on Wednesday with what he said was the last interest rate cut for a while. The Fed’s chair comments propelled the prices of both traditional stocks and crypto assets to fall, and Bitcoin, which reached

Happy Sunday Observers! It has been almost a year since Bitcoin spot BTFs were approved, but still, nothing excites the crypto community more than seeing the big sharks from traditional finance and international politics validate their industry. The market surged on Thursday following World Liberty Financial's crypto Christmas

Every day now, hundreds of crypto users are falling victim to scams and rug pulls that either derive from cyber attacks on unsuspecting influencers or from influencers themselves.

The National Center for Public Policy Research told Amazon: "Put 5% of Your Cash in Bitcoin". If you're expecting Amazon's board to read this and have some sort of Damascene conversion, think again.

Another U.S. state pushes for CBDCs to be banned — as a tokenization platform secures a crucial license for rolling out in the EU. Also in this issue: an overview of developments in China, Russia, and the EU central bank digital currencies.

Happy Sunday, Observers! This has been a major week for crypto, with Bitcoin finally surpassing the $100k mark following Donald Trump’s nomination of Paul Atkins as the next Chair of the Securities and Exchange Commission. The market was further energized on the day following Atkins’ appointment when Trump announced

The man who promised to "unbank" millions and created one of the worlds largest crypto lending platforms now faces up to three decades in prison after admitting to extensive market manipulation and fraud.

The imposition of martial law in South Korea on December 3rd led to an erratic market.

Jito is about to release tokens that will more than double the project's circulating supply, a move which has investors worried about the $JTO token price.

The key witness this week was former FTX engineering chief Nishad Singh. Subsequent witnesses called by the prosecution were less relevant, earning them a ticking-off from the Judge.

Sasha Markevich

The FTX Debtors proposed a settlement of customer property disputes this week, but it was so badly (or cleverly depending on how cynical you are) worded that most media outlets reported the wrong facts.

Sasha Markevich & Jack Martin

MakerDAO's recent launch, the Spark Protocol, offers enticing yields, drawing significant attention in the DeFi space. But with big players like Aave and Compound around, it's got to work hard to stand out and stay ahead.

Alexander Mardar

A new tax law in the European Union outlines a cross-border database for crypto-asset transactions that will make it easier for governments to crack down on criminal activity.

Eva Senzaj Pauram

The Bitcoin L2 developers have released the alpha version of the Taproot Asset protocol, which allows the building of stablecoins on top of the Bitcoin blockchain.

Alex Harutunian

Following a two-year investigation, the ECB is starting to lay the foundations for the potential issuance of its CBDC, although a final decision on whether to launch the digital euro has still not been made.

Jack Martin

Binance.US has updated its Terms of Use to remove support for USD deposits and withdrawals. Meanwhile the global exchange has stopped accepting new users in the U.K.

Sasha Markevich

Uniswap Labs has introduced a 0.15% fee on selected tokens via its primary front end and wallet. The move has sparked debate among users and a 5% drop in the value of its UNI token.

Alexander Mardar

It was beginning to look a lot like Christmas until Jerome Powell surprised markets on Wednesday with what he said was the last interest rate cut for a while. The Fed’s chair comments propelled the prices of both traditional stocks and crypto assets to fall, and Bitcoin, which reached

Happy Sunday Observers! It has been almost a year since Bitcoin spot BTFs were approved, but still, nothing excites the crypto community more than seeing the big sharks from traditional finance and international politics validate their industry. The market surged on Thursday following World Liberty Financial's crypto Christmas

Every day now, hundreds of crypto users are falling victim to scams and rug pulls that either derive from cyber attacks on unsuspecting influencers or from influencers themselves.

The National Center for Public Policy Research told Amazon: "Put 5% of Your Cash in Bitcoin". If you're expecting Amazon's board to read this and have some sort of Damascene conversion, think again.

Another U.S. state pushes for CBDCs to be banned — as a tokenization platform secures a crucial license for rolling out in the EU. Also in this issue: an overview of developments in China, Russia, and the EU central bank digital currencies.

Happy Sunday, Observers! This has been a major week for crypto, with Bitcoin finally surpassing the $100k mark following Donald Trump’s nomination of Paul Atkins as the next Chair of the Securities and Exchange Commission. The market was further energized on the day following Atkins’ appointment when Trump announced

The man who promised to "unbank" millions and created one of the worlds largest crypto lending platforms now faces up to three decades in prison after admitting to extensive market manipulation and fraud.

The imposition of martial law in South Korea on December 3rd led to an erratic market.